Form No Description Pages - Max Life Insurance

Form No Description Pages - Max Life Insurance

Form No Description Pages - Max Life Insurance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

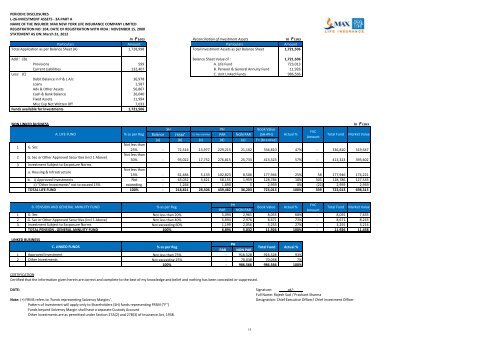

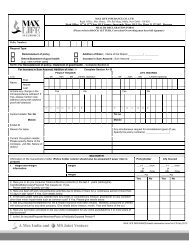

PERIODIC DISCLOSURESL-26-INVESTMENT ASSETS - 3A PART ANAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO: 104; DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000STATEMENT AS ON: March 31, 2012In ` Lacs Reconciliation of Investment Assets In ` LacsParticularsAmountParticularsAmountTotal Application as per Balance Sheet (A) 1,728,998 Total Investment Assets as per Balance Sheet 1,721,506Add : (B) Balance Sheet Value of : 1,721,506Provisions 599 A. <strong>Life</strong> Fund 723,013Current Liabilities 132,407 B. Pension & General Annuity Fund 11,926Less: (C) C. Unit Linked Funds 986,566Debit Balance in P & L A/c 36,978Loans 1,587Adv & Other Assets 56,867Cash & Bank Balance 26,040Fixed Assets 11,994Misc Exp <strong>No</strong>t Written Off 7,033Funds available for Investments 1,721,506NON LINKED BUSINESSA. LIFE FUND % as per RegSH PH Book ValueBalance FRSM + UL-<strong>No</strong>n Unit Res PAR NON PAR (SH+PH)(a) (b) (c) (d) (e) F= (b+c+d+e)1 G. Sec<strong>No</strong>t less than25% - 72,516 13,977 229,215 21,102 336,810 47% - 336,810 319,5472 G. Sec or Other Approved Securities (incl 1 Above)<strong>No</strong>t less than50% - 93,022 17,752 276,815 25,733 413,323 57% - 413,323 393,6023 Investment Subject to Excposure <strong>No</strong>rmsa. Housing & Infrastructure<strong>No</strong>t less than15% - 61,484 5,133 102,823 8,506 177,946 25% 58 177,946 174,221b. i) Approved Investments <strong>No</strong>t- 63,052 5,621 58,155 1,959 128,786 18% 303 128,786 127,533ii) "Other Investments" not to exceed 15% exceeding- 1,264 - 1,690 5 2,959 0% (22) 2,959 2,959TOTAL LIFE FUND 100% - 218,821 28,506 439,482 36,203 723,013 100% 339 723,013 698,315Actual %FVCAmountTotal FundIn ` LacsMarket ValueB. PENSION AND GENERAL ANNUITY FUND % as per RegPHFVCBook Value Actual %PAR NON PARAmountTotal Fund Market Value1 G. Sec <strong>No</strong>t less than 20%5,094 2,961 8,055 68% - 8,055 7,6352 G. Sec or Other Approved Securities (incl 1 Above) <strong>No</strong>t less than 40%5,694 2,976 8,671 73% - 8,671 8,2433 Investment Subject to Excposure <strong>No</strong>rms <strong>No</strong>t exceeding 60%1,199 2,056 3,255 27% - 3,255 3,214TOTAL PENSION , GENERAL ANNUITY FUND 100%6,894 5,032 11,926 100% - 11,926 11,458LINKED BUSINESSC. LINKED FUNDS % as per RegPHPAR NON PARTotal Fund Actual %1 Approved Investment <strong>No</strong>t less than 75%- 916,528 916,528 93%2 Other Investments <strong>No</strong>t exceeding 25%- 70,038 70,038 7%100%- 986,566 986,566 100%CERTIFICATIONCertified that the information given herein are correct and complete to the best of my knowledge and belief and nothing has been concealed or suppressed.DATE: Signature: sd/-Full Name: Rajesh Sud / Prashant Sharma<strong>No</strong>te: (+) FRMS refers to 'Funds representing Solvency Margins'.Designation: Chief Executive Officer/ Chief Investment OfficerPattern of Investment will apply only to Shareholders (SH) funds representing FRSM ("F")Funds beyond Solvency Margin shall have a separate Custody AccountOther Investments are as permitted under Section 27A(2) and 27B(3) of <strong>Insurance</strong> Act, 1938.11