2004 Crown Investments Corporation of Saskatchewan Annual Report

2004 Crown Investments Corporation of Saskatchewan Annual Report

2004 Crown Investments Corporation of Saskatchewan Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

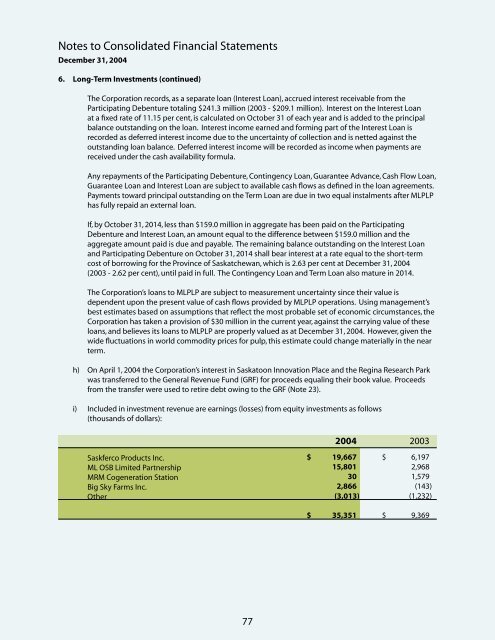

Notes to Consolidated Financial StatementsDecember 31, <strong>2004</strong>6. Long-Term <strong>Investments</strong> (continued)The <strong>Corporation</strong> records, as a separate loan (Interest Loan), accrued interest receivable from theParticipating Debenture totaling $241.3 million (2003 - $209.1 million). Interest on the Interest Loanat a fixed rate <strong>of</strong> 11.15 per cent, is calculated on October 31 <strong>of</strong> each year and is added to the principalbalance outstanding on the loan. Interest income earned and forming part <strong>of</strong> the Interest Loan isrecorded as deferred interest income due to the uncertainty <strong>of</strong> collection and is netted against theoutstanding loan balance. Deferred interest income will be recorded as income when payments arereceived under the cash availability formula.Any repayments <strong>of</strong> the Participating Debenture, Contingency Loan, Guarantee Advance, Cash Flow Loan,Guarantee Loan and Interest Loan are subject to available cash flows as defined in the loan agreements.Payments toward principal outstanding on the Term Loan are due in two equal instalments after MLPLPhas fully repaid an external loan.If, by October 31, 2014, less than $159.0 million in aggregate has been paid on the ParticipatingDebenture and Interest Loan, an amount equal to the difference between $159.0 million and theaggregate amount paid is due and payable. The remaining balance outstanding on the Interest Loanand Participating Debenture on October 31, 2014 shall bear interest at a rate equal to the short-termcost <strong>of</strong> borrowing for the Province <strong>of</strong> <strong>Saskatchewan</strong>, which is 2.63 per cent at December 31, <strong>2004</strong>(2003 - 2.62 per cent), until paid in full. The Contingency Loan and Term Loan also mature in 2014.The <strong>Corporation</strong>’s loans to MLPLP are subject to measurement uncertainty since their value isdependent upon the present value <strong>of</strong> cash flows provided by MLPLP operations. Using management’sbest estimates based on assumptions that reflect the most probable set <strong>of</strong> economic circumstances, the<strong>Corporation</strong> has taken a provision <strong>of</strong> $30 million in the current year, against the carrying value <strong>of</strong> theseloans, and believes its loans to MLPLP are properly valued as at December 31, <strong>2004</strong>. However, given thewide fluctuations in world commodity prices for pulp, this estimate could change materially in the nearterm.h) On April 1, <strong>2004</strong> the <strong>Corporation</strong>’s interest in Saskatoon Innovation Place and the Regina Research Parkwas transferred to the General Revenue Fund (GRF) for proceeds equaling their book value. Proceedsfrom the transfer were used to retire debt owing to the GRF (Note 23).i) Included in investment revenue are earnings (losses) from equity investments as follows(thousands <strong>of</strong> dollars):<strong>2004</strong> 2003Saskferco Products Inc.ML OSB Limited PartnershipMRM Cogeneration StationBig Sky Farms Inc.Other$19,66715,801302,866$6,1972,9681,579(143)(3,013) (1,232)$35,351$9,36977