Download Annual Report 2006 - Foskor

Download Annual Report 2006 - Foskor

Download Annual Report 2006 - Foskor

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

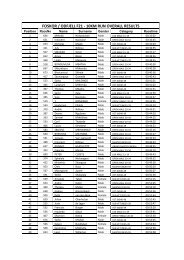

23.2.4 RECONCILIATION OF EQUITYas at 31 March <strong>2006</strong>Effect oftransitionR’000 Note SA GAAP to IFRS IFRSASSETSProperty, plant and equipment 23.2.4.1 1,540,054 140,547 1,680,601Ore stockpiling 50,677 – 50,677Intangible assets 27,438 – 27,438Investment in joint venture 25 – 25Available for sale investments 59,561 – 59,561Non–current assets 1,677,755 140,547 1,818,302Inventory 529,004 – 529,004Ore stockpile short-term 12,818 – 12,818Prepaid taxation 3,905 – 3,905Receivables and prepayments 584,914 – 584,914Bank and cash balances 427,359 – 427,359Current assets 1,558,000 – 1,558,000Total assets 3,235,755 140,547 3,376,302EQUITY AND LIABILITIESShare capital 45,284 – 45,284Retained earnings 23.2.4.3 890,506 103,557 994,063Fair value reserve (13,766) – (13,766)Shareholders’ equity 922,024 103,557 1,025,581Shareholders’ loan 1,450,000 – 1,450,000Total shareholders’ interest 2,372,024 103,557 2,475,581Non–interest–bearing borrowings 12,800 – 12,800Finance lease liability 23.2.4.2 – 34,167 34,167Environmental rehabilitation liability 152,442 – 152,442Post–employment liability 201,739 – 201,739Deferred tax liabilities – – –Non–current liabilities 366,981 34,167 401,148Trade and other payables 449,811 – 449,811Provisions 45,516 – 45,516Finance lease liability 23.2.4.2 – 2,823 2,823Current tax liability 1,423 – 1,423Current liabilities 496,750 2,823 499,573Total equity and liabilities 3,235,755 140,547 3,376,30223.2.4.1 Property, plant and equipment R’000Recognition of assets leased under finance lease 37,930Restatement of accumulated depreciation to reflect PPE’s useful lives rather than tax lives. 102,617Total impact – increase in PPE 140,547The assets that are leased under finance lease are treated as purchased and recognisedunder IFRS.Management has applied historical costs as deemed cost exemption in respect of property,plant and equipment. PPE’s residual values and remaining useful lives have been revised toreflect PPE’s lives rather than tax lives.31