2008 Annual Report - Hubbell Wiring Device-Kellems

2008 Annual Report - Hubbell Wiring Device-Kellems

2008 Annual Report - Hubbell Wiring Device-Kellems

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

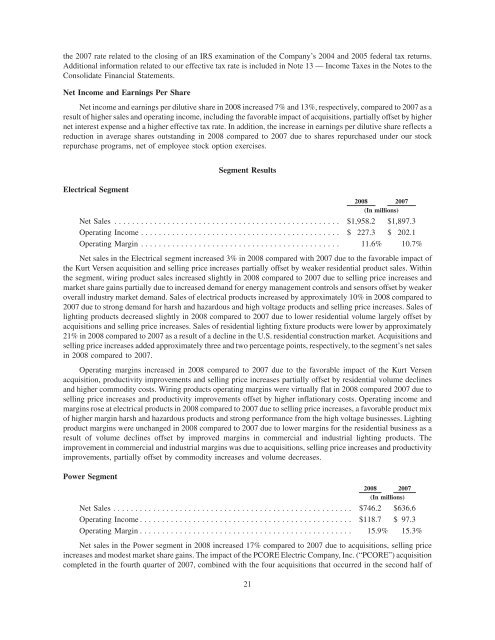

the 2007 rate related to the closing of an IRS examination of the Company’s 2004 and 2005 federal tax returns.Additional information related to our effective tax rate is included in Note 13 — Income Taxes in the Notes to theConsolidate Financial Statements.Net Income and Earnings Per ShareNet income and earnings per dilutive share in <strong>2008</strong> increased 7% and 13%, respectively, compared to 2007 as aresult of higher sales and operating income, including the favorable impact of acquisitions, partially offset by highernet interest expense and a higher effective tax rate. In addition, the increase in earnings per dilutive share reflects areduction in average shares outstanding in <strong>2008</strong> compared to 2007 due to shares repurchased under our stockrepurchase programs, net of employee stock option exercises.Segment ResultsElectrical Segment<strong>2008</strong> 2007(In millions)Net Sales ................................................... $1,958.2 $1,897.3Operating Income ............................................. $ 227.3 $ 202.1Operating Margin ............................................. 11.6% 10.7%Net sales in the Electrical segment increased 3% in <strong>2008</strong> compared with 2007 due to the favorable impact ofthe Kurt Versen acquisition and selling price increases partially offset by weaker residential product sales. Withinthe segment, wiring product sales increased slightly in <strong>2008</strong> compared to 2007 due to selling price increases andmarket share gains partially due to increased demand for energy management controls and sensors offset by weakeroverall industry market demand. Sales of electrical products increased by approximately 10% in <strong>2008</strong> compared to2007 due to strong demand for harsh and hazardous and high voltage products and selling price increases. Sales oflighting products decreased slightly in <strong>2008</strong> compared to 2007 due to lower residential volume largely offset byacquisitions and selling price increases. Sales of residential lighting fixture products were lower by approximately21% in <strong>2008</strong> compared to 2007 as a result of a decline in the U.S. residential construction market. Acquisitions andselling price increases added approximately three and two percentage points, respectively, to the segment’s net salesin <strong>2008</strong> compared to 2007.Operating margins increased in <strong>2008</strong> compared to 2007 due to the favorable impact of the Kurt Versenacquisition, productivity improvements and selling price increases partially offset by residential volume declinesand higher commodity costs. <strong>Wiring</strong> products operating margins were virtually flat in <strong>2008</strong> compared 2007 due toselling price increases and productivity improvements offset by higher inflationary costs. Operating income andmargins rose at electrical products in <strong>2008</strong> compared to 2007 due to selling price increases, a favorable product mixof higher margin harsh and hazardous products and strong performance from the high voltage businesses. Lightingproduct margins were unchanged in <strong>2008</strong> compared to 2007 due to lower margins for the residential business as aresult of volume declines offset by improved margins in commercial and industrial lighting products. Theimprovement in commercial and industrial margins was due to acquisitions, selling price increases and productivityimprovements, partially offset by commodity increases and volume decreases.Power Segment<strong>2008</strong> 2007(In millions)Net Sales ...................................................... $746.2 $636.6Operating Income ................................................ $118.7 $ 97.3Operating Margin ................................................ 15.9% 15.3%Net sales in the Power segment in <strong>2008</strong> increased 17% compared to 2007 due to acquisitions, selling priceincreases and modest market share gains. The impact of the PCORE Electric Company, Inc. (“PCORE”) acquisitioncompleted in the fourth quarter of 2007, combined with the four acquisitions that occurred in the second half of21