Form No Description Pages - Max Life Insurance

Form No Description Pages - Max Life Insurance

Form No Description Pages - Max Life Insurance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

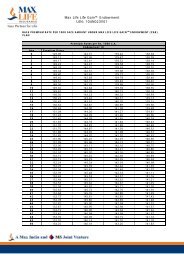

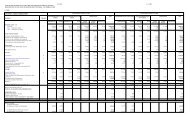

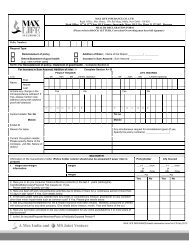

PERIODIC DISCLOSURESFORM L-27- UNIT LINKED - 3A PART BNAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO: 104; DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000STATEMENT AS ON: March 31, 2012Opening Balance (Market Value)Add: Inflow During the QuarterIncrease / (Decrease) Value of Inv. (Net)Less: Outflow during the QuarterTOTAL INVESTIBLE FUNDS (MKT VALUE)ParticularsGroup Gratuity Balanced fundULGF00217/04/06GRATBALANC104Group Gratuity Growth fundULGF00117/04/06GRATGROWTH104Group Gratuity ConservativeFundULGF00317/04/06GRATCONSER104Group SuperannuationBalanced FundULGF00523/01/07SANNBALANC104Group SuperannuationGrowth FundGroup SuperannuationConservative FundULGF00423/01/07SANNGROW ULGF00623/01/07SANNCONSETH104R1041,568 1,285 3,541 1 4 382 6,781225 14 573 0 97 232 1,14177 101 83 (0) (97) 32 19635 28 64 0 0 147 2741,835 1,371 4,134 1 5 498 7,843Total Group FundIn ` LacsApproved Investments (>=75%)Government BondsCorporate BondsInfrastructure BondsApproved EquityMoney MarketMutual fundsDeposit with BanksCurrent Assets:Accrued InterestBank BalanceDividend ReceivableReceivable for Sale of InvestmentsOther Current Assets (for Investments)Appropriation (Expropriation) AssetLess: Current LiabilitiesPayable for InvestmentsOther current liabilites (for Investments)Fund Mgmt Charges PayableInvestment Of Unit FundSub Total(A)Group Gratuity Balanced fundGroup Gratuity Growth fundGroup Gratuity ConservativeFundGroup SuperannuationBalanced FundGroup SuperannuationGrowth FundGroup SuperannuationConservative FundTotal Group FundActual Inv. % Actual Actual Inv. % Actual Actual Inv. % Actual Actual Inv. % Actual Actual Inv. % Actual Actual Inv. % Actual Actual Inv. % Actual423 23% 13 1% 2,171 53% 0 45% 1 26% 254 51% 2,861 36%65 4% 84 6% 352 9% 0 21% 1 14% 42 9% 544 7%469 26% 279 20% 908 22% - 0% - 0% 100 20% 1,756 22%460 25% 663 48% - 0% 0 29% 2 53% - 0% 1,126 14%105 6% 97 7% 78 2% - 0% - 0% 18 4% 298 4%- 0% - 0% - 0% - 0% - 0% - 0% - 0%140 8% 74 5% 458 11% 0 9% - 0% 42 8% 714 9%1,661 91% 1,210 88% 3,967 96% 1 105% 4 93% 456 91% 7,299 93%52 3% 23 2% 148 4% 0 1% 0 1% 15 3% 239 3%21 1% 2 0% 4 0% 0 0% 0 0% 0 0% 26 0%0 0% 0 0% - 0% - 0% - 0% - 0% 0 0%100 5% - 0% 502 12% - 0% 0 4% 85 17% 688 9%- 0% - 0% 0 0% - 0% 0 0% 25 5% 25 0%- 0% - 0% - 0% - 0% - 0% - 0% - 0%93 5% - 0% 488 12% 0 8% - 0% 82 16% 663 8%0 0% 0 0% - 0% - 0% - 0% - 0% 0 0%- 0% - 0% - 0% - 0% - 0% - 0% - 0%Other Investments (