Full year report 2012 - Nobel Biocare Corporate

Full year report 2012 - Nobel Biocare Corporate

Full year report 2012 - Nobel Biocare Corporate

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

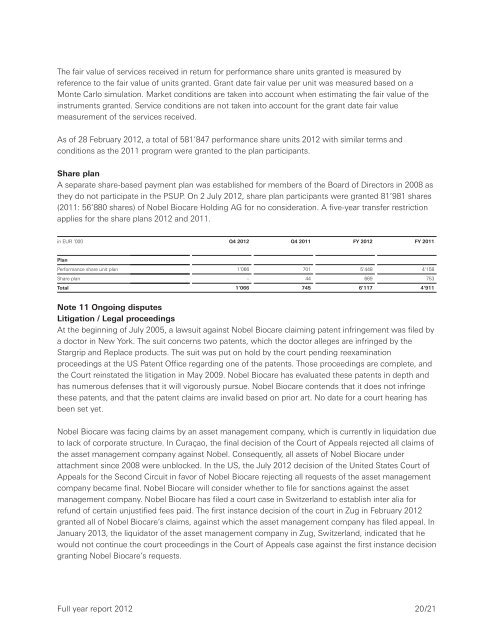

The fair value of services received in return for performance share units granted is measured byreference to the fair value of units granted. Grant date fair value per unit was measured based on aMonte Carlo simulation. Market conditions are taken into account when estimating the fair value of theinstruments granted. Service conditions are not taken into account for the grant date fair valuemeasurement of the services received.As of 28 February <strong>2012</strong>, a total of 581’847 performance share units <strong>2012</strong> with similar terms andconditions as the 2011 program were granted to the plan participants.Share planA separate share-based payment plan was established for members of the Board of Directors in 2008 asthey do not participate in the PSUP. On 2 July <strong>2012</strong>, share plan participants were granted 81’981 shares(2011: 56’880 shares) of <strong>Nobel</strong> <strong>Biocare</strong> Holding AG for no consideration. A five-<strong>year</strong> transfer restrictionapplies for the share plans <strong>2012</strong> and 2011.in EUR ’000 Q4 <strong>2012</strong> Q4 2011 FY <strong>2012</strong> FY 2011PlanPerformance share unit plan 1’066 701 5’448 4’158Share plan – 44 669 753Total 1’066 745 6’117 4’911Note 11 Ongoing disputesLitigation / Legal proceedingsAt the beginning of July 2005, a lawsuit against <strong>Nobel</strong> <strong>Biocare</strong> claiming patent infringement was filed bya doctor in New York. The suit concerns two patents, which the doctor alleges are infringed by theStargrip and Replace products. The suit was put on hold by the court pending reexaminationproceedings at the US Patent Office regarding one of the patents. Those proceedings are complete, andthe Court reinstated the litigation in May 2009. <strong>Nobel</strong> <strong>Biocare</strong> has evaluated these patents in depth andhas numerous defenses that it will vigorously pursue. <strong>Nobel</strong> <strong>Biocare</strong> contends that it does not infringethese patents, and that the patent claims are invalid based on prior art. No date for a court hearing hasbeen set yet.<strong>Nobel</strong> <strong>Biocare</strong> was facing claims by an asset management company, which is currently in liquidation dueto lack of corporate structure. In Curaçao, the final decision of the Court of Appeals rejected all claims ofthe asset management company against <strong>Nobel</strong>. Consequently, all assets of <strong>Nobel</strong> <strong>Biocare</strong> underattachment since 2008 were unblocked. In the US, the July <strong>2012</strong> decision of the United States Court ofAppeals for the Second Circuit in favor of <strong>Nobel</strong> <strong>Biocare</strong> rejecting all requests of the asset managementcompany became final. <strong>Nobel</strong> <strong>Biocare</strong> will consider whether to file for sanctions against the assetmanagement company. <strong>Nobel</strong> <strong>Biocare</strong> has filed a court case in Switzerland to establish inter alia forrefund of certain unjustified fees paid. The first instance decision of the court in Zug in February <strong>2012</strong>granted all of <strong>Nobel</strong> <strong>Biocare</strong>’s claims, against which the asset management company has filed appeal. InJanuary 2013, the liquidator of the asset management company in Zug, Switzerland, indicated that hewould not continue the court proceedings in the Court of Appeals case against the first instance decisiongranting <strong>Nobel</strong> <strong>Biocare</strong>’s requests.<strong>Full</strong> <strong>year</strong> <strong>report</strong> <strong>2012</strong>20/21