2008 Annual Report - Hubbell Wiring Device-Kellems

2008 Annual Report - Hubbell Wiring Device-Kellems

2008 Annual Report - Hubbell Wiring Device-Kellems

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

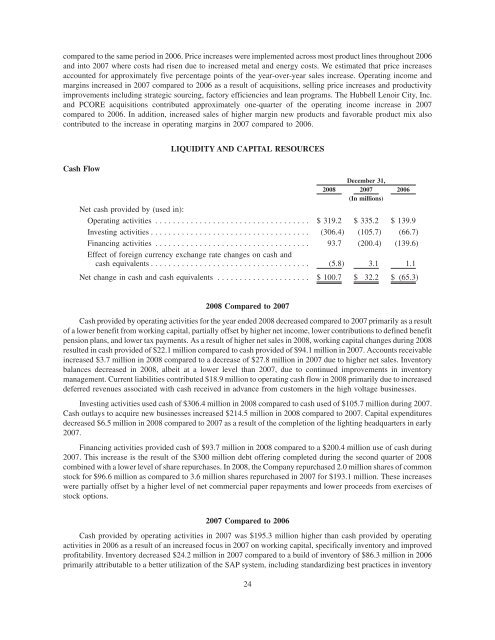

compared to the same period in 2006. Price increases were implemented across most product lines throughout 2006and into 2007 where costs had risen due to increased metal and energy costs. We estimated that price increasesaccounted for approximately five percentage points of the year-over-year sales increase. Operating income andmargins increased in 2007 compared to 2006 as a result of acquisitions, selling price increases and productivityimprovements including strategic sourcing, factory efficiencies and lean programs. The <strong>Hubbell</strong> Lenoir City, Inc.and PCORE acquisitions contributed approximately one-quarter of the operating income increase in 2007compared to 2006. In addition, increased sales of higher margin new products and favorable product mix alsocontributed to the increase in operating margins in 2007 compared to 2006.Cash FlowLIQUIDITY AND CAPITAL RESOURCESDecember 31,<strong>2008</strong> 2007 2006(In millions)Net cash provided by (used in):Operating activities ................................... $319.2 $ 335.2 $ 139.9Investing activities .................................... (306.4) (105.7) (66.7)Financing activities ................................... 93.7 (200.4) (139.6)Effect of foreign currency exchange rate changes on cash andcash equivalents .................................... (5.8) 3.1 1.1Net change in cash and cash equivalents ..................... $100.7 $ 32.2 $ (65.3)<strong>2008</strong> Compared to 2007Cash provided by operating activities for the year ended <strong>2008</strong> decreased compared to 2007 primarily as a resultof a lower benefit from working capital, partially offset by higher net income, lower contributions to defined benefitpension plans, and lower tax payments. As a result of higher net sales in <strong>2008</strong>, working capital changes during <strong>2008</strong>resulted in cash provided of $22.1 million compared to cash provided of $94.1 million in 2007. Accounts receivableincreased $3.7 million in <strong>2008</strong> compared to a decrease of $27.8 million in 2007 due to higher net sales. Inventorybalances decreased in <strong>2008</strong>, albeit at a lower level than 2007, due to continued improvements in inventorymanagement. Current liabilities contributed $18.9 million to operating cash flow in <strong>2008</strong> primarily due to increaseddeferred revenues associated with cash received in advance from customers in the high voltage businesses.Investing activities used cash of $306.4 million in <strong>2008</strong> compared to cash used of $105.7 million during 2007.Cash outlays to acquire new businesses increased $214.5 million in <strong>2008</strong> compared to 2007. Capital expendituresdecreased $6.5 million in <strong>2008</strong> compared to 2007 as a result of the completion of the lighting headquarters in early2007.Financing activities provided cash of $93.7 million in <strong>2008</strong> compared to a $200.4 million use of cash during2007. This increase is the result of the $300 million debt offering completed during the second quarter of <strong>2008</strong>combined with a lower level of share repurchases. In <strong>2008</strong>, the Company repurchased 2.0 million shares of commonstock for $96.6 million as compared to 3.6 million shares repurchased in 2007 for $193.1 million. These increaseswere partially offset by a higher level of net commercial paper repayments and lower proceeds from exercises ofstock options.2007 Compared to 2006Cash provided by operating activities in 2007 was $195.3 million higher than cash provided by operatingactivities in 2006 as a result of an increased focus in 2007 on working capital, specifically inventory and improvedprofitability. Inventory decreased $24.2 million in 2007 compared to a build of inventory of $86.3 million in 2006primarily attributable to a better utilization of the SAP system, including standardizing best practices in inventory24