Download Annual Report 2006 - Foskor

Download Annual Report 2006 - Foskor

Download Annual Report 2006 - Foskor

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

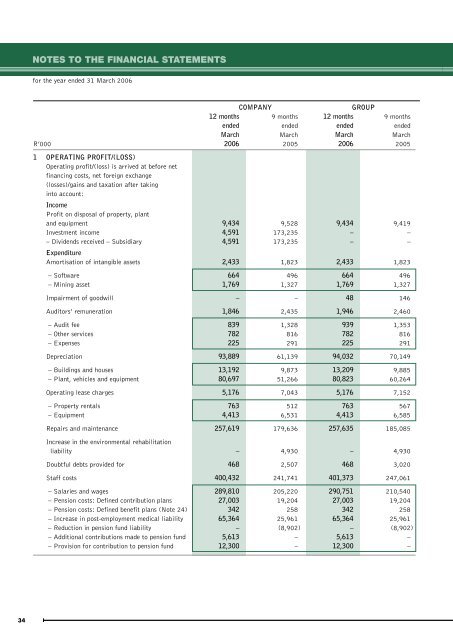

INCOME NOTES TO STATEMENTTHE FINANCIAL STATEMENTSfor the year ended 31 March <strong>2006</strong>COMPANYGROUP12 months 9 months 12 months 9 monthsended ended ended endedMarch March March MarchR’000 <strong>2006</strong> 2005 <strong>2006</strong> 20051 OPERATING PROFIT/(LOSS)Operating profit/(loss) is arrived at before netfinancing costs, net foreign exchange(losses)/gains and taxation after takinginto account:IncomeProfit on disposal of property, plantand equipment 9,434 9,528 9,434 9,419Investment income 4,591 173,235 – –– Dividends received – Subsidiary 4,591 173,235 – –ExpenditureAmortisation of intangible assets 2,433 1,823 2,433 1,823– Software 664 496 664 496– Mining asset 1,769 1,327 1,769 1,327Impairment of goodwill – – 48 146Auditors’ remuneration 1,846 2,435 1,946 2,460– Audit fee 839 1,328 939 1,353– Other services 782 816 782 816– Expenses 225 291 225 291Depreciation 93,889 61,139 94,032 70,149– Buildings and houses 13,192 9,873 13,209 9,885– Plant, vehicles and equipment 80,697 51,266 80,823 60,264Operating lease charges 5,176 7,043 5,176 7,152– Property rentals 763 512 763 567– Equipment 4,413 6,531 4,413 6,585Repairs and maintenance 257,619 179,636 257,635 185,085Increase in the environmental rehabilitationliability – 4,930 – 4,930Doubtful debts provided for 468 2,507 468 3,020Staff costs 400,432 241,741 401,373 247,061– Salaries and wages 289,810 205,220 290,751 210,540– Pension costs: Defined contribution plans 27,003 19,204 27,003 19,204– Pension costs: Defined benefit plans (Note 24) 342 258 342 258– Increase in post-employment medical liability 65,364 25,961 65,364 25,961– Reduction in pension fund liability – (8,902) – (8,902)– Additional contributions made to pension fund 5,613 – 5,613 –– Provision for contribution to pension fund 12,300 – 12,300 –34