2008 Annual Report - Hubbell Wiring Device-Kellems

2008 Annual Report - Hubbell Wiring Device-Kellems

2008 Annual Report - Hubbell Wiring Device-Kellems

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

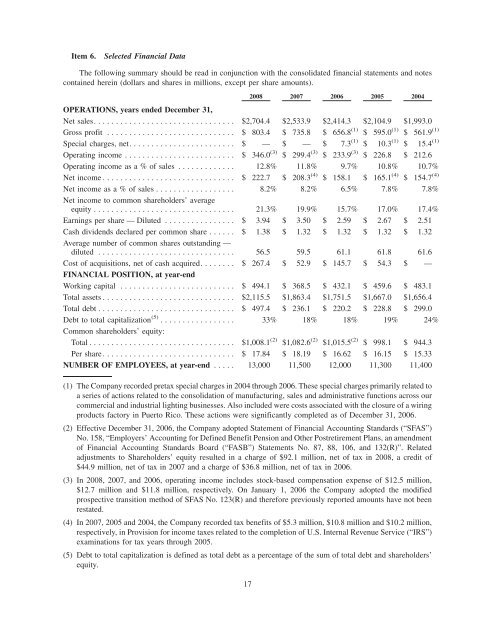

Item 6.Selected Financial DataThe following summary should be read in conjunction with the consolidated financial statements and notescontained herein (dollars and shares in millions, except per share amounts).<strong>2008</strong> 2007 2006 2005 2004OPERATIONS, years ended December 31,Net sales. ............................... $2,704.4 $2,533.9 $2,414.3 $2,104.9 $1,993.0Gross profit ............................. $ 803.4 $ 735.8 $ 656.8 (1) $ 595.0 (1) $ 561.9 (1)Special charges, net. ....................... $ — $ — $ 7.3 (1) $ 10.3 (1) $ 15.4 (1)Operating income ......................... $ 346.0 (3) $ 299.4 (3) $ 233.9 (3) $ 226.8 $ 212.6Operating income as a % of sales ............. 12.8% 11.8% 9.7% 10.8% 10.7%Net income .............................. $ 222.7 $ 208.3 (4) $ 158.1 $ 165.1 (4) $ 154.7 (4)Net income as a % of sales .................. 8.2% 8.2% 6.5% 7.8% 7.8%Net income to common shareholders’ averageequity ................................ 21.3% 19.9% 15.7% 17.0% 17.4%Earnings per share — Diluted . . . ............. $ 3.94 $ 3.50 $ 2.59 $ 2.67 $ 2.51Cash dividends declared per common share ...... $ 1.38 $ 1.32 $ 1.32 $ 1.32 $ 1.32Average number of common shares outstanding —diluted ............................... 56.5 59.5 61.1 61.8 61.6Cost of acquisitions, net of cash acquired. ....... $ 267.4 $ 52.9 $ 145.7 $ 54.3 $ —FINANCIAL POSITION, at year-endWorking capital .......................... $ 494.1 $ 368.5 $ 432.1 $ 459.6 $ 483.1Total assets .............................. $2,115.5 $1,863.4 $1,751.5 $1,667.0 $1,656.4Total debt ............................... $ 497.4 $ 236.1 $ 220.2 $ 228.8 $ 299.0Debt to total capitalization (5) ................. 33% 18% 18% 19% 24%Common shareholders’ equity:Total ................................. $1,008.1 (2) $1,082.6 (2) $1,015.5 (2) $ 998.1 $ 944.3Per share .............................. $ 17.84 $ 18.19 $ 16.62 $ 16.15 $ 15.33NUMBER OF EMPLOYEES, at year-end ..... 13,000 11,500 12,000 11,300 11,400(1) The Company recorded pretax special charges in 2004 through 2006. These special charges primarily related toa series of actions related to the consolidation of manufacturing, sales and administrative functions across ourcommercial and industrial lighting businesses. Also included were costs associated with the closure of a wiringproducts factory in Puerto Rico. These actions were significantly completed as of December 31, 2006.(2) Effective December 31, 2006, the Company adopted Statement of Financial Accounting Standards (“SFAS”)No. 158, “Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans, an amendmentof Financial Accounting Standards Board (“FASB”) Statements No. 87, 88, 106, and 132(R)”. Relatedadjustments to Shareholders’ equity resulted in a charge of $92.1 million, net of tax in <strong>2008</strong>, a credit of$44.9 million, net of tax in 2007 and a charge of $36.8 million, net of tax in 2006.(3) In <strong>2008</strong>, 2007, and 2006, operating income includes stock-based compensation expense of $12.5 million,$12.7 million and $11.8 million, respectively. On January 1, 2006 the Company adopted the modifiedprospective transition method of SFAS No. 123(R) and therefore previously reported amounts have not beenrestated.(4) In 2007, 2005 and 2004, the Company recorded tax benefits of $5.3 million, $10.8 million and $10.2 million,respectively, in Provision for income taxes related to the completion of U.S. Internal Revenue Service (“IRS”)examinations for tax years through 2005.(5) Debt to total capitalization is defined as total debt as a percentage of the sum of total debt and shareholders’equity.17