2004 Crown Investments Corporation of Saskatchewan Annual Report

2004 Crown Investments Corporation of Saskatchewan Annual Report

2004 Crown Investments Corporation of Saskatchewan Annual Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

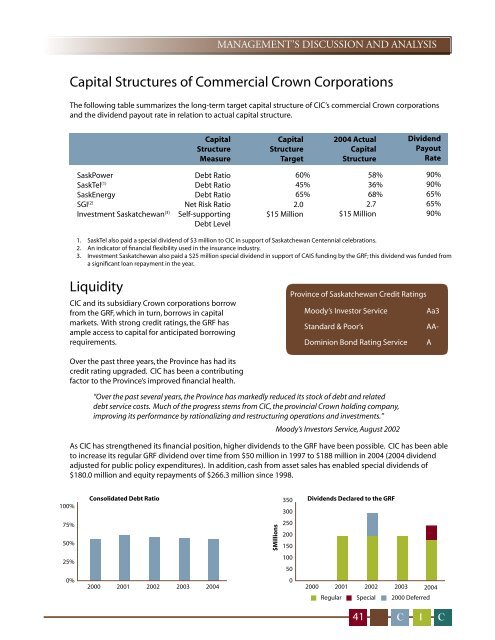

MANAGEMENT’S DISCUSSION AND ANALYSISCapital Structures <strong>of</strong> Commercial <strong>Crown</strong> <strong>Corporation</strong>sThe following table summarizes the long-term target capital structure <strong>of</strong> CIC’s commercial <strong>Crown</strong> corporationsand the dividend payout rate in relation to actual capital structure.CapitalStructureMeasureCapitalStructureTarget<strong>2004</strong> ActualCapitalStructureDividendPayoutRateSaskPowerSaskTel (1)SaskEnergySGI (2)Investment <strong>Saskatchewan</strong> (3)Debt RatioDebt RatioDebt RatioNet Risk RatioSelf-supportingDebt Level60%45%65%2.0$15 Million58%36%68%2.7$15 Million90%90%65%65%90%1. SaskTel also paid a special dividend <strong>of</strong> $3 million to CIC in support <strong>of</strong> <strong>Saskatchewan</strong> Centennial celebrations.2. An indicator <strong>of</strong> financial flexibility used in the insurance industry.3. Investment <strong>Saskatchewan</strong> also paid a $25 million special dividend in support <strong>of</strong> CAIS funding by the GRF; this dividend was funded froma significant loan repayment in the year.LiquidityCIC and its subsidiary <strong>Crown</strong> corporations borrowfrom the GRF, which in turn, borrows in capitalmarkets. With strong credit ratings, the GRF hasample access to capital for anticipated borrowingrequirements.Province <strong>of</strong> <strong>Saskatchewan</strong> Credit RatingsMoody’s Investor ServiceAa3Standard & Poor’sAA-Dominion Bond Rating Service AOver the past three years, the Province has had itscredit rating upgraded. CIC has been a contributingfactor to the Province’s improved financial health.“Over the past several years, the Province has markedly reduced its stock <strong>of</strong> debt and relateddebt service costs. Much <strong>of</strong> the progress stems from CIC, the provincial <strong>Crown</strong> holding company,improving its performance by rationalizing and restructuring operations and investments.”Moody’s Investors Service, August 2002As CIC has strengthened its financial position, higher dividends to the GRF have been possible. CIC has been ableto increase its regular GRF dividend over time from $50 million in 1997 to $188 million in <strong>2004</strong> (<strong>2004</strong> dividendadjusted for public policy expenditures). In addition, cash from asset sales has enabled special dividends <strong>of</strong>$180.0 million and equity repayments <strong>of</strong> $266.3 million since 1998.100%75%50%25%0%Consolidated Debt Ratio350 Dividends Declared to the GRF3001005002000 2001 2002 2003 <strong>2004</strong>2000 2001 2002 2003 <strong>2004</strong>Regular Special 2000 Deferred$Millions25020015041 C I C