Full year report 2012 - Nobel Biocare Corporate

Full year report 2012 - Nobel Biocare Corporate

Full year report 2012 - Nobel Biocare Corporate

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

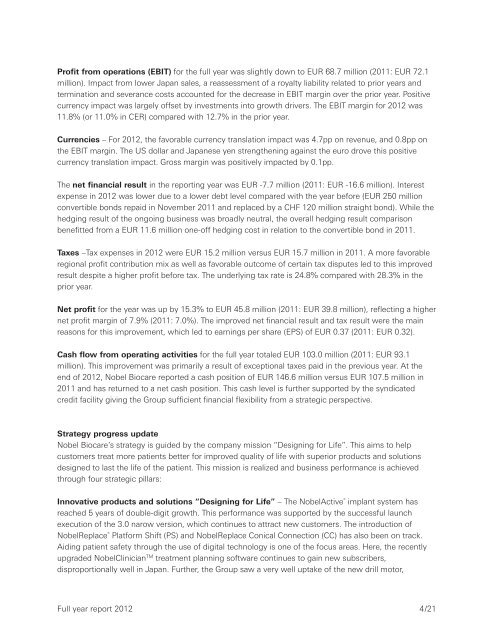

Profit from operations (EBIT) for the full <strong>year</strong> was slightly down to EUR 68.7 million (2011: EUR 72.1million). Impact from lower Japan sales, a reassessment of a royalty liability related to prior <strong>year</strong>s andtermination and severance costs accounted for the decrease in EBIT margin over the prior <strong>year</strong>. Positivecurrency impact was largely offset by investments into growth drivers. The EBIT margin for <strong>2012</strong> was11.8% (or 11.0% in CER) compared with 12.7% in the prior <strong>year</strong>.Currencies – For <strong>2012</strong>, the favorable currency translation impact was 4.7pp on revenue, and 0.8pp onthe EBIT margin. The US dollar and Japanese yen strengthening against the euro drove this positivecurrency translation impact. Gross margin was positively impacted by 0.1pp.The net financial result in the <strong>report</strong>ing <strong>year</strong> was EUR -7.7 million (2011: EUR -16.6 million). Interestexpense in <strong>2012</strong> was lower due to a lower debt level compared with the <strong>year</strong> before (EUR 250 millionconvertible bonds repaid in November 2011 and replaced by a CHF 120 million straight bond). While thehedging result of the ongoing business was broadly neutral, the overall hedging result comparisonbenefitted from a EUR 11.6 million one-off hedging cost in relation to the convertible bond in 2011.Taxes –Tax expenses in <strong>2012</strong> were EUR 15.2 million versus EUR 15.7 million in 2011. A more favorableregional profit contribution mix as well as favorable outcome of certain tax disputes led to this improvedresult despite a higher profit before tax. The underlying tax rate is 24.8% compared with 28.3% in theprior <strong>year</strong>.Net profit for the <strong>year</strong> was up by 15.3% to EUR 45.8 million (2011: EUR 39.8 million), reflecting a highernet profit margin of 7.9% (2011: 7.0%). The improved net financial result and tax result were the mainreasons for this improvement, which led to earnings per share (EPS) of EUR 0.37 (2011: EUR 0.32).Cash flow from operating activities for the full <strong>year</strong> totaled EUR 103.0 million (2011: EUR 93.1million). This improvement was primarily a result of exceptional taxes paid in the previous <strong>year</strong>. At theend of <strong>2012</strong>, <strong>Nobel</strong> <strong>Biocare</strong> <strong>report</strong>ed a cash position of EUR 146.6 million versus EUR 107.5 million in2011 and has returned to a net cash position. This cash level is further supported by the syndicatedcredit facility giving the Group sufficient financial flexibility from a strategic perspective.Strategy progress update<strong>Nobel</strong> <strong>Biocare</strong>’s strategy is guided by the company mission “Designing for Life”. This aims to helpcustomers treat more patients better for improved quality of life with superior products and solutionsdesigned to last the life of the patient. This mission is realized and business performance is achievedthrough four strategic pillars:Innovative products and solutions “Designing for Life” – The <strong>Nobel</strong>Active ® implant system hasreached 5 <strong>year</strong>s of double-digit growth. This performance was supported by the successful launchexecution of the 3.0 narow version, which continues to attract new customers. The introduction of<strong>Nobel</strong>Replace ® Platform Shift (PS) and <strong>Nobel</strong>Replace Conical Connection (CC) has also been on track.Aiding patient safety through the use of digital technology is one of the focus areas. Here, the recentlyupgraded <strong>Nobel</strong>Clinician TM treatment planning software continues to gain new subscribers,disproportionally well in Japan. Further, the Group saw a very well uptake of the new drill motor,<strong>Full</strong> <strong>year</strong> <strong>report</strong> <strong>2012</strong>4/21