Form No Description Pages - Max Life Insurance

Form No Description Pages - Max Life Insurance

Form No Description Pages - Max Life Insurance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

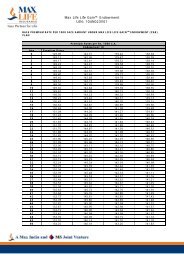

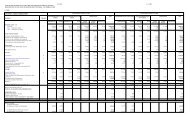

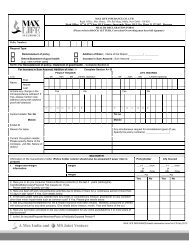

PERIODIC DISCLOSURESFORM L - 29 - DEBT SECURITIES - 7ANAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO: 104; DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000STATEMENT AS ON: March 31, 2012In ` LacsDetail Regarding Debt SecuritiesMarket ValueBook ValueAs at 31st March 2012 As at 31st March 2011 As at 31st March 2012 As at 31st March 2011ULIP <strong>No</strong>n-ULIP Totalas % of total foras % of total foras % of total foras % of total forULIP <strong>No</strong>n-ULIP TotalULIP <strong>No</strong>n-ULIP TotalULIP <strong>No</strong>n-ULIP Totalthis classthis classthis classthis classBreak down by creditratingAAA rated 204,839 250,522 455,361 45.21% 247,402 158,570 405,971 52.29% 204,839 255,052 459,891 44.54% 247,402 160,851 408,253 51.79%AA or better 18,093 10,268 28,361 2.82% 14,606 5,661 20,268 2.61% 18,093 10,848 28,941 2.80% 14,606 6,023 20,629 2.62%Rated below AA butabove A0 0 0 0.00% 0 0 0 0.00% 0 0 0 0.00% 0 0 - 0.00%Rated below A but aboveB0 0 0 0.00% 0 0 0 0.00% 0 0 0 0.00% 0 0 - 0.00%Any other 101,256 422,298 523,553 51.98% 45,527 304,617 350,143 45.10% 101,256 442,354 543,610 52.65% 45,527 313,819 359,345 45.59%324,188 683,087 1,007,275 100% 307,534 468,848 776,382 100% 324,188 708,254 1,032,442 100% 307,534 480,692 788,226 100%BREAKDOWN BYRESIDUALMATURITYUp to 1 year 125,580 53,030 178,610 17.73% 174,773 12,015 186,788 24.06% 125,580 53,052 178,632 17.30% 174,773 12,026 186,799 23.70%More than 1 yearandupto 3years85,130 48,135 133,265 13.23% 68,119 24,043 92,162 11.87% 85,130 48,581 133,711 12.95% 68,119 24,307 92,426 11.73%More than 3years and upto 7years67,150 119,272 186,422 18.51% 40,143 72,270 112,413 14.48% 67,150 121,839 188,989 18.31% 40,143 73,089 113,232 14.37%More than 7 years andup to 10 years44,937 121,746 166,684 16.55% 23,337 82,364 105,701 13.61% 44,937 125,124 170,062 16.47% 23,337 83,873 107,210 13.60%More than 10 years andup to 15 years329 116,470 116,799 11.60% 109 83,295 83,403 10.74% 329 121,899 122,228 11.84% 109 84,965 85,074 10.79%More than 15 years andup to 20 years58 104,833 104,891 10.41% 1,053 73,094 74,147 9.55% 58 108,459 108,517 10.51% 1,053 74,629 75,682 9.60%Above 20 years 1,004 119,600 120,604 11.97% 0 121,768 121,768 15.68% 1,004 129,299 130,303 12.62% 0 127,803 127,803 16.21%324,188 683,087 1,007,275 100% 307,534 468,848 776,382 100% 324,188 708,254 1,032,442 100% 307,534 480,692 788,226 100%Breakdown by type ofthe issuera. Central Government 36,563 378,824 415,386 41.24% 30,703 298,322 329,025 42.38% 36,563 398,385 434,948 42.13% 30,703 307,530 338,234 42.91%b. State Government 19,050 21,607 40,656 4.04% 1,742 1,421 3,162 0.41% 19,050 22,101 41,151 3.99% 1,742 1,414 3,156 0.40%c.Corporate Securities 268,576 282,657 551,233 54.73% 275,089 169,105 444,195 57.21% 268,576 287,768 556,344 53.89% 275,089 171,748 446,837 56.69%324,188 683,087 1,007,275 100% 307,534 468,848 776,382 100% 324,188 708,254 1,032,442 100% 307,534 480,692 788,226 100%<strong>No</strong>te1. In case of a debt instrument is rated by more than one agency, then the lowest rating will be taken for the purpose of classification.2. The detail of ULIP and <strong>No</strong>n-ULIP will be given separately.3. Market value of the securities will be in accordance with the valuation method specified by the Authority under Accounting/ Investment regulations.* Includes Government Securities, Treasury Bills, Reverse Repo and Fixed Deposits17