Full year report 2012 - Nobel Biocare Corporate

Full year report 2012 - Nobel Biocare Corporate

Full year report 2012 - Nobel Biocare Corporate

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

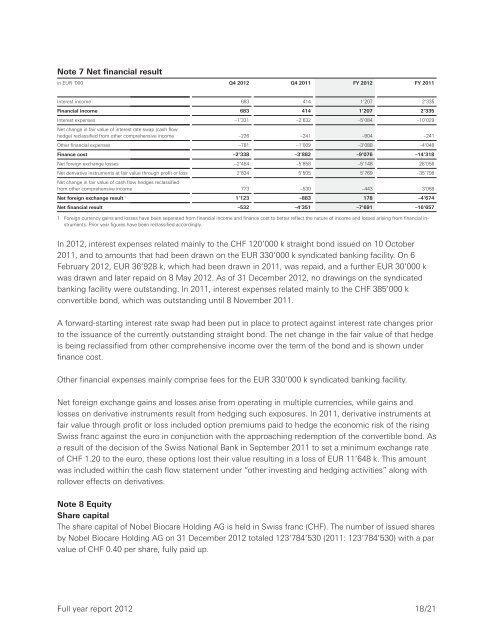

Note 7 Net financial resultin EUR ’000 Q4 <strong>2012</strong> Q4 2011 FY <strong>2012</strong> FY 2011Interest income 683 414 1’207 2’335Financial income 683 414 1’207 2’335Interest expenses –1’331 –2’632 –5’084 –10’029Net change in fair value of interest rate swap (cash flowhedge) reclassified from other comprehensive income –226 –241 –904 –241Other financial expenses –781 –1’009 –3’088 –4’048Finance cost –2’338 –3’882 –9’076 –14’318Net foreign exchange losses –2’484 –5’858 –5’148 28’056Net derivative instruments at fair value through profit or loss 2’834 5’505 5’769 –35’798Net change in fair value of cash flow hedges reclassifiedfrom other comprehensive income 773 –530 –443 3’068Net foreign exchange result 1 1’123 –883 178 –4’674Net financial result –532 –4’351 –7’691 –16’6571 Foreign currency gains and losses have been separated from financial income and finance cost to better reflect the nature of income and losses arising from financial instruments.Prior <strong>year</strong> figures have been reclassified accordingly.In <strong>2012</strong>, interest expenses related mainly to the CHF 120’000 k straight bond issued on 10 October2011, and to amounts that had been drawn on the EUR 330’000 k syndicated banking facility. On 6February <strong>2012</strong>, EUR 36’928 k, which had been drawn in 2011, was repaid, and a further EUR 30’000 kwas drawn and later repaid on 8 May <strong>2012</strong>. As of 31 December <strong>2012</strong>, no drawings on the syndicatedbanking facility were outstanding. In 2011, interest expenses related mainly to the CHF 385’000 kconvertible bond, which was outstanding until 8 November 2011.A forward-starting interest rate swap had been put in place to protect against interest rate changes priorto the issuance of the currently outstanding straight bond. The net change in the fair value of that hedgeis being reclassified from other comprehensive income over the term of the bond and is shown underfinance cost.Other financial expenses mainly comprise fees for the EUR 330’000 k syndicated banking facility.Net foreign exchange gains and losses arise from operating in multiple currencies, while gains andlosses on derivative instruments result from hedging such exposures. In 2011, derivative instruments atfair value through profit or loss included option premiums paid to hedge the economic risk of the risingSwiss franc against the euro in conjunction with the approaching redemption of the convertible bond. Asa result of the decision of the Swiss National Bank in September 2011 to set a minimum exchange rateof CHF 1.20 to the euro, these options lost their value resulting in a loss of EUR 11’648 k. This amountwas included within the cash flow statement under “other investing and hedging activities” along withrollover effects on derivatives.Note 8 EquityShare capitalThe share capital of <strong>Nobel</strong> <strong>Biocare</strong> Holding AG is held in Swiss franc (CHF). The number of issued sharesby <strong>Nobel</strong> <strong>Biocare</strong> Holding AG on 31 December <strong>2012</strong> totaled 123’784’530 (2011: 123’784’530) with a parvalue of CHF 0.40 per share, fully paid up.<strong>Full</strong> <strong>year</strong> <strong>report</strong> <strong>2012</strong>18/21