2008 Annual Report - Hubbell Wiring Device-Kellems

2008 Annual Report - Hubbell Wiring Device-Kellems

2008 Annual Report - Hubbell Wiring Device-Kellems

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

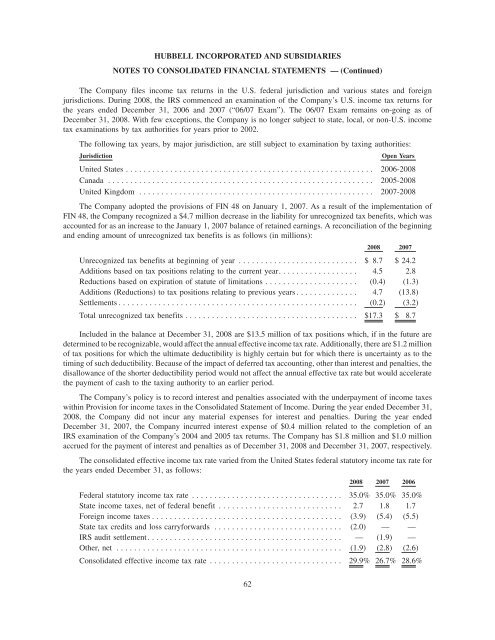

The Company files income tax returns in the U.S. federal jurisdiction and various states and foreignjurisdictions. During <strong>2008</strong>, the IRS commenced an examination of the Company’s U.S. income tax returns forthe years ended December 31, 2006 and 2007 (“06/07 Exam”). The 06/07 Exam remains on-going as ofDecember 31, <strong>2008</strong>. With few exceptions, the Company is no longer subject to state, local, or non-U.S. incometax examinations by tax authorities for years prior to 2002.The following tax years, by major jurisdiction, are still subject to examination by taxing authorities:JurisdictionHUBBELL INCORPORATED AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)Open YearsUnited States ........................................................ 2006-<strong>2008</strong>Canada ............................................................ 2005-<strong>2008</strong>United Kingdom ..................................................... 2007-<strong>2008</strong>The Company adopted the provisions of FIN 48 on January 1, 2007. As a result of the implementation ofFIN 48, the Company recognized a $4.7 million decrease in the liability for unrecognized tax benefits, which wasaccounted for as an increase to the January 1, 2007 balance of retained earnings. A reconciliation of the beginningand ending amount of unrecognized tax benefits is as follows (in millions):<strong>2008</strong> 2007Unrecognized tax benefits at beginning of year ........................... $ 8.7 $24.2Additions based on tax positions relating to the current year. ................. 4.5 2.8Reductions based on expiration of statute of limitations ..................... (0.4) (1.3)Additions (Reductions) to tax positions relating to previous years .............. 4.7 (13.8)Settlements ...................................................... (0.2) (3.2)Total unrecognized tax benefits ....................................... $17.3 $ 8.7Included in the balance at December 31, <strong>2008</strong> are $13.5 million of tax positions which, if in the future aredetermined to be recognizable, would affect the annual effective income tax rate. Additionally, there are $1.2 millionof tax positions for which the ultimate deductibility is highly certain but for which there is uncertainty as to thetiming of such deductibility. Because of the impact of deferred tax accounting, other than interest and penalties, thedisallowance of the shorter deductibility period would not affect the annual effective tax rate but would acceleratethe payment of cash to the taxing authority to an earlier period.The Company’s policy is to record interest and penalties associated with the underpayment of income taxeswithin Provision for income taxes in the Consolidated Statement of Income. During the year ended December 31,<strong>2008</strong>, the Company did not incur any material expenses for interest and penalties. During the year endedDecember 31, 2007, the Company incurred interest expense of $0.4 million related to the completion of anIRS examination of the Company’s 2004 and 2005 tax returns. The Company has $1.8 million and $1.0 millionaccrued for the payment of interest and penalties as of December 31, <strong>2008</strong> and December 31, 2007, respectively.The consolidated effective income tax rate varied from the United States federal statutory income tax rate forthe years ended December 31, as follows:<strong>2008</strong> 2007 2006Federal statutory income tax rate .................................. 35.0% 35.0% 35.0%State income taxes, net of federal benefit ............................ 2.7 1.8 1.7Foreign income taxes ........................................... (3.9) (5.4) (5.5)State tax credits and loss carryforwards ............................. (2.0) — —IRS audit settlement ............................................ — (1.9) —Other, net ................................................... (1.9) (2.8) (2.6)Consolidated effective income tax rate .............................. 29.9% 26.7% 28.6%62