2008 Annual Report - Hubbell Wiring Device-Kellems

2008 Annual Report - Hubbell Wiring Device-Kellems

2008 Annual Report - Hubbell Wiring Device-Kellems

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

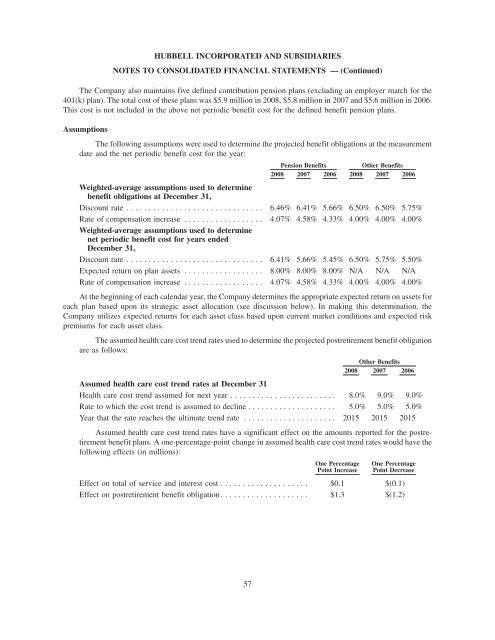

HUBBELL INCORPORATED AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)The Company also maintains five defined contribution pension plans (excluding an employer match for the401(k) plan). The total cost of these plans was $5.9 million in <strong>2008</strong>, $5.8 million in 2007 and $5.6 million in 2006.This cost is not included in the above net periodic benefit cost for the defined benefit pension plans.AssumptionsThe following assumptions were used to determine the projected benefit obligations at the measurementdate and the net periodic benefit cost for the year:Pension BenefitsOther Benefits<strong>2008</strong> 2007 2006 <strong>2008</strong> 2007 2006Weighted-average assumptions used to determinebenefit obligations at December 31,Discount rate ............................... 6.46% 6.41% 5.66% 6.50% 6.50% 5.75%Rate of compensation increase .................. 4.07% 4.58% 4.33% 4.00% 4.00% 4.00%Weighted-average assumptions used to determinenet periodic benefit cost for years endedDecember 31,Discount rate ............................... 6.41% 5.66% 5.45% 6.50% 5.75% 5.50%Expected return on plan assets .................. 8.00% 8.00% 8.00% N/A N/A N/ARate of compensation increase .................. 4.07% 4.58% 4.33% 4.00% 4.00% 4.00%At the beginning of each calendar year, the Company determines the appropriate expected return on assets foreach plan based upon its strategic asset allocation (see discussion below). In making this determination, theCompany utilizes expected returns for each asset class based upon current market conditions and expected riskpremiums for each asset class.The assumed health care cost trend rates used to determine the projected postretirement benefit obligationare as follows:Other Benefits<strong>2008</strong> 2007 2006Assumed health care cost trend rates at December 31Health care cost trend assumed for next year ........................ 8.0% 9.0% 9.0%Rate to which the cost trend is assumed to decline .................... 5.0% 5.0% 5.0%Year that the rate reaches the ultimate trend rate ..................... 2015 2015 2015Assumed health care cost trend rates have a significant effect on the amounts reported for the postretirementbenefit plans. A one-percentage-point change in assumed health care cost trend rates would have thefollowing effects (in millions):One PercentagePoint IncreaseOne PercentagePoint DecreaseEffect on total of service and interest cost .................... $0.1 $(0.1)Effect on postretirement benefit obligation .................... $1.3 $(1.2)57