POLICY FOR THE LEASE CAR SCHEME - NHS

POLICY FOR THE LEASE CAR SCHEME - NHS

POLICY FOR THE LEASE CAR SCHEME - NHS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>POLICY</strong> <strong>FOR</strong> <strong>THE</strong> <strong>LEASE</strong><strong>CAR</strong> <strong>SCHEME</strong>Reference number: Finance 004Title:Policy for the Lease Car SchemeVersion number: Version 1, Draft 1Policy Approved by: Corporate Management TeamDate of Approval: 22 nd March 2010Date Issued: 24 th March 2010Review Date: September 2011Document Author: Pratish Parmar, CommissioningAccountantDirector:Sue Bishop, Director of Finance

Version Control and Summary of ChangesVersionnumberVersion 1,Draft 1Version 1Draft 1Version 1Draft 1DateDecember2009January2010February2010Comments(description change and amendments)Policy produced by Leicestershire Partnership Truston behalf of the Facilities Consortium.Comments received from <strong>NHS</strong> Leicester City’sQuality Directorate to ensure this policy meets therequirements of the Policy for the Development,Review, Approval and Management of Polices,Procedures, Strategies and Guidelines (October2008).Initial Equality Impact Assessment by LeicestershirePartnership <strong>NHS</strong> Trust on behalf of the FacilitiesConsortium.Full review of the policy, which was coordinated bySteve Sibley (Commercial Manager of the Leicester,Leicestershire and Rutland Facilities Consortium).Membership includes: <strong>NHS</strong> Leicester City (<strong>NHS</strong> LC) <strong>NHS</strong> Leicestershire County & Rutland (<strong>NHS</strong>LCR) Leicestershire Partnership Trust (LPT)Comments received during consultation from: All members of the Consortium and their Financecolleagues Total Contract Management (TCM) Internal Audit Colleagues from Leicester City CommunityHealth Services (LCCHS) Finance & HumanResources departments. Policy presented to LCCHS’s Joint StaffConsultative Committee on 19 th January 2010.Policy presented to <strong>NHS</strong> LC’s Joint StaffConsultative Committee on 25 th February 2010.Version 1,Draft 1March 2010 Policy presented to and approved by <strong>NHS</strong> LeicesterCity’s Corporate Management Team on 22 nd March2010.Policy updated to include full version control andsummary of changes.Policy disseminated across <strong>NHS</strong> LC and LCCHSvia the Intranet.Policy for the Lease Cars Scheme – Version 1, Draft 1 Page 2 of 34

ContentsPage1. Introduction 52. Eligibility 53. Definitions 54. Duration of the Scheme 65. Nature of the Scheme 66. Reimbursement of Fuel for Business Use 7TERMS AND CONDITIONS:7. Hire 88. Payment 89. Hirer’s Obligation 910. Exclusion of Liability 911. Income Tax Position 1012. Fuel Benefit Tax 1013. Mileage Calculation and Reimbursement 1014. Business Mileage 1115. Journeys from Home 1116. Private Mileage 1117. Home to Base Mileage 1218. Excess Travel (Home to Base Mileage) 1219. Study Leave 1320. Mileage Record 13COSTS BORNE BY <strong>THE</strong> EMPLOYEE:21. Monthly Rental 1422. Variation to Charges 1423. Contract Terms 1524. Use of Car 1625. Accessories 1826. Maintenance and Repair 1827. Employee Responsibilities 1928. Insurance Requirements 2129. Accident Damage 23Policy for the Lease Cars Scheme – Version 1, Draft 1 Page 3 of 34

PageEARLY TERMINATION OF <strong>THE</strong> CONTRACT:30. Costs Borne by the Trust 2331. Costs Borne by the Employee 24AT <strong>THE</strong> END OF <strong>THE</strong> CONTRACT PERIOD:32. Action to be taken (including Extension of Lease Car Contract) 2433. Purchase of a Hire Car 2934. Title to the Vehicle 2935. General 3036. Communications 3037. Your Right to Cancel 3138. Cancellation Form 32Appendices:Appendix 1: Initial Equality Impact Assessment Tool -Leicestershire Partnership <strong>NHS</strong> Trust.33Policy for the Lease Cars Scheme – Version 1, Draft 1 Page 4 of 34

1. INTRODUCTIONThe scheme shall be known as the <strong>NHS</strong> Leicester City Car Schemehereafter referred to as “the scheme.”2. ELIGIBILITY2.1 The scheme supersedes all previous schemes, which were in placeprior to 1 April 2010. All new cars provided after 1 April 2010 are subjectto the terms and conditions contained herein?2.2 The purpose of the scheme is to provide access to transport foremployees who are required to be mobile and where it is in the interestof the Trust to do so. In this respect the opportunity to participate in thelease car scheme will be offered to all new and existing employees whoare eligible and are required to travel on Trust business.2.3 All other employees of the Trust are invited to apply to join the scheme.However, entry will be at the discretion of the Trust and all costs will beborne by the individual.3. DEFINITIONS“Scheme”“The Trust”“The Hirer”“Line Manager”“Budget Holder”“Scheme Manager”shall mean the lease car schemeshall mean the Leicestershire Partnership <strong>NHS</strong>Trustshall mean an employee of the Trust enteringinto this agreementshall mean the employees direct supervisor whowould sign mileage returnsshall mean the senior manager accountable forfinancial expenditureshall mean the management team selected bytender.Policy for the Lease Cars Scheme – Version 1, Draft 1 Page 5 of 34

4. DURATION OF <strong>THE</strong> <strong>SCHEME</strong>4.1 Entry to the scheme will be voluntary, however, an employee whodecides to enter the scheme will sign an undertaking with the Trust toparticipate in the scheme for a period of three years, or any such otherperiod that is agreed.Note – The scheme will place a three-year, or any other suchperiod, financial commitment on employees, and employeesshould study carefully all the conditions contained in thisdocument before applying to join. Employees signing the leasecar-leasing document (hereafter referred to as the “Agreement”)will be deemed to have entered into a binding legal agreement.4.2 The scheme is based on a binding contract between the <strong>NHS</strong> LeicesterCity (hereinafter referred to as “the Trust”) and a specific named person(hereinafter referred to as “the Employee”).5. <strong>THE</strong> NATURE OF <strong>THE</strong> <strong>SCHEME</strong>5.1 Under the scheme the Trust shall arrange through a contract hirecompany for the employee to be provided with a motor vehicle asspecified which will be taxed and fully maintained by the contract hirecompany. In addition, full comprehensive insurance cover will bearranged on behalf of the employee. The employee has a free choice ofcar provided that it is suitable for the business requirement. Due to thediverse nature of the work activities of the Trust’s employees it is notappropriate to specify a car type. However the Trust reserves the rightto reject an applicant’s selection if it is considered inappropriate forbusiness usage.5.2 The employee is required, as a condition of the cars being madeavailable for their private use, to pay (an amount of money) for theprivate use of the car. The monthly payment will be determined by theTrust at the beginning of the agreement. On signing the agreement toenter the car hire scheme the employee will voluntarily and permanentlyforego entitlement to <strong>NHS</strong> Travel Allowances for the duration of thePolicy for the Lease Cars Scheme – Version 1, Draft 1 Page 6 of 34

agreement.5.3 The calculation of the rental for the private use is based on anallowance that is determined by the business mileage undertaken bythe employee designated by the Trust. The allowances are arranged inmileage bands and are based on averaging principles.5.4 The Trust reserves the right to change the scheme at any time. In suchcircumstances, however, existing users’ lease contracts would beallowed to continue until their conclusion.5.5 All eligible staff, as defined in paragraph 2 – 2.3 above, will bedesignated a mileage band allowance, based on the estimated annualbusiness mileage agreed by the employee’s line manager. The mileageallowance will be subtracted from the total annual cost of the selectedcar and the resulting balance will be the charge to the employee for theprivate use of the car. VAT on private usage will be charged at thestandard rate prevailing at the time. The private use rental charge willbe adjusted for any variations between the estimated and actualmileages.6. REIMBURSEMENT OF FUEL <strong>FOR</strong> BUSINESS USE6.1 Staff will be required to refuel their lease cars and submit monthlyreturns showing business, private, excess mileage and home to basemileage, where appropriate on the mileage claim form available onScheme manager web page.6.2 Staff who travel on official Trust business will receive a fuel allowancefor all business mileage based on the agreed lease car mileage rate.This will be reviewed annually with consultation using Inland Revenueguidance. The fuel allowance is intended to do no more than cover thecosts necessarily incurred in the performance of official duties and doesnot cover fuel for private use.6.3 The fuel allowance will be paid through salary and is based on themileage quoted in the schedule. The employee will not receive anyPolicy for the Lease Cars Scheme – Version 1, Draft 1 Page 7 of 34

other travel allowances.6.4 Repeated failure to submit mileage returns may result in the fuelallowance being reduced or removed. This will have an effect on theemployee’s Income Tax and Value Added Tax.6.5 Repeated failure to submit mileage claims could also increase themonthly rental costs as all non reported mileage is treated as privatemileage and the costs of this are the responsibility of the driver.TERMS AND CONDITIONS7. HIRE7.1 The Trust has agreed to hire out and the Hirer shall take the vehicledescribed in the Schedule. The word “Vehicle” shall include all and anyreplacements of component parts and all additions and accessories inany way affixed to the Vehicle during the subsistence of this Agreementsubject to the terms and conditions set out in this Agreement, includingthe Schedule, for the Period of Hire and at the Rental stated in theSchedule.The word “Schedule” refers to the Acceptance form of the vehicle.7.2 The Hirer is an employee of the Trust and desires to hire a Vehicle foruse in the performance of his/her duties and/or for Social, Domestic andPleasure purposes. The Hirer acknowledges that he/she has selectedthe Vehicle and that the Trust has entered into a Lease Hire Agreementwith the Leasing Company for the purposes of this Agreement at therequest of the Hirer. A copy of the Leasing Company agreement will bemade available on request.8. PAYMENT8.1 The Hirer authorises the Trust to deduct the Rental and any otheramounts that may be due or become due under any part of thisAgreement from their salary, any remuneration and/or superannuationbenefits due to the Hirer from the Trust. These will include but not bePolicy for the Lease Cars Scheme – Version 1, Draft 1 Page 8 of 34

estricted to the following:-a) Monthly Hire Paymentb) Any excess mileage charge and any charges resulting from excesswear and tear at the end of the contract or on termination if sooner.c) Any payment for fixed penalty fines or any other costs for motoringoffences charged to the Trust.d) Any other charges imposed by the supplier that may be attributed tothe employee.e) Any insurance excess charges imposed that may be attributed to theemployee.f) Any increase in the annual cost of Road Fund Licence.g) Any reclaim as a result of over payment of fuel allowances.9. HIRER’S OBLIGATION9.1 The Hirer shall pay the Rentals and Excess Mileage Charge (if any)specified in the Schedule and all other monies falling due under theterms of this Agreement punctually at the times specified in theSchedule or elsewhere in this Agreement or at such other times as theTrust may notify to the hirer. Any such payment must include theappropriate amount of VAT on it. The rentals shall be paid withoutdemand and payments shall be made in accordance with the provisionsof Clause 21.9.2 Throughout the period of Hire, the Hirer agrees that they will not use orcause the Vehicle to be used in any way, which may result in the breachof any of the covenants, restrictions and any stipulations contained inthis Agreement.10. EXCLUSION OF LIABILITY10.1 Except in respect of death or personal injury arising as a result of thenegligence of the Trust or its employees (other than the Hirer) the Trustshall not be liable for any damage, loss, and charges of expensesarising out of or in consequence of the use of or any accident involvingPolicy for the Lease Cars Scheme – Version 1, Draft 1 Page 9 of 34

the Vehicle.10.2 The Hirer hereby undertakes to indemnify and keep indemnified theTrust and the Leasing Company from any liability arising from death orpersonal injury or damage to or theft or loss of property caused by or tothe Vehicle, unless such death, injury or damage is caused by thenegligence of the Trust or the Leasing Company (as appropriate) orhis/her respective employees (except the Hirer) or agents.11. INCOME TAX POSITION11.1 Employees who are allowed the private use of a lease car are deemedto be receiving a benefit in kind. Income tax will be charged at theapplicable rate based on regulations in use at the time. The Schememanager will inform the driver of changes.12. FUEL BENEFIT TAX12.1 Payment made to employees for fuel, for business use only, is at a ratethat reflects only the costs of fuel for business mileage. No benefit byway of fuel or payment of it will accrue to employees in respect ofhis/her private motoring. In consequence fuel benefit tax will not apply.13. MILEAGE CALCULATION AND REIMBURSEMENT13.1 The total contract mileage will be the estimates for the full contractperiod and will comprise of:-a) Business mileageb) Private mileagec) Home to Base mileaged) Excess mileage (due to relocation).Policy for the Lease Cars Scheme – Version 1, Draft 1 Page 10 of 34

14. BUSINESS MILEAGE14.1 Business mileage will be calculated by the employee’s Line Managerand agreed by a Budget Holder authorised to sign the application form.The level of business mileage will remain the responsibility of the LineManager. The employee will not be liable for any increased lease costsor excess mileage charges resulting from any changes to the businessmileage unless the changes are attributable to the employee’s actionsnot endorsed by the line manager. The Trust may also recover costsfrom employees who wilfully or through negligence, significantly exceedhis/her original estimated business mileage and fails to notify the Trustin a reasonable time to enable a recalculation of contributions to bemade.15. JOURNEYS FROM HOME15.1 If an employee drives direct from home to perform duties somewhereother than the normal place of work (for example, at a third partylocation) the HM Customs and Excise states that the business mileagefrom this journey will be deemed as the shorter of either:-a) The distance actually travelled.b) The distance between the third party location and the normal placeof work.16. PRIVATE MILEAGE16.1 Employees will be required to provide an estimate of his/her annualprivate mileage at the start of the contract. It is very important thatemployees provide an accurate assessment initially and also notify theScheme Manager of any significant changes that may affect the leasecontract.16.2 Employees will be charged for all private mileage that exceeds theoriginal contracted private mileage at the rate advised on the schedule.Contract hire companies do not provide refunds where estimatedPolicy for the Lease Cars Scheme – Version 1, Draft 1 Page 11 of 34

mileages are not reached, therefore refunds cannot be paid if theprivate mileage total is less than that agreed in the contract. Where adriver notifies the Scheme Manager of changes to the private use of thevehicle the cost of the increase may be spread over the balance of theterm at the discretion of the Trust.17. HOME TO BASE MILEAGE17.1 For the purpose of calculating the HM Customs and Excise income taxbenefit charge, home to base mileage is classified as private mileage.Home to base mileage is the actual mileage recorded on theemployee’s current travel claim form. Employees must notify theScheme Manager of any changes of home address.17.2 Employees who are asked to take his/her vehicle home for officialpurposes e.g. to respond to emergency call-out etc. will class the firsthome to base journey as private mileage. If the employee is called outand has to return to work or any other location on duty, the returnjourney and all subsequent call outs during the on call session will berecorded as business mileage. Employees who use his/her vehicle forbusiness use only and are requested to take their vehicle home for dutyon call purposes will be liable to pay car benefit in kind tax.17.3 Business mileage fuel reimbursement will not be paid for home to basemileage unless the employee is at that time on official business e.g.Emergency call out or when excess mileage has been agreed followingrelocation.18. EXCESS TRAVEL (HOME TO BASE MILEAGE)18.1 Where an employee has been relocated and an additional allowancehas been agreed, the excess mileage calculation will be based on thefollowing formula: -a) Agree the return distance between the employee’s home and oldbasePolicy for the Lease Cars Scheme – Version 1, Draft 1 Page 12 of 34

) Agree the return distance between the employee’s home and newbasec) Multiply the difference between a) and b) above by the working daysper week, less the number of days out of the office for businessjourneys starting from home.d) Multiply the number of journeys per week by the contracted weeksper year less any annual leave and Bank holidays due.19. STUDY LEAVE19.1 Where an employee undertakes official study leave all journeys will berecorded as business mileage subject to the normal rules for home tobase mileage above. Fuel reimbursement will be paid at the prevailingrate. The business mileage undertaken on study leave will be includedin the assessment of annual business mileage for the purpose ofallocating an allowance for the calculation of private use rental.20. MILEAGE RECORD20.1 Employees will continue to record accurately their total daily mileage onthe mileage record provided. The record is for control purposes onlyand not for payment.20.2 It is a condition of this contract that an employee continues to submithis/her mileage record and odometer reading each month, to his/herrelevant Line manager, for certification and approval before onwardtransmission to Scheme manager.20.3 The Director of Finance, the Chief Internal Auditor or their nominatedrepresentative may, at any time, request to see the milometer reading tocheck recordings.Policy for the Lease Cars Scheme – Version 1, Draft 1 Page 13 of 34

COSTS BORNE BY <strong>THE</strong> EMPLOYEE21. MONTHLY RENTAL21.1 The employee will pay the contributions agreed at the commencementof the contract and shown on the Quotation Form and the SecondSchedule (acceptance form) provided by the Scheme Manager.21.2 The Trust will pay the leasing cost of the car. As a condition of the carbeing available to the employee for private use, the Trust will require theemployee to pay a contribution for the private use according to thecalculation set out on the quotation form.21.3 Value Added Tax will be applied to the monthly rental.22. VARIATION TO CHARGES22.1 The rental may be varied by the Trust to take into account anyincreases or decreases resulting from changes to Insurance Rates,Road Fund Licence fees, VAT Rate and Contract Hire variations due tochanges in private mileage.22.2 Additional costs attributable to the employee will be those arising fromemployee’s actions or from misuse, negligence or breach of the contractconditions contained herein or contained within the manufacturer’shandbooks and other publications issued from time to time. Failure toensure that the vehicle is serviced at the recommended intervals orfailure to maintain correct air and fluid levels will constitute negligenceor breach of contract and may result in additional costs being levied onthe employee.22.3 The rental will be based on the latest price issued by the supplierapplicable at the time of delivery of the vehicle. The price may vary fromthe quotation provided at the time of application. The Trust will makeevery reasonable effort to notify employees of changes but it will notaccept liability for additional costs.Policy for the Lease Cars Scheme – Version 1, Draft 1 Page 14 of 34

22.4 Should any modifications be required to the vehicle due to statute, thecost will be shared between the employee and the Trust in the sameproportion that the original hire cost as split between the Trust and theemployee.22.5 The employee will pay for all fuel and the provision of all the vehiclestop up fluids.22.6 The employee will pay any fines for unlawful parking of the hired carand any other fines which arise through driving of that vehicle. Theemployee will also pay for any reasonable related legal, administrativeor maintenance costs which arise from an illegal act.22.7 The employee will pay excess charges imposed by the InsuranceCompany for claims for accidental damage, fire or theft, includingexcess charges for windscreens, window glass, mirrors and headlightreplacement unless they are on official business then the Trust will pay.22.8 The employee will pay the costs of repair and replacements to the carmade necessary as a result of deliberate abuse or wilful neglect. Theemployee on receipt of an account must reimburse any such costs thatthe Contractor and the Director of Finance considers to have beencaused by such deliberate abuse or wilful neglect, to the Trust for theamount due.23. CONTRACT TERMS23.1 Save as expressly provided for in this Agreement the Trust does notsupply the vehicle with or subject to any warranty express or implied byStatute or otherwise as to capacity, age, quality, state, condition orfitness for any purpose whatsoever.23.2 The employee must not sell, assign, re-hire, charge or part withpossession of the hired vehicle or attempt to do so except as authorisedunder the conditions of the lease.23.3 The act of omission of any person authorised by the employee to usePolicy for the Lease Cars Scheme – Version 1, Draft 1 Page 15 of 34

the vehicle shall for the purposes of the Agreement be deemed to bethe act of omission of the employee.23.4 The employee shall permit representatives of the Trust or the Schememanager to inspect the state and condition of the car at any reasonabletime.23.5 Subject to the employee continuing to be eligible under these terms andconditions he/she will normally have the option at the end of thecontract period to either: -a) Enter into a new hire agreement; orb) Use his/her own car on official Trust Business.24. USE OF <strong>CAR</strong>24.1 The car will generally be used only by the employee and immediatefamily and by anyone authorised by the Trust, provided that they areproperly qualified drivers holding a full current driving licence and areincluded on the insurance policy. Business use is restricted to when theemployee is using the car on Trust business.24.2 The hirer will submit a copy of a driving licence for each driver namedby the hirer to drive the vehicle and will be responsible for notifying theTrust of any changes including driving offences or penalties awardedagainst the nominated driver(s). The hirer will also notify the Trust ofany illness or disability suffered by any approved driver that may affectthe Trust’s vehicle insurance.24.3 The car may only be used for Trust business and normal social,domestic and pleasure purposes. The car shall be available for officialuse at all reasonable times except when the car is being repaired orserviced.24.4 The employee must not use, or permit to be used, the vehicle in breachof any sub-clauses neither of this clause nor for hire, reward,competition, trials or pace making. The vehicle may only be used forPolicy for the Lease Cars Scheme – Version 1, Draft 1 Page 16 of 34

driving tuition with the written agreement of the Trust.24.5 Use abroad is permitted subject to prior written application to theScheme Manager. Maintenance costs are not covered when the car isabroad. It is the employee’s responsibility to make specialarrangements to cover this period. The minimum acceptable cover isthat provided under AA 5 star cover. Employees will be advised on themaintenance requirement when written permission is given.24.6 If during the period of hire the vehicle becomes unroadworthy theemployee’s obligations to make the hire payments to the Trust underthis agreement will remain the same.24.7 All Trust business mileage shall be undertaken in the hired car unless itis not available due to repair or servicing. When a pool car is notavailable and where a private vehicle is used in lieu of the hired car thenbusiness mileage reimbursement will be calculated at the current leasecar fuel rate.24.8 Employees will also be required to travel by hired car, or with an officerclaiming <strong>NHS</strong> reimbursement whenever possible, rather than use publictransport.24.9 The employee is permitted to tow a caravan, boat or trailer providedprior approval in writing is obtained from the Contractor through theScheme Manager. Approval will not be forthcoming if the employee’schoice of vehicle is not considered suitable for the proposed towing.Any caravan, boat or trailer shall be towed only in conformity with alllegal requirements and the manufacturer’s specification.24.10 Should the contract hire company choose to charge an increased rentalto the Trust to cover the lower residual value and higher maintenancecosts which result from towing this charge will be paid in full by theemployee.Policy for the Lease Cars Scheme – Version 1, Draft 1 Page 17 of 34

25. ACCESSORIES25.1 The employee may request either at the time the vehicle is ordered or atany subsequent time, subject to written approval, the addition of anyaccessories approved by the leasing company. An approved dealer willthen add these to the vehicle at the employee’s expense. The employeewill not be entitled to remove from the vehicle either before or after theexpiration of the contract period, any such accessories so fitted savewith the written approval of the Leasing Company. No accessories maybe fitted to the vehicle except as permitted above.Income tax is chargeable on all accessories fitted to the lease car.Therefore, it is the responsibility of the employee to notify the SchemeManager of the item and the full list price excluding VAT of the item andthe price paid.26. MAINTENANCE AND REPAIR26.1 The scheme incorporates full maintenance which includes the cost of allservicing in accordance with the manufacturer’s recommendations,mechanical or electrical repairs, replacement tyres, batteries, exhaustexcept: -a) Where the need for repair or replacement arises by virtue of anybreach of the terms of this Agreement by the employee (when theemployee will be responsible) orb) Where in the opinion of the Contract Hire Company it would not beeconomic to repair the vehicle.26.2 AA/RAC membership or similar recovery or assistance services(including Relay and Homestart) is included in the scheme. Membershipof the recovery service is based on fleet arrangement and does notprovide corporate membership facilities.26.3 In certain cases repairs to tyres (i.e. punctures) will be the financialresponsibility of the employee although faults in tyres due to a problemin manufacture will be the financial responsibility of the servicing agent.Policy for the Lease Cars Scheme – Version 1, Draft 1 Page 18 of 34

Damage caused by accidents or running over debris etc. will be classedas accident damage and subject to insurance excesses. Where a tyre isreplaced the value of the remaining tread depth will be taken intoaccount.26.4 An appropriate dealer who is acceptable to the Contractor, the Trustand the Employee will carry out service maintenance and repair. Afranchised dealer must undertake all warranty work. Unauthorisedmaintenance/repair work could result in the withdrawal of the hiredvehicle from the employee.26.5 A driver’s handbook will be given to the employee when the car isdelivered. This handbook should be kept in the car for ease ofreference. The employee must familiarise him/herself with theinstructions contained therein for dealing with repairs to the vehiclewhether arising by virtue of an accident or otherwise and comply withthe same.26.6 The employee must not commit the Trust or Contract Hire Company toexpenditure for repairs estimated by the repairer to cost more than thebase figure provided by the insurance company or its representative,unless in an extreme emergency occurring outside working hours,without the express consent of the Leasing Company.26.7 Employees will be expected to organise their working day so that carservice/repair arrangements have the minimum effect on their workload.27. EMPLOYEE RESPONSIBILITIES27.1 The employee has specific responsibility for the following: -a) Keeping the car in a clean condition.b) At regular intervals checking the oil, water, lights, battery, brake andany other fluid levels, tyre pressures and the condition of tyres andtaking necessary corrective action.Policy for the Lease Cars Scheme – Version 1, Draft 1 Page 19 of 34

k) Not altering, modifying or removing any parts from the vehicle, norchanging any of the identification marks or numbers, without priorconsent in writing of the Leasing Company.l) Not overloading, overworking or otherwise subjecting the vehicle tostresses for which it is not designed, nor using the same to carrygoods for which it is not suited.m) Notifying the Scheme Manager as soon as reasonably practical ofany defect or failure of the odometer or milometer attached to thevehicle. In which event the Trust may in its absolute discretionestimate unrecorded mileage based upon the average distancecovered during the last complete year before such failure or defectwas discovered and such other relevant information as it chooses toconsider.28. INSURANCE REQUIREMENTS28.1 The vehicle shall be at risk of the Trust, which will keep in force, with theinsurer, comprehensive insurance cover including private use against: -a) Damage to the vehicle by fire, theft, accident and any other causeagainst which insurance is normally obtainable andb) Third party liability arising in connection with the use of the vehicleas required by law.28.2 The insurance, as arranged by the Trust, covers the full replacementvalue of the vehicle. The policy shows the interest of the Trust and theLeasing Company. In the event of a write off all monies will be paiddirect to the Leasing Company.28.3 Employees must make themselves familiar with the contents of thepolicy and will be required to complete a proposal form at the start ofthe contract, providing details of all drivers of the vehicle. Employeesmust submit a copy of each driver’s licence annually and notify theScheme Manager of any changes. Details of the policy and insuranceschedule will be made available, on request, from the SchemePolicy for the Lease Cars Scheme – Version 1, Draft 1 Page 21 of 34

Manager.28.4 The Trust will arrange and automatically renew the cover annually.Employees will ensure that they keep in force and do not by any act oromission invalidate the insurance cover.28.5 The Insurance Schedule incorporates standard excess in the event ofany claim. Additional excesses apply in the event that the vehicle isbeing driven by, or is in the charge of any person under 25 years of ageor any person who holds a driving licence for less than 12 monthsimmediately preceding the claim, or drivers with convictions for drinkdrive, drug offences etc.28.6 The Trust will be responsible for any excess insurance charges incurredduring business use of the vehicle. In all other cases where accidentshappen the employee will pay the excess. If, subsequently, any thirdparty claim is successful, refunds will be made accordingly.28.7 In the event of a claim for a windscreen or glass only replacement theexcess if applicable will be paid by the Trust and recovered from theemployee by cheque or salary deduction.28.8 The standard policy provides limited cover for the loss or damage topersonal effects in or on the insured vehicle if they are lost or damaged.Please note that we strongly advise that personal effects should not beleft in the car at anytime. If you do leave items in the car they should besecurely locked in the boot and kept out of sight.28.9 The Trust will not accept any liability for the loss or damage to personaleffects. Employees are advised to ensure that insurance cover isadequate for his/her needs; additional cover should be taken out ifnecessary. Personal effects are normally covered under domestichousehold contents policies.28.10 The insurance premium quoted does not include an indemnity againstfinancial loss consequent upon the early termination of the lease vehiclecontract.Policy for the Lease Cars Scheme – Version 1, Draft 1 Page 22 of 34

28.11 To attend or participate in any training that the Trust and /or insurancecompany request (which is supported by the Trust).29. ACCIDENT DAMAGE29.1 In the event of an accident the employee must follow the procedure setout in the leaflet “Road Traffic Accidents Procedural Guidance”contained within the drivers handbook.29.2 Employees are responsible for informing the Scheme Manager of theaccident by telephone and by completion and submission of theinsurance claim form as soon as possible. Employees should also enactall repairs necessary to restore the vehicle to its former condition priorto the accident as soon as possible after authority has been given.29.3 Where damage is light, the employee may choose to pay for the cost ofrepairs, subject to notification to the Scheme Manager.29.4 In the event of total loss through “write off” action, the insurancecompany will make payment direct to the Leasing Company.29.5 This Agreement will be terminated immediately following a total loss.EARLY TERMINATION OF <strong>THE</strong> CONTRACT30. COSTS BORNE BY <strong>THE</strong> TRUST30.1 In the event of the employees death in service or on early termination ofthe employee’s contract on the grounds of ill health or redundancy thereshall be no financial penalty to the employee or their Estate on accountof the early termination of contract for private use of the Car.30.2 In the event that the employee is absent from work for an extendedperiod on maternity leave, or on approved training, the employee whohas contracted for private use of the car, may choose to continue theprivate use at the contracted charge or to return the vehicle to the Trust.Policy for the Lease Cars Scheme – Version 1, Draft 1 Page 23 of 34

In the latter case there shall be no financial penalty to the employee onaccount of early termination of the contract.31. COSTS BORNE BY <strong>THE</strong> EMPLOYEE31.1 In the event of early surrender of the car for any reason not covered by30.1 and 30.2, the employee could be liable to pay the early terminationcharge imposed by the leasing company. This is usually the multiple ofthe monthly rental charge depending upon how long the contract has torun. The calculation of the charge varies between leasing companiesbut typically it could be as much as eight twelfths (if the contract is in thefirst year) of the annual lease rental paid by the Trust to the leasingcompany. On request the scheme manager will provide quotations.Note – it is very important that at least one month’s notice is given ofearly termination of the contract. (Failure to provide adequate noticecould result in a delay in the final payment of salary due, in order toresolve any problems).31.2 In the event of early termination detailed above, the employee will beliable to pay: -a) Any early termination charge imposed by the leasing company.b) Any outstanding insurance premium.c) The current administration fee contained in the cost data summaryd) Any costs arising from the condition of the car or excess mileage onhandover.31.3 Employees are advised to seek advice before terminating the contract.AT <strong>THE</strong> END OF <strong>THE</strong> CONTRACT PERIOD32. ACTION TO BE TAKEN (Including Extension of Lease CarContract)32.1 At the end of the contract hire period the employee must immediatelydeliver up the vehicle to the Trust in good repair and condition (fair wearPolicy for the Lease Cars Scheme – Version 1, Draft 1 Page 24 of 34

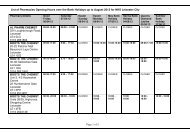

and tear only accepted, this is in the opinion of the lease company ) andfree from any defects other than those already notified by the employeeto the Trust.32.2 The car will be appraised for condition by the leasers representative inthe presence of the employee who will be invoiced by the leasecompany for the cost of any repairs that the Contractor considers areneeded to bring the car into good condition taking fair wear and tear intoaccount.32.3 In default of delivery of the vehicle upon termination, the Trust will beentitled without notice to retake possession of the vehicle and all costsand expenses incidental to the recovery of the vehicle incurred by theTrust must be repaid to the Trust by the employee.32.4 The employee will provide the Scheme Manager with the final mileagereadings. This along with the monthly return will be used to calculate thefinal charges for this lease.32.5 The tables below provide examples of various scenarios regardingresponsibility for end-of-contract costs. The scenarios should only betaken as a guide to procedures and actual costs will depend onindividual circumstances.Policy for the Lease Cars Scheme – Version 1, Draft 1 Page 25 of 34

End of Contract ScenariosKey:* Where excess business miles has not been agreed with the senior managerat the trust, there will be no adjustment to fuel allowance@ Some lease car providers have a buffer on excess mileage (usually upto2000 miles) so there would not be a payment to be made to the SchemeManager.# Some lease car providers do not provide a refund for credit mileage, andthere would be no corresponding payment made by the Scheme Manager.A. The overall mileage is the same as contracted mileage:Scenario 1BusinessMilesPersonalMilesTotalContracted 6000 15000 21000Actual 4000 17000 21000-2000 2000 0Trust Driver Scheme Mgr(Receive)/Pay (Receive)/Pay (Receive)/PayExcess Mileage adjustment (£70.00) £70.00 £0.00Fuel Allowance adjustment (£260.00) £260.00(£330.00) £330.00 £0.00Scenario 2BusinessMilesPersonalMilesTotalContracted 6000 15000 21000*Actual 7000 14000 210001000 -1000 0Trust Driver Scheme Mgr(Receive)/Pay (Receive)/Pay (Receive)/PayExcess Mileage adjustment £35.00 (£35.00) £0.00*Fuel Allowance adjustment £130.00 (£130.00)£165.00 (£165.00) £0.00Policy for the Lease Cars Scheme – Version 1, Draft 1 Page 26 of 34

B. Overall mileage is more than contracted miles:Scenario 3BusinessMilesPersonalMilesTotalContracted 6000 15000 21000Actual 5000 17000 22000-1000 2000 1000Trust Driver Scheme Mgr(Receive)/Pay (Receive)/Pay (Receive)/Pay@Excess Mileage adjustment (£35.00) £70.00 (£35.00)Fuel Allowance adjustment (£130.00) £130.00(£165.00) £200.00 (£35.00)Scenario 4BusinessMilesPersonalMilesTotalContracted 6000 15000 21000Actual 8000 14000 220002000 -1000 1000Trust Driver Scheme Mgr(Receive)/Pay (Receive)/Pay (Receive)/Pay@Excess Mileage adjustment £70.00 (£35.00) (£35.00)Fuel Allowance adjustment * £260.00 (£260.00)£330.00 (£295.00) (£35.00)Scenario 5BusinessMilesPersonalMilesTotalContracted 6000 15000 21000Actual 7000 16000 230001000 1000 2000Trust Driver Scheme Mgr(Receive)/Pay (Receive)/Pay (Receive)/Pay@Excess Mileage adjustment £35.00 £35.00 (£70.00)*Fuel Allowance adjustment £130.00 (£130.00)£165.00 (£95.00) (£70.00)Policy for the Lease Cars Scheme – Version 1, Draft 1 Page 27 of 34

C. Overall mileage is less than contracted miles:Scenario 6BusinessMilesPersonalMilesTotalContracted 6000 15000 21000Actual 5000 14000 19000-1000 -1000 -2000Trust Driver Scheme Mgr(Receive)/Pay (Receive)/Pay (Receive)/Pay#Excess Mileage adjustment (£35.00) (£35.00) £70.00Fuel Allowance adjustment (£130.00) £130.00(£165.00) £95.00 £70.00Scenario 7BusinessMilesPersonalMilesTotalContracted 6000 15000 21000Actual 4000 16000 20000-2000 1000 -1000Trust Driver Scheme Mgr(Receive)/Pay (Receive)/Pay (Receive)/Pay#Excess Mileage adjustment (£70.00) £35.00 £35.00Fuel Allowance adjustment (£260.00) £260.00(£330.00) £295.00 £35.00Scenario 8BusinessMilesPersonalMilesTotalExcess Mileage adjustment 6000 15000 21000Fuel Allowance adjustment 7000 13000 200001000 -2000 -1000Trust Driver Scheme Mgr(Receive)/Pay (Receive)/Pay (Receive)/Pay#Excess Mileage adjustment £35.00 (£70.00) £35.00*Fuel Allowance adjustment £130.00 (£130.00)£165.00 (£200.00) £35.00Policy for the Lease Cars Scheme – Version 1, Draft 1 Page 28 of 34

EXTENSION OF <strong>LEASE</strong> CONTRACT32.6 The Scheme Manager will be able to extend the contract withoutpermission from Trust whilst awaiting delivery of new vehicle.32.7 If an employee wishes to request an extension of the Lease they willrequire authorisation from their manager and their Trust stating thereasons as to why an extension is required. The Trust has the right torefuse this request.33. PURCHASE OF A HIRED <strong>CAR</strong>33.1 At the end of the contract hire period, or on early termination of thecontract, the employee will be given the opportunity to purchase thevehicle at a rate agreed with the contract hire company.34. TITLE TO <strong>THE</strong> VEHICLE34.1 Nothing in this Agreement is to be construed as implying that title to theVehicle can or shall at any time pass to the hirer. However, it is agreedand understood that between the date of the Agreement and the timewhen the vehicle is actually returned to the Trust, the hirer (being theperson by whom the vehicle is kept) is the “owner” of the vehicle for thepurposes of section 1 – 2 of the Road Traffic Act 1974 (and anystatutory re-enactment thereof). If, notwithstanding the above, anynotices are served upon, or proceedings instigated against the Trust orthe Leasing Company in respect of any offence allegedly committed, orexcess charge allegedly incurred, in respect of the vehicle during theaforesaid period, the Trust and the Leasing Company shall be at libertyto take such action in relation thereof as the Trust or the LeasingCompany in their reasonable discretion deem fit (including paying anyfines, penalties, or excess charges whether legally demandable or not,or defending such proceedings) and the Hirer shall indemnify the Trustto the Leasing Company in respect of fines, penalties, excess chargescosts or legal expenses and shall further indemnify the Trust against theadministration costs involved. The hirer should notify the Line ManagerPolicy for the Lease Cars Scheme – Version 1, Draft 1 Page 29 of 34

of any such fees, penalties or excess charges incurred during thecourse of the hirer carrying out their duties.35. GENERAL35.1 The rights and remedies of the Trust hereunder shall not be affected byany giving of time or any other concession or indulgence granted by orneglect of the Trust to the hirer.35.2 The hirer shall not assign transfer charge the benefit of or in any waymake over this Agreement nor pledge or purport to pledge the Trustscredit.35.3 All amendments to this Agreement shall be made in writing.35.4 The employee must immediately report any changes to their personalcircumstances to the scheme manager this includes changes to wherethe car is being kept.36. COMMUNICATIONS36.1 Any communication required or permitted under the terms of thisAgreement shall (unless otherwise provided) be in writing and shall bedelivered in person or sent by registered mail as appropriate, properlyposted and fully pre-paid in an envelope properly addressed to, in thecase of the hirer, the address set out in the Schedule or as otherwisenotified in writing to the Trust and in the case of the Trust to TotalContract Management, Dominion Way, Rustington, West Sussex, BN163HQ.Policy for the Lease Cars Scheme – Version 1, Draft 1 Page 30 of 34

37. YOUR RIGHT TO CANCELThe Consumer Credit Act 1974 covers this Agreement and lays down certainrequirements for your protection which must be satisfied when the Agreementis made. If they are not, the owner cannot enforce the Agreement against youwithout a court order.If you would like to know more about the protection and remedies providedunder the Act, you should contact either your local Trading StandardsDepartment or your nearest Citizen’s Advice Bureau.You have a right to cancel this agreement. You can do this by sending ortaking a written NOTICE of cancellation to the Trust to the address shownbelow. You have FIVE DAYS starting with the day after you received this copy.You can use the form provided.If you cancel this agreement, any money you have paid, goods given in partexchange(or their value) and property given, as security must be returned toyou. You will not have to make any further payment.If you already have goods under the agreement, you should not use them andshould keep them safe. (Legal action may be taken against you if you do nottake proper care of them). You can wait for them to be collected from you andyou need not hand them over unless you receive a written request. If you wish,however, you may return the goods yourself.Policy for the Lease Cars Scheme – Version 1, Draft 1 Page 31 of 34

38. CANCELLATION <strong>FOR</strong>MOnly complete and return this form, if you wish to cancel the agreement.To:Total Contract Management (TCM)Dominion WayRustingtonWest SussexBN16 3HQI / We hereby give notice that I / we wish to cancel the Agreement for Leasecar.Signed: …………………………………………………… Date: ……………………Name: …………………………………………………………………………………Address:……………………………………………………………………………………………………….………………………………………………………………………………………….………………………………………………………………………………………….……………………………………………………………………………Policy for the Lease Cars Scheme – Version 1, Draft 1 Page 32 of 34

APPENDIX 1 – Equality Impact Assessment SummaryPolicy for the Lease Cars Scheme – Version 1, Draft 1 Page 33 of 34

Policy for the Lease Cars Scheme – Version 1, Draft 1 Page 34 of 34