OCOB Ann Rep 07-08 - Orfalea College of Business - Cal Poly San ...

OCOB Ann Rep 07-08 - Orfalea College of Business - Cal Poly San ...

OCOB Ann Rep 07-08 - Orfalea College of Business - Cal Poly San ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

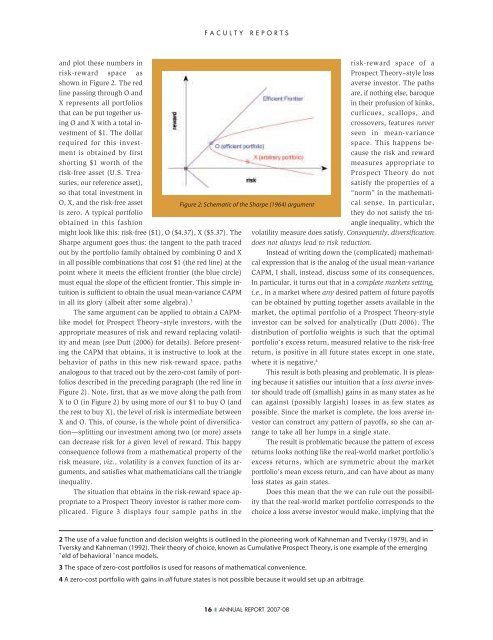

FACULTY REPORT<strong>San</strong>d plot these numbers inrisk-reward space asshown in Figure 2. The redline passing through O andX represents all portfoliosthat can be put together usingO and X with a total investment<strong>of</strong> $1. The dollarrequired for this investmentis obtained by firstshorting $1 worth <strong>of</strong> therisk-free asset (U.S. Treasuries,our reference asset),so that total investment inO, X, and the risk-free assetis zero. A typical portfolioobtained in this fashionmight look like this: risk-free ($1), O ($4.37), X ($5.37). TheSharpe argument goes thus: the tangent to the path tracedout by the portfolio family obtained by combining O and Xin all possible combinations that cost $1 (the red line) at thepoint where it meets the efficient frontier (the blue circle)must equal the slope <strong>of</strong> the efficient frontier. This simple intuitionis sufficient to obtain the usual mean-variance CAPMin all its glory (albeit after some algebra). 3The same argument can be applied to obtain a CAPMlikemodel for Prospect Theory–style investors, with theappropriate measures <strong>of</strong> risk and reward replacing volatilityand mean (see Dutt (2006) for details). Before presentingthe CAPM that obtains, it is instructive to look at thebehavior <strong>of</strong> paths in this new risk-reward space, pathsanalogous to that traced out by the zero-cost family <strong>of</strong> portfoliosdescribed in the preceding paragraph (the red line inFigure 2). Note, first, that as we move along the path fromX to O (in Figure 2) by using more <strong>of</strong> our $1 to buy O (andthe rest to buy X), the level <strong>of</strong> risk is intermediate betweenX and O. This, <strong>of</strong> course, is the whole point <strong>of</strong> diversification—splittingour investment among two (or more) assetscan decrease risk for a given level <strong>of</strong> reward. This happyconsequence follows from a mathematical property <strong>of</strong> therisk measure, viz., volatility is a convex function <strong>of</strong> its arguments,and satisfies what mathematicians call the triangleinequality.The situation that obtains in the risk-reward space appropriateto a Prospect Theory investor is rather more complicated.Figure 3 displays four sample paths in theFigure 2: Schematic <strong>of</strong> the Sharpe (1964) argumentrisk-reward space <strong>of</strong> aProspect Theory–style lossaverse investor. The pathsare, if nothing else, baroquein their pr<strong>of</strong>usion <strong>of</strong> kinks,curlicues, scallops, andcrossovers, features neverseen in mean-variancespace. This happens becausethe risk and rewardmeasures appropriate toProspect Theory do notsatisfy the properties <strong>of</strong> a“norm” in the mathematicalsense. In particular,they do not satisfy the triangleinequality, which thevolatility measure does satisfy. Consequently, diversificationdoes not always lead to risk reduction.Instead <strong>of</strong> writing down the (complicated) mathematicalexpression that is the analog <strong>of</strong> the usual mean-varianceCAPM, I shall, instead, discuss some <strong>of</strong> its consequences.In particular, it turns out that in a complete markets setting,i.e., in a market where any desired pattern <strong>of</strong> future pay<strong>of</strong>fscan be obtained by putting together assets available in themarket, the optimal portfolio <strong>of</strong> a Prospect Theory-styleinvestor can be solved for analytically (Dutt 2006). Thedistribution <strong>of</strong> portfolio weights is such that the optimalportfolio’s excess return, measured relative to the risk-freereturn, is positive in all future states except in one state,where it is negative. 4This result is both pleasing and problematic. It is pleasingbecause it satisfies our intuition that a loss averse investorshould trade <strong>of</strong>f (smallish) gains in as many states as hecan against (possibly largish) losses in as few states aspossible. Since the market is complete, the loss averse investorcan construct any pattern <strong>of</strong> pay<strong>of</strong>fs, so she can arrangeto take all her lumps in a single state.The result is problematic because the pattern <strong>of</strong> excessreturns looks nothing like the real-world market portfolio’sexcess returns, which are symmetric about the marketportfolio’s mean excess return, and can have about as manyloss states as gain states.Does this mean that the we can rule out the possibilitythat the real-world market portfolio corresponds to thechoice a loss averse investor would make, implying that the2 The use <strong>of</strong> a value function and decision weights is outlined in the pioneering work <strong>of</strong> Kahneman and Tversky (1979), and inTversky and Kahneman (1992). Their theory <strong>of</strong> choice, known as Cumulative Prospect Theory, is one example <strong>of</strong> the emerging˚eld <strong>of</strong> behavioral ˚nance models.3 The space <strong>of</strong> zero-cost portfolios is used for reasons <strong>of</strong> mathematical convenience.4 A zero-cost portfolio with gains in all future states is not possible because it would set up an arbitrage.16 ❚ ANNUAL REPORT 20<strong>07</strong>-<strong>08</strong>