Download Annual Report 2006 - Foskor

Download Annual Report 2006 - Foskor

Download Annual Report 2006 - Foskor

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MISSION• We accept our responsibility towards all stakeholders inclusiveof the communities in which we conduct our business.• Our primary business is the beneficiation of phosphate rockconcentrate for the production of phosphoric acid and phosphate-based fertilisers, which are sold into the international anddomestic markets.• Our secondary business activities include:– The production of electrofused zirconia from zircon sand; and– The recovery of low concentrates of copper sulphide minerals.• The Group is committed to:– Competitive, reliable, effective production and marketing;– Striving for excellence as the benchmark of all our endeavours;– Providing an environment conducive to personal developmentand participation by all employees;– Complying with the spirit of the transformation process withinthe framework of legislative measures;– Maintaining the highest ethical, professional, quality and losscontrol standards; and– Continuing to be environmentally responsible.VISIONTo create, maintain and enhance a financially viable, performance-driven business, capable of delivering sustained superior financialand social returns to our shareholders.PROFILEThe <strong>Foskor</strong> Group is a well-established South African group ofcompanies. The Group has grown from a single phosphate miningoperation since 1951 to become one of the world’s largest, mostdynamic phosphate and phosphoric acid producers.The Group’s recent emergence as a world leader has been basedon various strategic initiatives, including:• Strategic capital investment to ensure a sustainableinfrastructure;• An emphasis on inter-group synergies to ensure shareholdervalue maximisation; and• A focus on expanding the core value-adding operations of theGroup.The Group has three major operating entities:• A phosphate rock mine and beneficiation plant situated inPhalaborwa;• A phosphoric acid plant situated in Richards Bay; and• A sulphuric acid plant situated in Richards Bay.A secondary activity – and valuable source of revenue – is theproduction of electrofused zirconia from zircon sand. The recoveryof copper sulphide mineral found in the phosphate ore alsocontributes to the Group’s income, while magnetite recovered fromthe foskorite ore is stockpiled as a possible future source of ironand titanium.

TABLE OF CONTENTSDirectors and Management 02Chairman’s Review 04Chief Executive Officer’s Review 06Chief Financial Officer’s Review 10Corporate Review 12<strong>Annual</strong> Financial StatementsDirectors’ Declaration 15Auditors’ <strong>Report</strong> 16<strong>Report</strong> of the Directors 17Balance Sheet 20Income Statement 21Statement of Changes in Equity 22Cash Flow Statement 23Principal Accounting Policies 24Notes to the Financial Statements 34Five-year Review 54Notice to Members/Administrators 57Administration 58

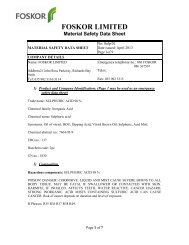

DIRECTORS AND MANAGEMENTList of Directors, Committees and Management as at the end of the 12 month financialperiod ended on 31 March <strong>2006</strong>:BOARD OF DIRECTORSMs M NhlanhlaInsertMs LBR MthembuInsert(Sitting from left to right) Ms Z Monnakgotla (Member); Mr LL van Niekerk (Chairman); Mr MA Pitse (CEO)(Standing from left to right) Ms RK Morathi (Deputy Chairman); Dr DS Phaho (Member); Mr PJ Ledger (Member);Mr G van Wyk (Member); Mr A Vellayan (Member)BOARD AUDIT & RISK COMMITTEEMr G van WykChairmanMr MA PitseCEOMs RK MorathiMemberMs LBR Mthembu MemberMs M NhlanhlaMemberBOARD TECHNICAL COMMITTEEMr PJ LedgerChairmanMr MA PitseCEOMs Z Monnakgotla MemberDr DS PhahoMemberBOARD HUMAN RESOURCES COMMITTEEMs RK MorathiChairmanMr MA PitseCEOMr LL van Niekerk MemberMr G van WykMemberMr A VellayanMember2

EXECUTIVE MANAGEMENT(Sitting from left to right)Ms AUS KhanyileMr TJ KoekemoerMr MA PitseMr J VaidhyanathanCompany Secretary:B.ProcChief Financial Officer:B.Com (Hons) CA (SA) AEPPresident & CEO:B.Compt (Hons), MBL, CA (SA)Vice President:AcidB.E. (Mech)(Standing from left to right)Mr F van der SchyffMr CFH SchmidtMr G SkhosanaMr ND NaidooGeneral Manager:Rock & CopperB.Sc (Mech. Eng), MBA, GCCMines & WorksGeneral Manager:ZirconiaB.ScVice President:Sales & MarketingB.Com, MDPD, ASMPDVice President:Human ResourcesB.Sc (Chem Eng), MBL,Global EDPMr JW HornChief Operating Officer:B-Eng, Pr-Eng, MSAIIE,(Hons) BB & A, MBAMr H MalhotraVice President:Procurement & LogisticsB.Sc, M.Tech (Mech Eng)3

CHAIRMAN’S REVIEWOur focus is ongrowth – not onlygrowth of agriculturalproducts, but alsogrowth for ourselvesand our country.The year under review can only be described asa turbulent one, characterised by a mixture ofhighs and lows, opportunities and challenges.The Board however has to recognise that theGroup has had a major turnaround towardsprofitability with the breakeven exchange ratebeing improved from circa R8,90 in 2003 tocirca R6 to the US dollar.The Board and Management deeply regretthe death of Mr Xulu, a contractor at ourRichards Bay operation, who suffered a fatalaccident when he fell approximately 25 metresthrough the roof of the rock store to his death.Condolences were passed on to his employer,family and loved ones.It is also unfortunate that the efforts towardsproving that <strong>Foskor</strong> is a responsible corporatecitizen with regard to safety, health and theenvironment are not bearing fruit and nottranslating into results. The Richards BayPlant, had eight disabling incidents concerningown employees. A fire destroyed the mainsulphur feed conveyor and two reportableenvironmental incidents occurred at the plantin Richards Bay. Environmental gas emissionpermit requirements have been met 99,93% ofthe time, which is the best performance for theGroup in recent history.The Phalaborwa operation again excelled inthe safety, health and environmental arena withonly five disabling injuries for the period and adisabling injury frequency rate of 0,23 which isworld class. The Phalaborwa operations wereawarded OSHAS 18000 on their first attemptand retained their ISO 9001 and ISO 14001certification.Safety and environmental compliance will receiveincreased focus in order for the Group to achievethe targets set in the mission statement.During the year, the shareholder, the IndustrialDevelopment Corporation (IDC), diluted itsshareholding by selling 2,5% to CoromandelFertilisers Limited (CFL), an Indian company.Further, <strong>Foskor</strong> and CFL entered into a BusinessAssistance Agreement (BAA) with the objectiveof transferring technical, operational and otherskills and know-how to <strong>Foskor</strong> and improving theprofitability. Through this, CFL could – over threeyears, of which the first year is the year underreview – increase its shareholding to circa 16%.The first year of the involvement of CFL, theStrategic Equity Partner, has come to an end. Theinvolvement of CFL has resulted in the RichardsBay operation achieving record production levelsof 625 532 tons compared to a previous recordof 575 000 tons of P 2O 5in 2004.The <strong>Foskor</strong> strategic intent, direction andperformance against strategic targets have beenreviewed by the Board. The vision and missionwas confirmed and new strategic initiatives havebeen identified for executive management toachieve for the new year and in the medium term.The Board is confident that by achieving theseobjectives, the <strong>Foskor</strong> Group would realise itsvision of becoming a financially viable business,delivering superior financial and social returnsto all stakeholders.FINANCIAL PERFORMANCEGroup revenue increased by 43% (annualised)to R2.6bn in <strong>2006</strong>.The Group achieved a major turnaround inprofitability of R552m, from a net loss aftertax of R477m in 2005 to a net profit after taxof R75m for the current year.The Group had a positive free cash flowamounting to R95m. This was the first positivefree cash flow in at least ten years. This,combined with a positive bank balance in excessof R400m and unutilised banking facilities inexcess of R300m, puts the Group in a soundfinancial position.Due to continuously declining feed gradesas a result of the depletion of above groundreserves, the Phalaborwa division marginallyproduced less phosphate rock than budget.A strategic project was initiated in order tofind a cost effective replacement for this feedconstituting about 40% of the productioncapacity. The Pyroxenite Expansion Project(PEP) will investigate alternative options ofexploiting the South Pyroxenite reserve in orderto maintain or even increase production levels ofphosphate rock at Phalaborwa for the next 50years. The Extension Eight plant performanceimproved towards the latter half of the year.The bottleneck hampering performance tocapacity is still the dry mill. A project has beenlaunched to eliminate this constraint, ensuringmaximal benefits from the flotation capacity inthe plant. Production costs are under control,4

however, due to the igneous nature of the oresource, compared to sedimentary types of rock,the plant remains in the top 10th percentile interms of cost of production of rock phosphateproducers in the world. The challenge is tofind niche, high value markets for this superiorquality rock phosphate.The investment of some four years ago ofexpanding the installed capacity at RichardsBay to circa 750 000 tons of P 2O 5, is now,with the assistance of CFL, starting to payoff. Production levels of phosphoric acid wererestricted by unforeseen shutdowns as well aslogistical constraints in getting the phosphaterock from Phalaborwa to Richards Bay. Year onyear the production cost per ton of phosphoricacid was well controlled, partly due to thevolume effect, but was negatively impactedby, predominantly, increased maintenance.The <strong>Foskor</strong> Group is now looking forward toextracting maximum value from the expansionand capturing market share by producing atcapacity within the near future.The increased capacity utilisation of theRichards Bay plant culminated in an increasein phosphoric acid sales into India and granularfertiliser sales locally.One local converter of phosphate rock has shutdown its operation, which led to a reduction ofphosphate rock sales into the domestic market.As a further result of the increased rockrequirements of the Richards Bay plant, exportsto Japan were limited.Trading conditions into India will remaintight, specifically as a result of difficult pricenegotiations and the Indian government’sproposed amended pricing policies.The Group expects that sales tonnages andprices of phosphoric acid, granular fertiliserand phosphate rock will continue to increase inthe future leading to improved profitability.The objective is to further diversify the marketsand become less reliant on the Indian consumergroups.The market for the procurement of strategicraw materials remained at high levels andwill continue to be a key driver for the Group.Sulphur and ammonia markets are watchedclosely in order to ensure the best deals for<strong>Foskor</strong>. The increased focus and participationof our suppliers are beginning to pay off and thepositive impact on production costs can be seenin the operations.<strong>Foskor</strong>, as a strategic investment of the IDC,has an obligation to the government to be afrontrunner and role model with respect to thepromotion of Broad Based Black EconomicEmpowerment (BBBEE). Direct purchasesfrom BBBEE suppliers have reached 40% ofdiscretionary procurement for the whole Group,which placed orders to the value of R270mwith SMMEs (small, medium and microenterprises) and true black empowered andowned companies. This will continue to increasethrough the focused efforts and dedicationof <strong>Foskor</strong> management, enabling the realempowerment of the black community into themainstream economy of our country.The <strong>Foskor</strong> Human Capital is and will remainof strategic and vital importance to the successof the Group.The <strong>Foskor</strong> Group has adopted and implementeda formal Employment Equity Policyrecognising the importance of changing thecompany’s demographic profile, in line with thedemographics of the areas in which it operates, tocreate a diverse and skilled employee workforce.These targets have been incorporated into theperformance management targets of top andsenior management. Attracting and retainingHistorically Disadvantaged South Africans(HDSAs) to Phalaborwa continues to be a majorchallenge. The national shortage of artisansis also now having an impact on the Group’sability to attract and retain skilled artisans andthis is one area where the achievement of the settargets is proving extremely challenging. Labourrelations throughout the Group continued toflourish without any industrial action takingplace during the period under review.<strong>Foskor</strong>’s dual strategic approach of dealingwith the impacts and seriousness of the HIV/AIDS pandemic includes both preventativeprogrammes, such as education and awareness,and support programmes, which include theprovision of anti-retroviral treatment andnutritional supplements. These efforts towardscombating this challenge and managing theimpacts thereof in the workplace will remainhigh on the corporate agenda for the Group.A revised health care policy, with a changein medical aid service provider for the lowerincome groups, was approved and implementedduring the year under review. All employees nowhave the option to belong to one of the medicalaid schemes utilised by the company.In conclusion, I would like to acknowledge theefforts of the executive team, employees andcontractors and express the Board’s sincerethanks and appreciation for their commitmentand achievements during the year. At the sametime I wish to assure them of the continuedsupport of the Board for their efforts, becausewe all believe in the sustainable future of <strong>Foskor</strong>.I would also like to express my appreciation tomy colleagues on the Board for their wisdom andcounsel. As with 2005, this certainly has beenanother challenging year but I look forward withconfidence to improved performance during thenext financial year.5

CHIEF EXECUTIVE OFFICER’S REVIEWWe takephosphaterock fromthe earth.OVERVIEWThe challenges <strong>Foskor</strong> faced in the 2005/<strong>2006</strong>financial year were many and varied and anotherinteresting year was experienced, leading to theGroup being on the brink of a major turnaround.The challenge in respect of proving our safetyand environmental responsibility persisted at theRichards Bay plant. Unfortunately, on 3 February<strong>2006</strong>, Mr Xulu from a contracting firm lost hislife when he fell approximately 25 metres fromthe rock store roof. Further to this, the operationhad eight disabling incidents concerning ownemployees. A fire destroyed the main sulphur feedconveyor on 3 March <strong>2006</strong> and two reportableenvironmental incidents occurred at the plantin Richards Bay: the first was an ammonia leakin June 2005 and the second a sulphur trioxideemission from Sulphuric Acid Plant A inNovember 2005.The first year of the involvement of the StrategicEquity Partner, Coromandel Fertilisers Limited(CFL) from India, has drawn to a close. TheBusiness Assistance Agreement (BAA) with CFLhas culminated in the Richards Bay operationachieving record production levels.The <strong>Foskor</strong> Board and Executive Managementhave again reviewed the <strong>Foskor</strong> strategic directionand identified the strategic key initiatives that arenecessary for the short and medium term in orderto achieve the corporate vision and mission.FINANCIAL PERFORMANCEGroup revenue increased by R768m or 43%,from R1806m (annualised) in 2005, to R2574min <strong>2006</strong>. Approximately 40% of the increasein revenue originates from a tolling agreementbetween <strong>Foskor</strong> and Sasol Nitro for themanufacture of phosphoric acid and deflorinatedacid. A 33% increase in volume of phosphoricacid sales from Richards Bay and price increasesapproaching 10%, made up the balance.Coromandel Fertilisers Limited (CFL), to providetechnical, operational, maintenance, purchasingand business assistance to <strong>Foskor</strong>. The underlyingprinciple of the BAA is to remunerate CFL forits efforts to improve <strong>Foskor</strong>’s Earnings beforeInterest and Tax(es) (EBIT) over and abovethe ongoing initiatives of <strong>Foskor</strong>. CFL is also acustomer of <strong>Foskor</strong> and the majority shareholderof Godavari Fertilisers and Chemicals (GFCL) ofIndia, in which <strong>Foskor</strong> has a 5% shareholding.Remuneration in terms of the BAA agreementis discussed in the Directors’ <strong>Report</strong> elsewhere.The real financial benefits cannot be measured atthis stage with sufficient reliability, although theimpact can be felt at the operational level.The financial remuneration payable to CFL islimited to a maximum of R300m and will beutilised to purchase further equity in <strong>Foskor</strong> ifand when audited at the end of the measurementperiod.PRODUCTION AND OPERATIONSThe Phalaborwa division produced 2.528m tons ofphosphate rock, which is 6, 2% below budget. Oremined was on budget. Waste removal was 6.7mtons, which was 2.9% below the budget. Accidentdamage to a large haul truck, which reducedthe fleet size by 8.3% for a part of the year,substantial downtime on the Extension Eight millat the beginning of the year, and lower recoverieson two of the streams were the major contributingfactors to these variances. This improved towardsthe latter half of the financial year. Costs have beenwell contained and ended on 4.7% below budget(11.5% below budget including copper credits).Extension Eight has achieved the best performanceto date and is performing as well as can be expected,but the Loesche mill remains a bottleneck in theproduction stream. Extension Eight ended the year10.4% below budget, but in the past three monthsit has achieved 3.0% above budget. A project hasbeen launched to evaluate de-bottlenecking theExtension Eight production stream.The Group achieved a major turnaround inprofitability of R552m, from a net loss after taxof R477m in 2005 to a net profit after tax ofR75m for the year under review.BUSINESS ASSISTANCE AGREEMENTIn February 2005, <strong>Foskor</strong> entered into a BAA withProduction cost of phosphate rock was wellcontrolled. The negative effect of lower thanbudgeted production was offset mainly by thehigh copper price reflected in the copper credits,but also by strict cost control and further costreduction initiatives that has been successfullyimplemented during the year.6

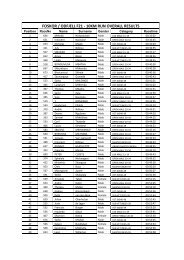

The remaining <strong>Foskor</strong> ore reserves are summarisedin the following table together with the calculatedlife at the current consumption rate.In-houseOre Expected ClassificationIdentity MT Life Resource ReserveNorth Measured ProvenPyroxenite 531 +40 years Resource Reserves+7 years Measured ProvenArea 9 70 * Resource ReservesMarginal 12 months Measured Provendumps 6 ** Resource ReservesPMCActiveTailings +11 years Measured ProvenDams 160 *** Resource ReservesSouth Measured ProvenPyroxenite 1650 +50 years Resource ReservesTable 1: <strong>Foskor</strong> Reserves and ResourcesPMC – Palaborwa Mining CompanyMT – million metric tons* 4 years at increased rate to replace Marginaldumps** at January <strong>2006</strong>*** Full feasibility completedThe above ground ore reserves known as<strong>Foskor</strong>ite (Area 9 and Marginal), previouslymined and stockpiled will be depleted by theend of 2009. <strong>Foskor</strong> has embarked on a projectknown as Pyroxenite Expansion Project (PEP)to replace the <strong>Foskor</strong>ite ore with Pyroxenite oreto be sourced from the new South Pyroxeniteopen pit. The feasibility and technical cost studyphase of the project has already been approvedand will be completed by March 2007. Thisstudy will form the basis on which a decisionon the implementation of the project will bemade. The implementation of the PEP is thenplanned to start in April 2007 and be completedby December 2009. Indications at this stage arethat the South Pyroxenite pit has phosphate richore reserves sufficient to sustain <strong>Foskor</strong> for thenext 50+ years.All the applicable mineral rights applications havebeen lodged with the Department of Minerals andEnergy. Some of these have been finalised, and areply is being awaited on the rest.The production in Richards Bay was 626k tonsof phosphoric acid against a previous best of575k and a capacity of 750k tons. Sulphuricacid production, was 1 771k tons, which was 6%below budget. At the beginning of the financialyear, after the shutdown, all the sulphuricacid plants experienced teething problems.Production in the latter part of the year wasrestricted by the poor availability of rockphosphate from Phalaborwa due to logisticalconstraints. Production was further hamperedby the fire incident in the sulphur conveyor.Lower production in granular fertilisers wasmainly due to lower off take in the market andmaintenance and operational problems in theplant.Cost of production of phosphoric acid wasadversely affected by unexpected expenditure dueto increased maintenance and a backlog paymentfor gypsum disposal to sea as well as the shutdownsand other accidents and incidents. Year on yearthe production cost per ton of phosphoric acid waswell controlled, partly due to the volume effect.The demurrage per ton was also drastically reducedby 30% compared to previous years, due to quickturnaround of the ships and increased transfer ofacid as the export pipeline was replaced in time.MARKETING AND SALESThe overall sales of phosphoric acid and granularfertilisers were significantly up, compared tothe previous financial year. This is mainly as aresult of an improvement in the production ofphosphoric acid.Total sales of phosphate rock to the localmarket, excluding inter-company sales, werebelow those of the previous financial year asa result of logistical limitations as well as areduction in the demand in the local market.Only circa 140 000 tons of phosphate rock wereexported to the Japanese market.Total export of phosphoric acid to India wasaround 12% above budget and total granularfertiliser sales were 41% below budget; thegranular fertiliser sales were negatively impactedby the production problems experienced atthe Richards Bay plant as well as by marketconditions.It is expected that the new negotiations for thephosphoric acid selling price into India will againprove to be difficult. At the time of writing thisreport, new selling prices of phosphoric acid forthe period April <strong>2006</strong> to March 2007 were notyet finalised.The Group expects that sales tonnages andprices on phosphoric acid, granular fertiliser andphosphate rock will continue to increase in thefuture.SAFETY, HEALTH, ENVIRONMENT ANDQUALITY (SHEQ)The Rock and Copper division achieved 1.6 millionfatality-free shifts and 2.6 million man-hourswithout a disabling injury during this period, butthe latter has been reduced to 0.8 million manhourswithout a disabling injury due to an injuryduring December 2005.Both the Rock and Copper as well as the Zirconiadivisions based in Phalaborwa, had successfulintegrated SHEQ audits, achieving OHSAS18000, ISO 9001 and ISO 14001 certificationover and above being awarded the DEKRA 5Shields award for safety, health, environmentand quality management for integrated SHEQsystems.In accordance with the water permit issued bythe Department of Water Affairs and Forestry(DWAF), Phalaborwa operations have successfullyoperated the collection points around thetailings dams and not discharged any water intothe Selati River during the year under review.The Richards Bay plant has embarked on theimplementation of the Process Safety ManagementSystem (PSMS), which is mandatory in the USAfor hazardous installations.The fatality in February <strong>2006</strong> of a contractorwho was working on the roof of the phosphaterock store is regrettable. However, negligence onthe part of the deceased for not adhering to thesafety measures was found to be the cause of theaccident.All plants in Richards Bay outperformed thepermit emission requirements, with the SulphuricAcid Plant achieving its highest compliance recordof all time of 99.93%. Complaints to the RichardsBay Clean Air Association reduced from 50% to30% for the year under review.Two reportable environmental incidents occurredat the plant in Richards Bay. The first was anammonia leak in June 2005 and the second asulphur trioxide emission from Sulphuric AcidPlant A in November 2005.The Phosphoric Acid production facility maintainedits ISO 9001 accreditation for quality.A fire occurred in March <strong>2006</strong>, at the SulphurTransfer Tower and associated conveyor belt.7

CHIEF EXECUTIVE OFFICER’S REVIEWWe enrich ourphosphate rockwith the additionof sulphur.The cause of the fire was attributed to friction andhigh dust content from the sulphur received fromthe Middle East. The structures were subsequentlyrepaired and put to use.Post the financial year closure, on 7 May <strong>2006</strong>, atransformer at the old phosphoric acid plant caughtfire, causing substantial damage to electrical cables;and Business Interruption is estimated to be as muchas 50 days.It is clear that safety and environmental complianceand responsibility should remain the key focus areafor the Richards Bay operation for the year tocome.MINE CLOSURE COST PROVISIONThe Group is aware of the increasing emphasison environmental accounting and accountability.Management is continually assessing and monitoringthe various environmental issues facing the Group.Based on a Mine Rehabilitation and Closure CostAssessment done by African EPA during 2005,the contingent liability has been recognised for theissuing of guarantees to the Department of Mineralsand Energy in terms of Regulation 54(2) of theRegulations promulgated in terms of the Mineralsand Petroleum Resources Department Act, 2003(Act 28 of 2004). The recommended mine closurecost at this stage (ignoring salvage value) is R223m.A commitment has been made to the Department ofEnvironmental Affairs with respect to the phased indelivery of guarantees. The value of the Trust as at31 March <strong>2006</strong> amounts to R41.2m.PROCUREMENT AND LOGISTICSDuring the first quarter of the year the internationalsulphur market was high but during the latter period,sulphur prices softened, which had a positive impacton the final product costing. Due to high productionthe volume of usage in the Richards Bay divisionwas higher by 9% than for the previous 12 monthperiod.high production of phosphoric acid at the RichardsBay plant.Once again, the focus of procurement has beenon promotion of Black Economic Empowerment(BBBEE). During the year under review, directpurchases from BBBEE suppliers have reached40% of discretionary procurement for the wholeGroup (excluding reagents and strategic rawmaterials on total purchases). The total spend wasR677m and the BBBEE spend came to R270m. Thisachievement is attributable to clear dedication of<strong>Foskor</strong> management to ensuring black participationin the main supply chain of <strong>Foskor</strong>.OUR HUMAN CAPITALEMPLOYMENT EQUITYIn line with the Employment Equity Act the <strong>Foskor</strong>Group has adopted a formal Employment EquityPolicy. The policy recognises the importance ofchanging the company’s demographic profile,in line with the demographics of the areas inwhich it operates, to create a diverse and skilledemployee workforce. Employment Equity targetsset by Employment Equity and Skills DevelopmentCommittees consisting of Management, OrganisedLabour, Women and Disabled Employeesrepresentatives are approved by the Boardof Directors. These targets form part of theperformance management targets of top and seniormanagement. Although the planned employmentequity targets, for the Group as a whole, for theyear under review, were substantially met, it isproving a major challenge to attract HistoricallyDisadvantaged South Africans (HDSAs) toPhalaborwa and to retain them. The shortage ofartisans in the country is also having an impacton the Group’s ability to attract and retain skilledartisans and this is one area where the achievementof the set targets is proving extremely challenging.This was somewhat alleviated by the developmentof in-house talent in line with the Section 28 artisantraining programme.During the period under review ammonia marketswere stable and quite high. Procurement of ammoniawas carried out on annual contract from Sabic andat the time when rates were on a downward trend.During the period under review, 40 000 tons ofammonia were purchased, which is more or less thesame as that of the previous 12 month period.Total shipments of Rock to Richards Bay were 10%higher than for the previous financial year due toSKILLS DEVELOPMENTThe Workplace Skills Plan and annual trainingreports for the operations in Phalaborwa andthe plant in Richards Bay are set, monitored andapproved by the two Employment Equity and SkillsDevelopment Committees respectively and thensubmitted to the relevant Sector Education andTraining Authority (SETA) – which in this caseis the Mining Qualifications Authority (MQA) orthe Chemical Industries Education and Training8

Authority (CHIETA) and the Department ofLabour. <strong>Foskor</strong> has received refund grants inexcess of 60% of the skills levies paid.employees is currently under investigation. Thepost-retirement health care and pension benefitsare also under review.safety and environmental compliance in RichardsBay will also assist in making the next year one tobe excited about.The Adult Basic Education and Training (ABET)programme is substantially complete in RichardsBay, with the Phalaborwa operation makingsubstantial progress in the period under review.The transfer of skills forms part of the BAA withCFL. Two batches of employees from RichardsBay were sent to India for training at CFL’soperations. A number of specialists were alsobrought from India to train <strong>Foskor</strong> employeesidentified for succession planning.INDUSTRIAL RELATIONSLabour relations throughout the Group continuedto flourish, without any industrial action takingplace during the period under review.HIV/AIDSThe challenges associated with the impact of HIV/AIDS on <strong>Foskor</strong> are being addressed. Althoughdifficult to quantify, due to the confidentialityassociated with the disease, the effects includeabsenteeism, reduced productivity, employeesbeing unable to perform their normal duties, lossof personnel and increased direct and indirectcosts. <strong>Foskor</strong>’s dual strategy approach includespreventative programmes such as education andawareness as well as support programmes, whichinclude the provision of anti-retroviral treatmentand nutritional supplements. A learnershipprogramme has also been started with theintention of having skills ready for replacement ofemployees lost to the pandemic.EMPLOYEE BENEFITSIt remains the objective of the Group to provideaffordable, effective and sustainable healthcare to all employees and their dependents inan equitable manner. It is for this reason thata revised health care policy, with a change inmedical aid service provider for the lower incomegroups, was approved by the <strong>Foskor</strong> Board andimplemented during the year under review. Allemployees are entitled to belong to a medical aidscheme of their choice from among those utilisedby the company.The Group operates a variety of Pension,Provident and Retirement funds together withDeath and Disability Insurance benefits. A processto integrate the various funds and benefits for allREMUNERATIONThe Group has a Board Human ResourcesCommittee, consisting of the CEO and nonexecutivedirectors, which is chaired by a nonexecutivedirector. Its specific terms of referenceinclude consideration and recommendation tothe Board on matters relating to general staffpolicy, remuneration, profit bonuses, executiveremuneration, directors’ remuneration and fees,service contracts and Group retirement and healthcare benefits.The Board Human Resources Committee wasalso, during the period under review, activelyinvolved in addressing the post retirement pensionand medical aid liabilities.The Company also has a Group RemunerationCommittee that, amongst other things, addressesequity in terms of salary and wages across theGroup.DIRECTORS’ REMUNERATIONThe Board Human Resources Committee considersthe remuneration of all directors and executives.The financial statements accompanying this reportreflect the directors’ earnings and other benefits.OUTLOOK FOR <strong>2006</strong>/2007The main challenges for the Group will remain theconversion of our efforts in the arena of safety andenvironmental responsibility into results. Anotherfocus area will be the achievement of operationaltargets and specifically the containment ofproduction costs. A slight shift in focus will alsobe towards the mining operation, specifically theconversion of mineral rights and the PyroxeniteExpansion and Ore Replacement Project.The Group will continue to be faced with challengesin the market with the pricing of phosphoricacid into India and the phosphate rock into thedomestic market. Further challenges are alsoexpected with the supply of raw materials, morespecifically sulphur. Economic stability in SouthAfrica and a more consistent exchange rate arepredicted, which will certainly assist the businessmodel.The continued support from our partner, CFL, interms of increased production, improvement ofThe proposed acquisition of the Phalaborwa Worksof Sasol Nitro (‘FEDMIS”) was opposed by theCompetitions Commission and was scheduled tobe defended before the Competitions Tribunal on8 May <strong>2006</strong>. This trial has been delayed, however,due to alternatives that are being investigated withSasol and third parties.ACKNOWLEDGEMENTOn behalf of executive management, I wishto express sincere thanks and appreciation to<strong>Foskor</strong>’s shareholders, our Board of Directors,our employees and our contractors – for theircommitment and support during a year that wasfull of challenges.I am convinced that <strong>Foskor</strong> now has the team,plant and strategy in place to deliver on our visionof maximising shareholder value in a safe andresponsible manner according to sound corporategovernance principles. With the support of thecapable and motivated team we now have in placeI am looking forward to taking on the challengesof the year ahead.IN APPRECIATIONMy sincere appreciation to Mr LL van Niekerk,outgoing Chairman of the board of directors of theGroup for the significant role he played in turningthis orginisation around.9

CHIEF FINANCIAL OFFICER’S REVIEWThe main drivers influencing the period’s results are tabled below.Key Drivers <strong>2006</strong> 2005 2005 2004 VariancePeriod months 12 <strong>Annual</strong>ised 9 12 <strong>2006</strong>/2005Exchange Rate – R/$ average 6,37 6,17 6,17 6,83 0,20 3%Revenue – R'm 2 574 1 806 1 354 2 051 769 43%Volume – Sales– Phosphoric Acid (P 2O 5) – 000’ tons 581 437 328 435 144 33%– Granular – 000’ tons 177 173 130 296 4 2%– Phosphate Rock – 000’ tons 2 605 2 575 1 931 3 016 30 1%Volume – Production– P 2O 5– 000’ tons 626 541 406 575 85 16%– Phosphate Rock – 000’ tons 2 528 2 791 2 093 2 642 (263) (9)%Prices – Sales (average)– P 2O 5– CFR Price – $/t 440 399 399 356 41 10%– Phosphate Rock – FOR Price – $/t 59 54 54 43,3 5 9%Prices – Raw material cost– Sulphur – delivered – Price – $/t 85 86 86 80 (1) (1)%We use ourphosphate rockto producephosphoric acid.REVENUEGroup revenue increased by R768m or 43% fromR1,806m (annualised) in 2005 to R2574m in<strong>2006</strong>. The major contributors to the change inrevenue were:• The 3% weakening of the South African Randagainst the US Dollar (US$) from an averageof R6.17/$ during 2005 to R6.37/$ during<strong>2006</strong>. The positive impact of this change onrevenue exceeds R80m.• The selling prices for both phosphate rock andphosphoric acid are determined in the worldmarket in US Dollar terms. Approximately75% of revenue is derived from exports andmore than 95% of total revenue is based ondollar denominated prices.• Sales volume of phosphoric acid increased by33% from 437k tons (annualised) to 581ktons. All phosphoric sales are exported, mainlyto India. The positive impact of this additionalvolume on revenue has been R366m.• The average CFR price of phosphoric acidincreased by $46/t or 12% from $399/tduring the year to March 2005 to an averageof $440/t ($445/t at year end). The positiveimpact of this price variance has been R152m.• Sales volumes of granular fertiliser increased by2% from 173k tons (annualised) to 177k tons.The positive impact of this on revenue has beenR48m from both price and volume increase.• Phosphate rock sales increased marginally by1% from 2575k (annualised) tons to 2605ktons. More than 75% of the sales are exportedor sold to our Richards Bay plant with thebalance being sold to the local market.• The average FOR price of phosphate rockincreased by 9% from $54/t to $59/t.TOLLING ARRANGEMENT WITH SASOLNITRO• The tolling agreement came into effect as from1 September 2005 whereby <strong>Foskor</strong> suppliesthe raw materials to Sasol Nitro and sells thefinished goods to the local market. For thisservice, <strong>Foskor</strong> pays Sasol Nitro a monthlyfixed fee as well as variable charges per productproduced.• The production outputs from Sasol Tollinghas been 113k tons of phosphoric acid, whichincluded 27k tons used to produce def acid.• Sales volumes of phosphoric acid were 82k tonsand 26k tons of def acid. Sulphuric acid salesamounted to 59k tons. All sales were made inthe local market.• The revenue generated from Sasol Tolling salesamounted to R320m.PRODUCTION• Production of phosphoric acid increased by 85ktons or 16%, from 541k tons (annualised) to626k tons. This improvement was achieved withthe assistance from staff seconded to <strong>Foskor</strong>as per the Business Assistance Agreement(BAA) between <strong>Foskor</strong> and CoromandelFertilisers Limited (CFL) of India. Productionof granulation increased by 29k tons or 18%,from 161k tons (annualised) to 190k tons.• Production of phosphate rock declined by 9%or 263k tons, from 2791k tons (annualised) to2528k tons. The major reasons for this declineare that <strong>Foskor</strong>ite ore reserves are diminishingrapidly and come to its end in about three yearstime; most of the higher quality ore has alreadybeen processed. Declining grades on the one<strong>Foskor</strong>ite stream and operational challenges(mineralogical) on the other <strong>Foskor</strong>ite streamhave resulted in lower product output. In10

addition, maintenance problems on ExtensionEight, including a fan bearing failure, reducedthe product output.OPERATING PROFITThe Group achieved a major turnaround inprofitability of R456m – from an operating lossof R420m in 2005 to an operating profit of R36mfor the current year. Before taking into accountthe impairment of R300m in the previous year,the operating profit improved by R156m.The major contributors to the year on year changeinclude:• The weakening of the Rand against the US$resulted in an additional operating profit ofcirca R50m.• The increase in production of phosphoric acidin Richard Bay resulted in an increase in profitof circa R48m.• Increase in sales prices of phosphoric acid of10% from $399/t to an average of $440/tand the increase in local phosphate rock pricesfrom $54/t to $59/t, better efficiencies and thecurtailment in the increase in Rand based costshave assisted in the turnaround.• While the breakeven for the Group was morethan R8/$ two years ago, it has reduced tocirca R6/$.• The effect of changes in the exchangerate is material for the Group. At currentproduction levels and cost structures theeffect of a R1 change in the exchange rate(from say R6/$ to R7/$) has a R250m effectat the operating profit level.• The post retirement medical aid liabilityincreased by R65m, from R136m in theprevious year to R201m during the currentyear. This increase is partly due to a catch-up.• Distribution cost increased by 25% or R111m,from R428m annualised (R321m for 9 months)to R533m. The major part of the increase relatesto the export of phosphoric acid from RichardsBay to India, which increased with 37% orR77m from R204m, (annualised from R153mfor nine months), to R281m. The Dollar ratepaid on exports for the current year on averageamounted to $74.79 as compared to last year’saverage of $68.22. Most of the shipments in thecurrent year were shipped to the east coast; theDollar cost per ton is on average $10 more thanthe west coast.IMPAIRMENTThe balance sheet values of <strong>Foskor</strong>’s assets havebeen assessed in accordance with InternationalAccounting Standards (IAS) 36 (AC128) onImpairment of Assets, which requires that eachoperating unit, as well as the Group as a whole, bemeasured. Unlike the previous year, in which theRichards Bay plant was impaired with R300m, noadditional or reversal of impairment is requiredas at year end.ADOPTING OF INTERNATIONAL REPORTINGSTANDARDS (IFRS)In respect of property, plant and equipment(PPE) the company has elected to use the fairvalue exemption allowed under IFRS, deemingthe depreciated cost of an asset to be its fairvalue. A revaluation carried out by independentvaluators indicated that the fair values exceed thenet carrying values as follows:• the Phalaborwa plant’s fair value exceeds thecarrying value of R738m by almost R500m;and• the Richards Bay plant’s fair value exceeds thecarrying value of R842m, after the previousyear’s impairment of R300m, by just overR200m.A full impairment test was performed, the resultof which was to then impair the said R700mexcess in full, to arrive at a more acceptablecarrying value currently disclosed in the <strong>Annual</strong>Financial Statements.By not adjusting for the excess value of justover R700m and after revisiting the residualvalues and the remaining useful lives of assets,the depreciation charge had to be reduced. Thecharge for the previous nine month period had tobe reduced by R44m, from R115m to R71m. Thecharge for the current year amounts to R94mand is R59m lower than the R153m, based onthe previous accounting policy.WORKING CAPITALA negative cash flow resulting from workingcapital outflow amounted to R86m. The majorcontributors are:• A negative contribution of R140.6m fromreceivables, which increased from R444.3m in2005 to R584.9m in <strong>2006</strong>. The major reasonfor this relates to additional debtors amountingto R144m as a result of the Sasol Nitro tollingagreement.• A negative contribution of R58.6m frominventory, which increased from R470.4m toR529m due to:– Inventory relating to the tolling arrangementwith Sasol Nitro amounting to R49m.– Logistical constraints relating to thetransport of rock from Phalaborwa toRichards Bay and limited storage facilitiesat Richards Bay had a negative impact onsupplying rock to the Richards Bay plantand the export of rock. Phosphate rockamounting to 44k tons had to be importedto satisfy the demand for rock at theRichards Bay plant. Phosphate rock stocklevels decreased marginally from 399ktons in March 2005 to 365k tons in March<strong>2006</strong> against a target of 200k tons.– The rock inventory at Richards Baydecreased from 27.2k tons to 1.4k tons.– Sulphur inventory decreased from 25.6k tonsto 10.5k tons.– Phosphoric acid inventory decreased by14.4k tons, from 56.7k tons to 42.3k tons.– Granular inventory increased by 6k tons,from 20k tons to 26k tons.• A positive impact from accounts payable andprovisions, which increased by R84.3m andR28.9m respectively.FREE CASH FLOWThe free cash flow (defined as the net of cash flowfrom operating activities and net cash used ininvesting activities) amounts to R95.1m. This wasthe first positive free cash flow over at least theprior 10 years. (Also refer to Five-Year Reviewat the back of the notes to the <strong>Annual</strong> FinancialStatements.)CAPITAL AND RELATED EXPENDITURECapital expenditure incurred by the Group duringthe period amounted to R105m (nine months2005: R133m or R92m before capitalisingfinance lease of R41.5m due to early adoption ofIFRIC4).The capital expenditure approximates to 68%of the depreciation of R153m before the IFRSadjustment referred to above, or 110% of thedepreciation of R95m after the IFRS adjustment.Repairs and maintenance of R258m are on a parwith those of previous years: i.e. R185m for thenine month period ending March 2005, R265mduring 2004 and R250m during 2003.FINANCING STRUCTURE OF THE GROUPThe Group had a positive bank balance of R427m(2005: R335m) at year end with no InterestBearing Debt.The R1 450m loan from the Industrial DevelopmentCorporation (IDC) is:• Subordinated in favour of all other loans andcreditors;• Non-interest-bearing; and• Fixed, with no repayment terms.Unutilised interest bearing facilities at year endamounted to R328m.11

CORPORATE REVIEWBOARD AND BOARD SUB-COMMITTEESAll directors have unlimited access to the adviceand services of the Group Secretary, who isresponsible to the Board for ensuring that Boardprocedures are followed.and non-quantifiable risks (e.g. reputation).5. Risk management is a process that iscontinual and evolving in nature so that itremains dynamic and relevant to the businessas business changes over time.Our phosphate rockis returned to theearth in the form offertilizer.The Board has established the following subcommitteesto assist in the discharge of itsduties:• Human Resources• Technical• Audit & RiskThe Board Audit & Risk Committee comprisesfour non-executive directors and the President/CEO. The Chief Financial Officer andrepresentatives from the external auditors,internal auditors and management attend themeetings of the Committee.The Committee is authorised by the Board toaccess any internal audit report and financialinformation and can instruct the managementof <strong>Foskor</strong>, the internal auditors or the externalauditors to conduct any investigation or studyas it deems necessary. Both the internal andexternal auditors have unrestricted access tothe Committee, which meets at least once everyquarter. The Board Audit & Risk Committeeoperates in accordance with a formalised BoardAudit & Risk Committee Charter.Management has reviewed the <strong>Annual</strong> FinancialStatements with the Board Audit & RiskCommittee and the external auditors. The qualityand appropriateness of the accounting policieswere fully discussed with the external auditors.The Board Audit & Risk Committee considersthe <strong>Annual</strong> Financial Statements of <strong>Foskor</strong>(Pty) Limited and its subsidiaries to be a fairrepresentation of its financial position, resultsof operations and cash flow information for theyear ended 31 March <strong>2006</strong>.RISK MANAGEMENT<strong>Foskor</strong>’s risk management philosophy is:1. Risk management does not equate to riskavoidance.2. To create and enhance shareholder value, riskhas to be borne.3. We do not seek to avoid risk but to understandit properly, manage it effectively and evaluateit in the context of the reward that is beingearned.4. Equal attention is paid to both quantifiableLike all commodity exporters, the Group isvulnerable to the exchange rate. Its effortsto reduce its vulnerability are affected by thecurrent high cost of strategic raw materials,which increases logistical and operationscosts. The recent restructuring and operationalcontinuous improvement efforts are utilised tomanage this risk.The system of risk management and internalcontrol is intertwined with the company’soperating activities to provide assurance thatenterprise-wide policies and procedures are inplace to address all forms of risk identified asinherent to the company’s activities. We followa combined assurance concept to manageenterprise-wide risk.In 2001 <strong>Foskor</strong> introduced an integrated riskmanagement system in order to comply withgood corporate governance in line with King2 Commission recommendations. This systemhas been continuously upgraded and in <strong>2006</strong><strong>Foskor</strong> intends to intensify its risk managementefforts by streamlining the risk methodology andtraining all staff in its proper implementation.In the new financial year <strong>Foskor</strong> intends utilisingproactive data analysis tools to better managethe fraud risks from a prevention, detection andresponse perspective. This will help to identifyfraud red flags, hidden or masked relationships,and fraud control weaknesses.INTERNAL CONTROL AND INTERNALAUDITTo meet its responsibility with respect to providingreliable and accurate financial information, theGroup maintains financial and operating systemsof internal control. These controls are designedto provide reasonable assurance regarding theachievement of organisational objectives withrespect to:• the effectiveness and efficiency of operations;• the safeguarding of the company’s assets(including assets);• compliance with applicable laws, regulationsand supervisory requirements;12

• supporting business sustainability under normalas well as adverse operating conditions;• the reliability of reporting; and• behaving responsibly towards all stakeholders.In accordance with recommended corporategovernance practice, it is the policy of <strong>Foskor</strong> (Pty)Limited to maintain a centralised independentinternal audit function, titled <strong>Foskor</strong> Group AuditServices (FGAS).The role of this function is to assist the BoardAudit & Risk Committee of the Board of Directors,as well as management personnel at all levels,in the effective exercise of their responsibilitiesthrough the provision of analyses, appraisals,recommendations, counsel, and informationconcerning the activities reviewed, and bypromoting effective control at reasonable cost.The internal audit function is thus responsible forproviding independent assurance to the BoardAudit & Risk Committee regarding the effectivemanagement of all risks, which may impact theachievement of the business objectives.The scope of the work of FGAS is to determinewhether <strong>Foskor</strong>’s network of risk management,control and governance processes, as designedand represented, is adequate and functioning in amanner to ensure:• Risks are appropriately identified andmanaged.• Interaction with the various governance groupswithin the company occurs as appropriate.• Significant financial, managerial and operatinginformation is accurate, reliable and timely.• Employee’s actions are in compliance withpolicies, standards, procedures and applicablelaws and regulations.• Resources are acquired economically, usedeffectively, and adequately protected.• Programmes, plans and objectives areachieved.• Quality and continuous improvement arefostered in the organisation control process.• Significant legislative or regulatory issuesimpacting on the company are recognised andaddressed appropriately.Based on its assessment, as well as internal andexternal audit, the Group believes that, as at 31March <strong>2006</strong>, its system of internal control metthe criteria for effective internal control.CODE OF ETHICS<strong>Foskor</strong> (Pty) Ltd is committed to organisationalintegrity and sound business ethics as set out inthe codes of corporate governance best practices.<strong>Foskor</strong> (Pty) Ltd has adopted a Code of Ethics,which incorporates the Group’s operating, financialand behavioural policies in a set of integratedvalues and standards required of employees intheir interaction with one and another and withall stakeholders. The code is distributed to allemployees of the Group.An ethics hotline facility exists to enable staffto report unethical behaviour anonymously. Thishotline is the responsibility of FGAS, whichensures that all unethical behaviour is adequatelyinvestigated and feedback is provided timeously tothe business. A comprehensive fraud report is alsoprovided to the Board Audit & Risk Committee forreview and approval.In the new financial year, <strong>Foskor</strong> intends:• Measuring the ethical climate within the Groupby means of an integrity thermometer;• Revising and consolidating the existing Ethicspolicy, Code of Ethics and related material;and• Launching and rolling out a revised ethicspolicy together with the ethics awarenessprogrammes.STAKEHOLDER COMMUNICATION ANDEMPLOYEE PARTICIPATIONThe CEO continues his monthly feedback sessionsto the general workforce. The purpose of thefeedback sessions is to share information, sourcethe views and inputs of employees and providefeedback on company performance and futurestrategies.In the new year, the Group engaged the servicesof a Public Relations company, Burns, to improvethe overall image of the Group and generalcommunication to both internal and externalstakeholders.13

We take from the earth,and we put back into theearth. We ensure growthand sustenance for SouthAfrica and the rest of theworld. Our phosphate rockmakes plants grow, helpsagriculture, feeds ourcountry, feeds the world.14

DIRECTORS’ DECLARATIONDIRECTORS’ RESPONSIBILITY FORTHE FINANCIAL STATEMENTSTo the members of <strong>Foskor</strong> (Pty) LimitedThe directors are responsible for monitoring the preparation and theintegrity of the financial statements and related information includedin this <strong>Report</strong>.In order for the Board to discharge its responsibilities, managementhas developed and continues to maintain a system of internal control.The Board has ultimate responsibility for the system of internal controland reviews its operation primarily through the audit committee andindirectly through other risk-monitoring committees.<strong>Foskor</strong> endorses the Code of Corporate Practices and Conduct ascontained in the King <strong>Report</strong> on Corporate Governance and adheresto the Code in all material respects.The directors believe that the Group will be a going concern in the yearahead. For this reason they continue to adopt the going concern basisin preparing the Group financial statements. The financial statementsfor the 12 month period ended 31 March <strong>2006</strong> set out on pages 17to 53 were approved by the Board of Directors on 19 June <strong>2006</strong> andare signed on its behalf byAdequate accounting records and an effective system of internalcontrols are maintained to provide reasonable assurance that assetsare safeguarded and that transactions are executed in accordancewith policies and procedures.MA PitsePresident and Chief Executive OfficerLL Van NiekerkChairmanAs part of the system of internal control the internal audit functionconducts operational, financial and specific audits and co-ordinatesaudit coverage with the external auditors. The external auditors areresponsible for reporting on the financial statements.The financial statements are prepared in accordance with InternationalFinancial <strong>Report</strong>ing Standards and incorporate responsible disclosurein line with the accounting philosophy of the Group. The financialstatements are based on appropriate accounting policies consistentlyapplied and supported by reasonable and prudent judgements andestimates.CERTIFICATE BY COMPANY SECRETARYI hereby certify that the company has lodged with the registrar allsuch returns as required in terms of the Companies Act of 1973 asamended.AUS KhanyileSecretary15

AUDITORS’ REPORTIndependent auditors’ report to the members of <strong>Foskor</strong> (Proprietary)LimitedWe have audited the annual financial statements and group annualfinancial statements of <strong>Foskor</strong> (Proprietary) Limited set out on pages17 to 53 for the year ended 31 March <strong>2006</strong>. These financial statementsare the responsibility of the company’s directors. Our responsibility is toexpress an opinion on these financial statements based on our audit.We conducted our audit in accordance with International Standards onAuditing. Those Standards require that we plan and perform the auditto obtain reasonable assurance about whether the financial statementsare free of material misstatement. An audit includes examining, ona test basis, evidence supporting the amounts and disclosures in thefinancial statements. An audit also includes assessing the accountingprinciples used and significant estimates made by management, as wellas evaluating the overall financial statement presentation. We believethat our audit provides a reasonable basis for our opinion.In our opinion, the financial statements present fairly, in all materialrespects, the financial position of the company and of the group at31 March <strong>2006</strong>, and the results of their operations and cash flowsfor the year then ended in accordance with International Financial<strong>Report</strong>ing Standards and in the manner required by the CompaniesAct of South Africa.PRICEWATERHOUSECOOPERS INCRegistered Auditors19 June <strong>2006</strong>SunninghillNGUBANE & CO INCRegistered Auditors19 June <strong>2006</strong>Durban16

REPORT OF THE DIRECTORSFor the 12 Month period ended 31 March <strong>2006</strong>The directors have pleasure in submitting their report and the <strong>Annual</strong>Financial Statements of the company and the Group for the 12 monthperiod ended 31 March <strong>2006</strong>.The term Group, in the context of the financial statements, refers to thecompany and its subsidiaries.NATURE OF BUSINESSThe core business of the Group is the manufacture and supply ofinternational standard merchant grade phosphoric acid and relatedgranular fertiliser products at the Richards Bay plant. All the phosphoricacid is exported and the granular sales are divided between exports andlocal markets.More than 75% of the phosphate rock concentrate produced at thePhalaborwa mine is transported to the Richards Bay plant for theproduction of phosphoric acid. The balance of the phosphate rock issold in local markets and exported mainly to Japan and the Far East.Export prices are generally, on a net back basis, after distributioncosts, 15% to 20% more profitable than local salesFINANCIAL RESULTSExports contribute to more than 75% of the Group’s revenue andlocal sales are based on US Dollar denominated prices. The volatilityexperienced by the Rand on the foreign exchange market continues tohave a detrimental effect on the financial results for the period. Theaverage R/$ exchange rate for <strong>2006</strong> was R6.37/$ compared to theprevious period’s R6.17/$.Group revenue increased by R768m or 43%, from R1 806m (annualised)in 2005 to R2 574m in <strong>2006</strong>.The Group achieved a major turnaround in profitability of R456m, froman operating loss of R420m in 2005 to an operating profit of R36m forthe current year. Before taking into account the impairment of R300min the previous period, the operating profit improved by R156m.The net profit for the year increased by R552m from the previous year’s netloss of R477m to a net profit for the current year amounting to R75m.The activities of the Group fall into four principal classes of business,and the estimated proportion of net operating income attributable tothese classes is further explained in the annual report.SHARE CAPITALThe authorised capital remained unchanged during this period at:• 8 100 000 ordinary shares of R1 each; and• 23 500 000 new class ‘B’ ordinary shares of R1 each.During April 2005, <strong>Foskor</strong> issued the following shares to CoromandelFertilisers Limited (CFL):• 23 500 000 ‘B’ shares of R1 each with a share premium of R0.5821per share; and• 199 590 ordinary shares of R1 each with a share premium ofR0.60586.The issued ordinary share capital increases from 7 784 000 shares ofR1 each to 7 983 590 shares of R1 each. The shareholding in <strong>Foskor</strong>is as follows:• 97.5% of the shares are held by the Industrial DevelopmentCorporation (IDC) of South Africa Limited;• 2.5% of the shares are held by CFL, an Indian based company.The directors are authorised, until the next annual general meeting, toissue unissued ordinary shares.SUBSIDIARIESDetails of the subsidiaries and associates of the company are set out inNote 7 to the <strong>Annual</strong> Financial Statements.ENVIRONMENTAL ACCOUNTINGThe Group is aware of the increasing emphasis on environmentalaccounting and accountability. Management is continually assessingand monitoring the various environmental issues facing the Group.Based on a Mine Rehabilitation and Closure Cost Assessment done byAfrican EPA during 2005:Net shortfall at this stage R ‘000- Recommended mine closure cost 223,410- Estimated salvage value at this stage 204,967- Closure deficit at this stage 18,443- Contingencies 46,915- Net shortfall before realising assets held inEnvironmental Trust 65,358A contingent liability has been recognised for the issuing of guaranteesto the Department of Minerals and Energy as follows (refer Note 20 tothe <strong>Annual</strong> Financial Statements): R ‘000- Recommended mine closure cost at thisstage (ignoring salvage value) 223,410- Less assets held by the Environmental Trust(refer note below) 41,223- Shortfall 182,187- Guarantee to be issued July <strong>2006</strong> 50,000- Guarantee to be issued July 2007 50,000- Guarantee to be issued July 2009 (estimated at betweenR82m and R100m)The total environmental rehabilitation liability has been estimated atR152.4 million after taking into account the following (refer Note 25to the <strong>Annual</strong> Financial Statements): R ‘000- The closure cost of the mine 223 410- Contingencies 20 000- The weighted average cost of capital 12.1%- Estimated escalation per annum 4.8%- Costs discounted to present value 7.3%The value of the Trust amounting to R41.2m is offset against theliability of R152.4m leaving a net figure of R111.2 m on the BalanceSheet (refer Note 25 to the <strong>Annual</strong> Financial Statements).FOSKOR REHABILITATION TRUST (PHALABORWA MINE)Details of contributions to the Trust are as follows (refer Note 25 to the<strong>Annual</strong> Financial Statements):June 1995 R 4 500 000June 1996 R 5 894 000June 1997 R 1 217 000June 1998 R 1 160 000June 1999 R 500 000June 2000 R 496 083June 2004 R 3 000 000March <strong>2006</strong> R 8 000 000R 24 767 083The current market value of the assets in the Trust is R41.233 million,which is regarded as adequate at this point when considering theremaining life of the Phalaborwa mine.BUSINESS ASSISTANCE AGREEMENT – CONTINGENTLIABILITY (refer Note 20 to the <strong>Annual</strong> Financial Statements)<strong>Foskor</strong> entered into a Business Assistance Agreement (BAA) withCoromandel Fertilisers Limited (CFL) in February 2005 to provide17

REPORT OF THE DIRECTORStechnical, operational, maintenance, purchasing and business assistanceto <strong>Foskor</strong>. The underlying principle of the BAA is to remunerate CFLfor its efforts to improve <strong>Foskor</strong>’s Earnings Before Interest and Tax(EBIT) over and above the ongoing initiatives of <strong>Foskor</strong>. CFL isalso a customer of <strong>Foskor</strong> and the majority shareholder of GodavariFertilisers and Chemicals (GFCL) of India, in which <strong>Foskor</strong> has a 5%shareholding.Remuneration in terms of the BAA agreement is based on theimprovement of the EBIT as calculated during the measurement periodof 1 April 2007 through to 31 March 2008 against that of the baseperiod of 1 January through to 31 March 2005, annualised. The EBITwill be adjusted for any improvement outside of CFL’s contribution.These adjustments include: exchange rate movements, selling pricemovements, raw material price movements, abnormal items such asinsurance claims, and <strong>Foskor</strong>’s own continuous improvement benefitsequivalent to 7.5% of the cost of production.The remuneration payable to CFL is limited to a maximum of R300mand will be utilised to purchase further equity in <strong>Foskor</strong> – a minimum of7.5% shareholding if sufficient remuneration were earned after taxes,thus giving CFL a 10% stake in <strong>Foskor</strong> (2.5% currently). CFL canincrease the shareholding to a maximum of 16.5%, based on earningsafter taxes.The liability cannot be measured with sufficient reliability at this stageand is therefore not recognised. The liability can only be measured afterthe 12 month period ending March 2008.INSURANCE AND RISK MANAGEMENTThe Group’s philosophy is to manage its risks in order to protect itsassets and earnings against unacceptable financial loss and to avoidlegal liabilities. In this regard, possible catastrophic type risks areinsured at a relatively advantageous cost with satisfactory cover whilenon-catastrophic type risks are self-insured. The management of riskis further supported by the Group’s health and safety programmes, andmaintenance of the ISO 9002 (quality) and ISO 14001 (environmental)standards. <strong>Foskor</strong> was the first mining company in South Africa toreceive the latter accreditation.Fixed assets are insured at current replacement value, which has beenestimated by an external valuator.Risk surveys and assessments are an integral part of the Group’srisk management policy and are performed on an integrated Grouprisk management system. Risks identified during these surveys areeliminated, reduced or transferred to the insurers.EMPLOYMENT EQUITYThe Group supports employment equity and the development andpromotion of previously disadvantaged employees and complies with therequirements of the promulgated Employment Equity Act. The Groupbelieves in developing and promoting people from within the company.Training and development programmes are in place to ensure that everyemployee will have the opportunity to enhance his or her potential. TheGroup also adheres to the requirements of the Skills Development Actand sees this as yet another opportunity to develop employees.EVENTS AFTER BALANCE SHEET DATEPost the financial year closure, on 7 May <strong>2006</strong>, a transformer at the oldphosphoric acid plant in Richards Bay caught fire, causing substantialdamage to electrical cables; Business Interruption is estimated to be asmuch as 50 days.The financial impact of Business Interruption for 47 days will be around56 000 tons of P 2O 5, of which the first 14 days will be excluded as perthe terms of the Business Interruption Insurance Policy.It is envisaged that production for the year to March 2007 will, despitethis incident, exceed the previous year’s production of 625k tons.The financial impact of repair of equipment is estimated to be betweenR20m and R25m, of which R5m is to be excluded as excess under theinsurance claim and the balance would be claimed under the MachineryBreakdown Policy.The anticipated net negative impact for the <strong>2006</strong>/7 year will be lessthan R20m.Refer commentary under the directorate paragraph below, regardingthe resignation of the chairman of the board of directors of the Groupsubsequent to year end.DIRECTORATEDuring the period under review, the following changes in the directorateoccurred:Resignations: 22 June 2005Mr HN GiyoseMr F VenterAppointments: 22 June 2005Mr PJ LedgerMs RK MorathiMr A VellayanMs M NhlanhlaMs Z MonnakgotlaMs LBR MthembuAppointments: 12 July 2005Dr DS PhahoSubsequent to year end on the 19 June <strong>2006</strong>, the Chairman Mr LL vanNiekerk, resigned as Chairman and Director of the Group.Mr MG Qhena, Chief Executive Officer of the Industrial DevelopmentCorporation, was appointed as the Chairman of the board of directorsof the Group effective from 19 June <strong>2006</strong>.Other than the employment contract of the Chief Executive Officer,there were no contracts during or at the end of the financial periodin which any directors of the company were materially interested. Noservice contracts exist between the company and any of its non-executivedirectors having notice period exceeding one month, or providing forcompensation and benefits in excess of one month’s salary.MINE, HEALTH AND SAFETY ACTThe Group’s statistical report on health and safety, prepared in termsof the Mine, Health and Safety Act, 1996, was submitted to the MineInspector and is available on request from the company.18

FINANCIALS19

BALANCE SHEETas at 31 March <strong>2006</strong>COMPANYGROUP12 months 9 months 12 months 9 monthsended ended ended endedMarch March March MarchR’000 NOTES <strong>2006</strong> 2005 <strong>2006</strong> 2005ASSETSProperty, plant and equipment 5 1,678,998 1,403,844 1,680,601 1,698,547Ore stockpiling 50,677 65,619 50,677 65,619Intangible assets 6 27,438 29,871 27,438 29,919Investments in subsidiaries 7 83,083 83,083 – –Loans to subsidiaries 7 6,988 7,436 – –Investment in joint venture 8 25 25 25 25Available for sale investments 9 59,561 40,818 59,561 40,933Non-current receivables 10 – 306,357 – 1,066Non-current assets 1,906,770 1,937,053 1,818,302 1,836,109Inventory 11 528,917 468,935 529,004 470,404Ore stockpile short-term 12,818 12,134 12,818 12,134Prepaid taxation 3,100 1,131 3,905 3,880Receivables and prepayments 12 580,259 448,268 584,914 444,270Bank and cash balances 423,570 333,245 427,359 335,244Current assets 1,548,664 1,263,713 1,558,000 1,265,932Total assets 3,455,434 3,200,766 3,376,302 3,102,041EQUITY AND LIABILITIESShare capital 13 45,284 7,784 45,284 7,784Retained earnings 313,858 233,958 994,063 919,188Fair value reserve (13,766) (18,223) (13,766) (18,223)Shareholders’ equity 345,376 223,519 1,025,581 908,749Shareholders’ loan 14 1,450,000 1,450,000 1,450,000 1,450,000Total shareholders’ interest 1,795,376 1,673,519 2,475,581 2,358,749Non-interest-bearing borrowings 15 12,800 12,800 12,800 12,800Finance lease liability 16 34,167 36,989 34,167 36,989Environmental rehabilitation liability 25 152,442 152,442 152,442 152,442Loans from subsidiaries 7 761,631 810,684 – –Post-employment liability 24 201,739 136,375 201,739 136,375Deferred tax liabilities 17 – – – –Non-current liabilities 1,162,779 1,149,290 401,148 338,606Trade and other payables 18 448,940 358,400 449,811 365,471Provisions 19 45,516 16,538 45,516 16,538Finance lease liability 16 2,823 3,019 2,823 3,019Current tax liability – – 1,423 19,658Current liabilities 497,279 377,957 499,573 404,686Total equity and liabilities 3,455,434 3,200,766 3,376,302 3,102,04120

INCOME STATEMENTSfor the year ended 31 March <strong>2006</strong>COMPANYGROUP12 months 9 months 12 months 9 monthsended ended ended endedMarch March March MarchR’000 NOTES <strong>2006</strong> 2005 <strong>2006</strong> 2005Revenue 2,574,291 1,542,751 2,574,375 1,354,385Cost of sales (1,819,483) (1,351,204) (1,819,483) (1,058,151)Gross profit 754,808 191,547 754,892 296,234Other operating income 26,622 29,603 24,337 28,664Distribution costs (537,409) (325,627) (533,322) (321,776)Impairment of property, plant and equipment – (300,000) – (300,000)Other operating costs (124,621) (101,082) (126,538) (105,978)Premium on post-employment liability (83,278) (17,059) (83,278) (17,059)Operating profit/(loss) 1 36,122 (522,618) 36,091 (419,915)Net finance income/(costs) 2 27,560 19,318 27,777 (2,082)Net foreign exchange gain/(losses) 3 11,619 (5,386) 11,633 (5,484)Investment income 4,591 173,235 – –Share of the results of Joint Venture – 338 – 338Profit /(loss) before taxation 79,892 (335,113) 75,501 (427,143)Taxation 4 8 4,115 (626) (50,530)Net profit/(loss) for the year 79,900 (330,998) 74,875 (477,673)21

STATEMENT OF CHANGES IN EQUITYfor the year ended 31 March <strong>2006</strong>Share Retained Fair valuecapital earnings reserve TotalR’000 R’000 R’000 R’000GROUPBalance at 1 July 2004 7,784 1,352,547 (22,918) 1,337,413Net income recognised directly to equity – 44,314 – 44,314Net loss for the nine months period – (477,673) – (477,673)Net fair value gain:Available for sale investments – – 4,695 4,695Balance at 31 March 2005 7,784 919,188 (18,223) 908,749Ordinary shares issued during the year 23,700 – – 23,700Share premium 13,800 13,800Net profit for the year – 74,875 – 74,875Net fair value gain:Available for sale investments – – 4,457 4,457Balance at 31 March <strong>2006</strong> 45,284 994,063 (13,766) 1,025,581COMPANYBalance at 1 July 2004 7,784 524,176 (22,918) 509,042Net income recognised directly to equity – 40,780 40,780Net loss for the nine months period – (330,998) – (330,998)Net fair value gain:Available for sale investments – – 4,695 4,695Balance at 31 March 2005 7,784 233,958 (18,223) 223,519Ordinary shares issued during the year 23,700 – – 23,700Share premium 13,800 – – 13,800Net profit for year – 79,900 – 79,900Net fair value gain:Available for sale investments – – 4,457 4,457Balance at 31 March <strong>2006</strong> 45,284 313,858 (13,766) 345,37622

CASH FLOW STATEMENTfor the year ended 31 March <strong>2006</strong>COMPANYGROUP12 months 9 months 12 months 9 monthsended ended ended endedMarch March March MarchR’000 NOTE <strong>2006</strong> 2005 <strong>2006</strong> 2005CASH FLOWS FROM OPERATINGACTIVITIESCash generated from/(applied to) operations 26 124,679 (85,825) 111,483 35,709Net finance income/(costs) 27,560 19,318 27,777 (2,082)Net foreign exchange gains/(losses) 11,619 (5,386) 11,633 (5,484)Dividend received 4,591 173,235 – –Taxation (1,961) 4,075 (18,886) (37,600)Net cash generated from/(used in)operating activities 166,488 105,417 132,007 (9,457)CASH FLOW FROM INVESTINGACTIVITIESAdditions to property, plant and equipment (105,240) (126,529) (105,247) (133,420)Acquisition of computer software – (490) – (490)Proceeds on disposal of property, plant and equipment 37,807 11,533 37,807 11,533Movements in loans to subsidiaries (48,605) (117,562) – –Investment by Coromandel Fertilisers Limited 37,500 – 37,500 –Disposal of unlisted investments – – – 403Contribution made to environmental rehabilitation trust (8,000) – (8,000) –Repayment of non-current receivables 13,393 1,012 1,066 3,420Investment in joint venture – 412 – 412Net cash used in investing activities (73,145) (231,624) (36,874) (118,142)CASH FLOW FROM FINANCINGACTIVITIES(Decrease)/increase in finance lease liability (2,822) 40,008 (2,822) 40,008Decrease in current portion of financelease liability (196) – (196) –Decrease in interest-bearing borrowings – (397,062) – (397,062)Decrease in current portion of interestbearingborrowings – (95,767) – (95,767)Increase in shareholders’ loans – 905,745 – 905,745Net cash (used in)/generated fromfinancing activities (3,018) 452,924 (3,018) 452,924NET INCREASE IN CASHAND CASH EQUIVALENTS 90,325 326,717 92,115 325,325CASH AND CASH EQUIVALENTS ATBEGINNING OF YEAR 333,245 6,528 335,244 9,919CASH AT BANK AND IN HAND ATEND OF YEAR 423,570 333,245 427,359 335,244CASH AT BANK AND IN HAND 423,570 333,245 427,359 335,244BANK OVERDRAFT – – – –23