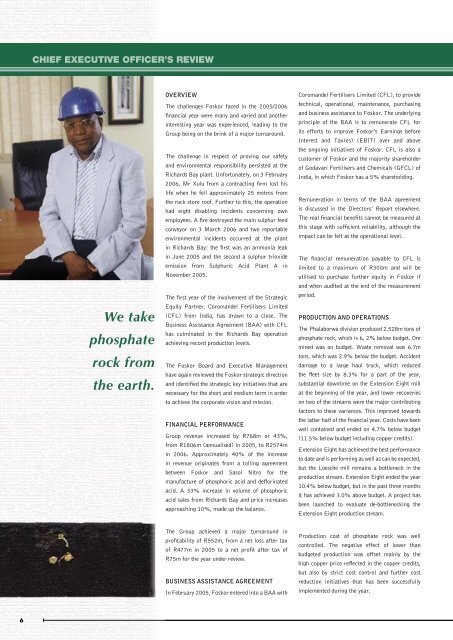

CHIEF EXECUTIVE OFFICER’S REVIEWWe takephosphaterock fromthe earth.OVERVIEWThe challenges <strong>Foskor</strong> faced in the 2005/<strong>2006</strong>financial year were many and varied and anotherinteresting year was experienced, leading to theGroup being on the brink of a major turnaround.The challenge in respect of proving our safetyand environmental responsibility persisted at theRichards Bay plant. Unfortunately, on 3 February<strong>2006</strong>, Mr Xulu from a contracting firm lost hislife when he fell approximately 25 metres fromthe rock store roof. Further to this, the operationhad eight disabling incidents concerning ownemployees. A fire destroyed the main sulphur feedconveyor on 3 March <strong>2006</strong> and two reportableenvironmental incidents occurred at the plantin Richards Bay: the first was an ammonia leakin June 2005 and the second a sulphur trioxideemission from Sulphuric Acid Plant A inNovember 2005.The first year of the involvement of the StrategicEquity Partner, Coromandel Fertilisers Limited(CFL) from India, has drawn to a close. TheBusiness Assistance Agreement (BAA) with CFLhas culminated in the Richards Bay operationachieving record production levels.The <strong>Foskor</strong> Board and Executive Managementhave again reviewed the <strong>Foskor</strong> strategic directionand identified the strategic key initiatives that arenecessary for the short and medium term in orderto achieve the corporate vision and mission.FINANCIAL PERFORMANCEGroup revenue increased by R768m or 43%,from R1806m (annualised) in 2005, to R2574min <strong>2006</strong>. Approximately 40% of the increasein revenue originates from a tolling agreementbetween <strong>Foskor</strong> and Sasol Nitro for themanufacture of phosphoric acid and deflorinatedacid. A 33% increase in volume of phosphoricacid sales from Richards Bay and price increasesapproaching 10%, made up the balance.Coromandel Fertilisers Limited (CFL), to providetechnical, operational, maintenance, purchasingand business assistance to <strong>Foskor</strong>. The underlyingprinciple of the BAA is to remunerate CFL forits efforts to improve <strong>Foskor</strong>’s Earnings beforeInterest and Tax(es) (EBIT) over and abovethe ongoing initiatives of <strong>Foskor</strong>. CFL is also acustomer of <strong>Foskor</strong> and the majority shareholderof Godavari Fertilisers and Chemicals (GFCL) ofIndia, in which <strong>Foskor</strong> has a 5% shareholding.Remuneration in terms of the BAA agreementis discussed in the Directors’ <strong>Report</strong> elsewhere.The real financial benefits cannot be measured atthis stage with sufficient reliability, although theimpact can be felt at the operational level.The financial remuneration payable to CFL islimited to a maximum of R300m and will beutilised to purchase further equity in <strong>Foskor</strong> ifand when audited at the end of the measurementperiod.PRODUCTION AND OPERATIONSThe Phalaborwa division produced 2.528m tons ofphosphate rock, which is 6, 2% below budget. Oremined was on budget. Waste removal was 6.7mtons, which was 2.9% below the budget. Accidentdamage to a large haul truck, which reducedthe fleet size by 8.3% for a part of the year,substantial downtime on the Extension Eight millat the beginning of the year, and lower recoverieson two of the streams were the major contributingfactors to these variances. This improved towardsthe latter half of the financial year. Costs have beenwell contained and ended on 4.7% below budget(11.5% below budget including copper credits).Extension Eight has achieved the best performanceto date and is performing as well as can be expected,but the Loesche mill remains a bottleneck in theproduction stream. Extension Eight ended the year10.4% below budget, but in the past three monthsit has achieved 3.0% above budget. A project hasbeen launched to evaluate de-bottlenecking theExtension Eight production stream.The Group achieved a major turnaround inprofitability of R552m, from a net loss after taxof R477m in 2005 to a net profit after tax ofR75m for the year under review.BUSINESS ASSISTANCE AGREEMENTIn February 2005, <strong>Foskor</strong> entered into a BAA withProduction cost of phosphate rock was wellcontrolled. The negative effect of lower thanbudgeted production was offset mainly by thehigh copper price reflected in the copper credits,but also by strict cost control and further costreduction initiatives that has been successfullyimplemented during the year.6

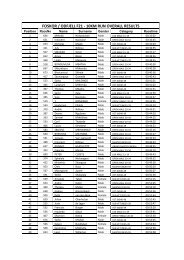

The remaining <strong>Foskor</strong> ore reserves are summarisedin the following table together with the calculatedlife at the current consumption rate.In-houseOre Expected ClassificationIdentity MT Life Resource ReserveNorth Measured ProvenPyroxenite 531 +40 years Resource Reserves+7 years Measured ProvenArea 9 70 * Resource ReservesMarginal 12 months Measured Provendumps 6 ** Resource ReservesPMCActiveTailings +11 years Measured ProvenDams 160 *** Resource ReservesSouth Measured ProvenPyroxenite 1650 +50 years Resource ReservesTable 1: <strong>Foskor</strong> Reserves and ResourcesPMC – Palaborwa Mining CompanyMT – million metric tons* 4 years at increased rate to replace Marginaldumps** at January <strong>2006</strong>*** Full feasibility completedThe above ground ore reserves known as<strong>Foskor</strong>ite (Area 9 and Marginal), previouslymined and stockpiled will be depleted by theend of 2009. <strong>Foskor</strong> has embarked on a projectknown as Pyroxenite Expansion Project (PEP)to replace the <strong>Foskor</strong>ite ore with Pyroxenite oreto be sourced from the new South Pyroxeniteopen pit. The feasibility and technical cost studyphase of the project has already been approvedand will be completed by March 2007. Thisstudy will form the basis on which a decisionon the implementation of the project will bemade. The implementation of the PEP is thenplanned to start in April 2007 and be completedby December 2009. Indications at this stage arethat the South Pyroxenite pit has phosphate richore reserves sufficient to sustain <strong>Foskor</strong> for thenext 50+ years.All the applicable mineral rights applications havebeen lodged with the Department of Minerals andEnergy. Some of these have been finalised, and areply is being awaited on the rest.The production in Richards Bay was 626k tonsof phosphoric acid against a previous best of575k and a capacity of 750k tons. Sulphuricacid production, was 1 771k tons, which was 6%below budget. At the beginning of the financialyear, after the shutdown, all the sulphuricacid plants experienced teething problems.Production in the latter part of the year wasrestricted by the poor availability of rockphosphate from Phalaborwa due to logisticalconstraints. Production was further hamperedby the fire incident in the sulphur conveyor.Lower production in granular fertilisers wasmainly due to lower off take in the market andmaintenance and operational problems in theplant.Cost of production of phosphoric acid wasadversely affected by unexpected expenditure dueto increased maintenance and a backlog paymentfor gypsum disposal to sea as well as the shutdownsand other accidents and incidents. Year on yearthe production cost per ton of phosphoric acid waswell controlled, partly due to the volume effect.The demurrage per ton was also drastically reducedby 30% compared to previous years, due to quickturnaround of the ships and increased transfer ofacid as the export pipeline was replaced in time.MARKETING AND SALESThe overall sales of phosphoric acid and granularfertilisers were significantly up, compared tothe previous financial year. This is mainly as aresult of an improvement in the production ofphosphoric acid.Total sales of phosphate rock to the localmarket, excluding inter-company sales, werebelow those of the previous financial year asa result of logistical limitations as well as areduction in the demand in the local market.Only circa 140 000 tons of phosphate rock wereexported to the Japanese market.Total export of phosphoric acid to India wasaround 12% above budget and total granularfertiliser sales were 41% below budget; thegranular fertiliser sales were negatively impactedby the production problems experienced atthe Richards Bay plant as well as by marketconditions.It is expected that the new negotiations for thephosphoric acid selling price into India will againprove to be difficult. At the time of writing thisreport, new selling prices of phosphoric acid forthe period April <strong>2006</strong> to March 2007 were notyet finalised.The Group expects that sales tonnages andprices on phosphoric acid, granular fertiliser andphosphate rock will continue to increase in thefuture.SAFETY, HEALTH, ENVIRONMENT ANDQUALITY (SHEQ)The Rock and Copper division achieved 1.6 millionfatality-free shifts and 2.6 million man-hourswithout a disabling injury during this period, butthe latter has been reduced to 0.8 million manhourswithout a disabling injury due to an injuryduring December 2005.Both the Rock and Copper as well as the Zirconiadivisions based in Phalaborwa, had successfulintegrated SHEQ audits, achieving OHSAS18000, ISO 9001 and ISO 14001 certificationover and above being awarded the DEKRA 5Shields award for safety, health, environmentand quality management for integrated SHEQsystems.In accordance with the water permit issued bythe Department of Water Affairs and Forestry(DWAF), Phalaborwa operations have successfullyoperated the collection points around thetailings dams and not discharged any water intothe Selati River during the year under review.The Richards Bay plant has embarked on theimplementation of the Process Safety ManagementSystem (PSMS), which is mandatory in the USAfor hazardous installations.The fatality in February <strong>2006</strong> of a contractorwho was working on the roof of the phosphaterock store is regrettable. However, negligence onthe part of the deceased for not adhering to thesafety measures was found to be the cause of theaccident.All plants in Richards Bay outperformed thepermit emission requirements, with the SulphuricAcid Plant achieving its highest compliance recordof all time of 99.93%. Complaints to the RichardsBay Clean Air Association reduced from 50% to30% for the year under review.Two reportable environmental incidents occurredat the plant in Richards Bay. The first was anammonia leak in June 2005 and the second asulphur trioxide emission from Sulphuric AcidPlant A in November 2005.The Phosphoric Acid production facility maintainedits ISO 9001 accreditation for quality.A fire occurred in March <strong>2006</strong>, at the SulphurTransfer Tower and associated conveyor belt.7