Form No Description Pages - Max Life Insurance

Form No Description Pages - Max Life Insurance

Form No Description Pages - Max Life Insurance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

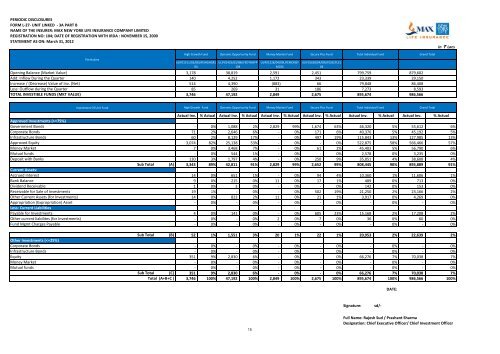

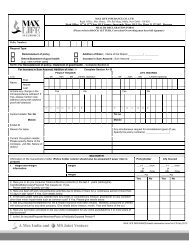

PERIODIC DISCLOSURESFORM L-27- UNIT LINKED - 3A PART BNAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO: 104; DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000STATEMENT AS ON: March 31, 2012Opening Balance (Market Value)Add: Inflow During the QuarterIncrease / (Decrease) Value of Inv. (Net)Less: Outflow during the QuarterTOTAL INVESTIBLE FUNDS (MKT VALUE)ParticularsHigh Growth Fund Dynamic Opportunity Fund Money Market Fund Secure Plus FundTotal Individual FundGrand TotalULIF01311/02/08LIFEHIGHGR104ULIF01425/03/08LIFEDYNOPP104ULIF01528/04/09LIFEMONEYM104ULIF01628/04/09LIFESECPLS1043,178 38,819 2,591 2,451 799,759 879,602140 4,252 1,172 343 23,339 29,150514 4,390 (883) 66 79,848 86,40885 269 31 186 7,273 8,5933,746 47,192 2,849 2,675 895,674 986,566In ` LacsInvestment Of Unit FundHigh Growth Fund Dynamic Opportunity Fund Money Market Fund Secure Plus FundTotal Individual FundGrand TotalApproved Investments (>=75%)Government BondsCorporate BondsInfrastructure BondsApproved EquityMoney MarketMutual fundsDeposit with BanksCurrent Assets:Accrued InterestBank BalanceDividend ReceivableReceivable for Sale of InvestmentsOther Current Assets (for Investments)Appropriation (Expropriation) AssetLess: Current LiabilitiesPayable for InvestmentsOther current liabilites (for Investments)Fund Mgmt Charges PayableSub Total(A)Actual Inv. % Actual Actual Inv. % Actual Actual Inv. % Actual Actual Inv. % Actual Actual Inv. % Actual Actual Inv. % Actual- 0% 1,088 2% 2,829 99% 1,674 63% 46,320 5% 55,612 6%71 2% 2,646 6% - 0% 171 6% 40,376 5% 45,192 5%60 2% 8,129 17% - 0% 497 19% 115,843 13% 127,985 13%3,074 82% 25,138 53% - 0% - 0% 522,875 58% 566,466 57%7 0% 3,468 7% - 0% 61 2% 45,403 5% 56,790 6%- 0% 544 1% - 0% - 0% 2,578 0% 3,235 0%130 3% 1,797 4% - 0% 250 9% 35,051 4% 38,608 4%3,343 89% 42,811 91% 2,829 99% 2,652 99% 808,445 90% 893,889 91%14 0% 651 1% - 0% 94 4% 10,360 1% 11,606 1%9 0% 215 0% 11 0% 17 1% 489 0% 713 0%1 0% 3 0% - 0% - 0% 142 0% 153 0%19 1% - 0% - 0% 502 19% 21,250 2% 23,166 2%14 0% 823 2% 11 0% 21 1% 3,917 0% 4,269 0%- 0% - 0% - 0% - 0% - 0% - 0%4 0% 141 0% - 0% 605 23% 15,168 2% 17,208 2%- 0% - 0% 2 0% 7 0% 36 0% 60 0%- 0% - 0% - 0% - 0% - 0% - 0%Other Investments (