Private Loans and Choice in Financing Higher Education - College ...

Private Loans and Choice in Financing Higher Education - College ...

Private Loans and Choice in Financing Higher Education - College ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

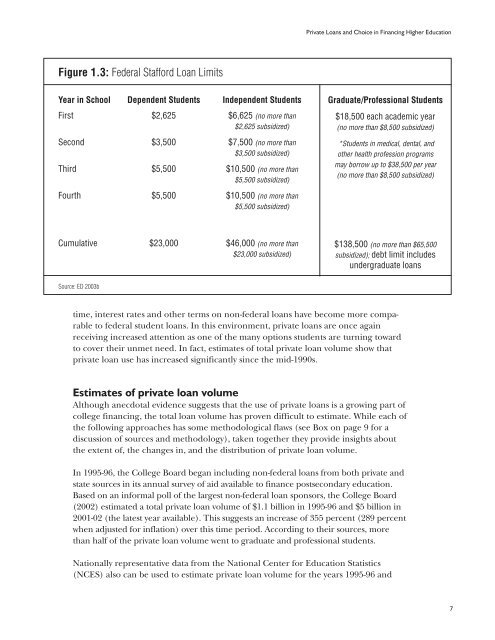

<strong>Private</strong> <strong>Loans</strong> <strong>and</strong> <strong>Choice</strong> <strong>in</strong> F<strong>in</strong>anc<strong>in</strong>g <strong>Higher</strong> <strong>Education</strong>Figure 1.3: Federal Stafford Loan LimitsYear <strong>in</strong> School Dependent Students Independent StudentsFirst $2,625 $6,625 (no more than$2,625 subsidized)Second $3,500 $7,500 (no more than$3,500 subsidized)Third $5,500 $10,500 (no more than$5,500 subsidized)Graduate/Professional Students$18,500 each academic year(no more than $8,500 subsidized)*Students <strong>in</strong> medical, dental, <strong>and</strong>other health profession programsmay borrow up to $38,500 per year(no more than $8,500 subsidized)Fourth $5,500 $10,500 (no more than$5,500 subsidized)Cumulative $23,000 $46,000 (no more than$23,000 subsidized)$138,500 (no more than $65,500subsidized); debt limit <strong>in</strong>cludesundergraduate loansSource: ED 2003btime, <strong>in</strong>terest rates <strong>and</strong> other terms on non-federal loans have become more comparableto federal student loans. In this environment, private loans are once aga<strong>in</strong>receiv<strong>in</strong>g <strong>in</strong>creased attention as one of the many options students are turn<strong>in</strong>g towardto cover their unmet need. In fact, estimates of total private loan volume show thatprivate loan use has <strong>in</strong>creased significantly s<strong>in</strong>ce the mid-1990s.Estimates of private loan volumeAlthough anecdotal evidence suggests that the use of private loans is a grow<strong>in</strong>g part ofcollege f<strong>in</strong>anc<strong>in</strong>g, the total loan volume has proven difficult to estimate. While each ofthe follow<strong>in</strong>g approaches has some methodological flaws (see Box on page 9 for adiscussion of sources <strong>and</strong> methodology), taken together they provide <strong>in</strong>sights aboutthe extent of, the changes <strong>in</strong>, <strong>and</strong> the distribution of private loan volume.In 1995-96, the <strong>College</strong> Board began <strong>in</strong>clud<strong>in</strong>g non-federal loans from both private <strong>and</strong>state sources <strong>in</strong> its annual survey of aid available to f<strong>in</strong>ance postsecondary education.Based on an <strong>in</strong>formal poll of the largest non-federal loan sponsors, the <strong>College</strong> Board(2002) estimated a total private loan volume of $1.1 billion <strong>in</strong> 1995-96 <strong>and</strong> $5 billion <strong>in</strong>2001-02 (the latest year available). This suggests an <strong>in</strong>crease of 355 percent (289 percentwhen adjusted for <strong>in</strong>flation) over this time period. Accord<strong>in</strong>g to their sources, morethan half of the private loan volume went to graduate <strong>and</strong> professional students.Nationally representative data from the National Center for <strong>Education</strong> Statistics(NCES) also can be used to estimate private loan volume for the years 1995-96 <strong>and</strong>7