Form No Description Pages - Max Life Insurance

Form No Description Pages - Max Life Insurance

Form No Description Pages - Max Life Insurance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

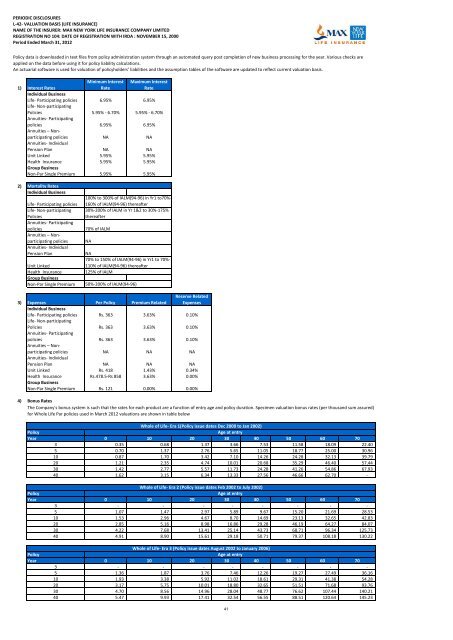

PERIODIC DISCLOSURESL-42- VALUATION BASIS (LIFE INSURANCE)NAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO 104: DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000Period Ended March 31, 2012Policy data is downloaded in text files from policy administration system through an automated query post completion of new business processing for the year. Various checks areapplied on the data before using it for policy liability calculations.An actuarial software is used for valuation of policyholders’ liabilities and the assumption tables of the software are updated to reflect current valuation basis.1) Interest RatesMinimum InterestRate<strong>Max</strong>imum InterestRateIndividual Business<strong>Life</strong>- Participating policies 6.95% 6.95%<strong>Life</strong>- <strong>No</strong>n-participatingPolicies 5.95% - 6.70% 5.95% - 6.70%Annuities- Participatingpolicies 6.95% 6.95%Annuities – <strong>No</strong>nparticipatingpolicies NA NAAnnuities- IndividualPension Plan NA NAUnit Linked 5.95% 5.95%Health <strong>Insurance</strong> 5.95% 5.95%Group Business<strong>No</strong>n-Par Single Premium 5.95% 5.95%2)Mortality RatesIndividual Business<strong>Life</strong>- Participating policies<strong>Life</strong>- <strong>No</strong>n-participatingPoliciesAnnuities- ParticipatingpoliciesAnnuities – <strong>No</strong>nparticipatingpoliciesAnnuities- IndividualPension PlanUnit LinkedHealth <strong>Insurance</strong>Group Business<strong>No</strong>n-Par Single Premium100% to 300% of IALM(94-96) in Yr1 to70%-160% of IALM(94-96) thereafter30%-200% of IALM in Yr 1&2 to 30%-175%thereafter70% of IALMNANA70% to 150% of IALM(94-96) in Yr1 to 70%-110% of IALM(94-96) thereafter125% of IALM50%-200% of IALM(94-96)3) Expenses Per Policy Premium RelatedReserve RelatedExpensesIndividual Business<strong>Life</strong>- Participating policies Rs. 363 3.63% 0.10%<strong>Life</strong>- <strong>No</strong>n-participatingPolicies Rs. 363 3.63% 0.10%Annuities- Participatingpolicies Rs. 363 3.63% 0.10%Annuities – <strong>No</strong>nparticipatingpolicies NA NA NAAnnuities- IndividualPension Plan NA NA NAUnit Linked Rs. 418 1.43% 0.34%Health <strong>Insurance</strong> Rs.478.5-Rs 858 3.63% 0.00%Group Business<strong>No</strong>n-Par Single Premium Rs. 121 0.00% 0.00%4) Bonus RatesThe Company's bonus system is such that the rates for each product are a function of entry age and policy duration. Specimen valuation bonus rates (per thousand sum assured)for Whole <strong>Life</strong> Par policies used in March 2012 valuations are shown in table belowWhole of <strong>Life</strong>- Era 1(Policy issue dates Dec 2000 to Jan 2002)PolicyYear 0 10 20Age at entry30 40 50 60 703 0.35 0.68 1.37 3.66 7.53 11.58 18.09 22.405 0.70 1.37 2.76 5.65 11.05 18.77 25.00 30.9610 0.87 1.70 3.42 7.10 14.26 24.28 32.13 39.7920 1.21 2.35 4.74 10.01 20.68 35.29 46.40 57.4430 1.42 2.77 5.57 11.73 24.28 41.26 54.86 67.9340 1.62 3.15 6.34 13.33 27.56 46.66 62.70 -Whole of <strong>Life</strong>- Era 2 (Policy issue dates Feb 2002 to July 2002)PolicyYear 0 10 20Age at entry30 40 50 60 703 - - - - - - - -5 1.07 1.47 2.97 5.89 9.67 15.20 21.69 28.5310 1.53 2.96 4.67 8.70 14.69 23.13 32.65 42.8320 2.85 5.16 8.98 16.86 29.28 46.19 64.27 84.0730 4.22 7.68 13.41 25.14 43.73 68.71 96.34 125.7340 4.91 8.90 15.61 29.18 50.71 79.37 108.18 130.22Whole of <strong>Life</strong>- Era 3 (Policy issue dates August 2002 to January 2006)PolicyYear 0 10 20Age at entry30 40 50 60 703 - - - - - - - -5 1.36 1.87 3.76 7.46 12.26 19.27 27.49 36.1610 1.93 3.38 5.92 11.02 18.61 29.31 41.38 54.2820 3.17 5.75 10.01 18.80 32.65 51.51 71.68 93.7630 4.70 8.56 14.96 28.04 48.77 76.62 107.44 140.2140 5.47 9.93 17.41 32.54 56.55 88.51 120.64 145.2341