Download Annual Report 2006 - Foskor

Download Annual Report 2006 - Foskor

Download Annual Report 2006 - Foskor

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

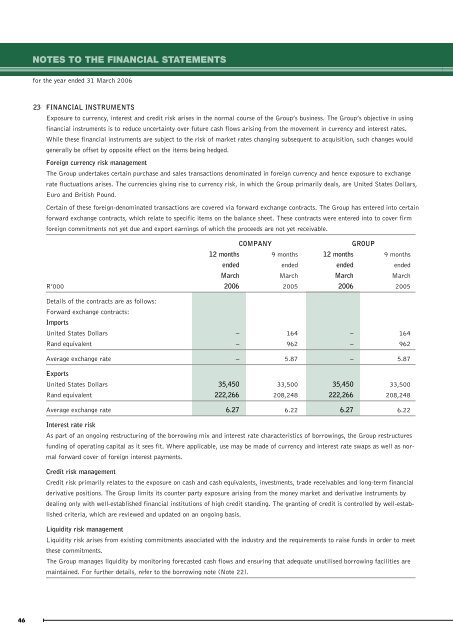

INCOME NOTES TO STATEMENTTHE FINANCIAL STATEMENTSfor the year ended 31 March <strong>2006</strong>23 FINANCIAL INSTRUMENTSExposure to currency, interest and credit risk arises in the normal course of the Group’s business. The Group’s objective in usingfinancial instruments is to reduce uncertainty over future cash flows arising from the movement in currency and interest rates.While these financial instruments are subject to the risk of market rates changing subsequent to acquisition, such changes wouldgenerally be offset by opposite effect on the items being hedged.Foreign currency risk managementThe Group undertakes certain purchase and sales transactions denominated in foreign currency and hence exposure to exchangerate fluctuations arises. The currencies giving rise to currency risk, in which the Group primarily deals, are United States Dollars,Euro and British Pound.Certain of these foreign-denominated transactions are covered via forward exchange contracts. The Group has entered into certainforward exchange contracts, which relate to specific items on the balance sheet. These contracts were entered into to cover firmforeign commitments not yet due and export earnings of which the proceeds are not yet receivable.COMPANYGROUP12 months 9 months 12 months 9 monthsended ended ended endedMarch March March MarchR’000 <strong>2006</strong> 2005 <strong>2006</strong> 2005Details of the contracts are as follows:Forward exchange contracts:ImportsUnited States Dollars – 164 – 164Rand equivalent – 962 – 962Average exchange rate – 5.87 – 5.87ExportsUnited States Dollars 35,450 33,500 35,450 33,500Rand equivalent 222,266 208,248 222,266 208,248Average exchange rate 6.27 6.22 6.27 6.22Interest rate riskAs part of an ongoing restructuring of the borrowing mix and interest rate characteristics of borrowings, the Group restructuresfunding of operating capital as it sees fit. Where applicable, use may be made of currency and interest rate swaps as well as normalforward cover of foreign interest payments.Credit risk managementCredit risk primarily relates to the exposure on cash and cash equivalents, investments, trade receivables and long-term financialderivative positions. The Group limits its counter party exposure arising from the money market and derivative instruments bydealing only with well-established financial institutions of high credit standing. The granting of credit is controlled by well-establishedcriteria, which are reviewed and updated on an ongoing basis.Liquidity risk managementLiquidity risk arises from existing commitments associated with the industry and the requirements to raise funds in order to meetthese commitments.The Group manages liquidity by monitoring forecasted cash flows and ensuring that adequate unutilised borrowing facilities aremaintained. For further details, refer to the borrowing note (Note 22).46