ANNUAL REPORT 2007 | 2008 - Gimv

ANNUAL REPORT 2007 | 2008 - Gimv

ANNUAL REPORT 2007 | 2008 - Gimv

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

RESULTS<br />

<strong>Gimv</strong> posts net profi t of<br />

over EUR 160 million<br />

For the 12 months of the <strong>2007</strong>-<strong>2008</strong> fi nancial year, <strong>Gimv</strong> posted<br />

a net profi t (group share) of EUR 161.4 million. This compares<br />

with EUR 249.3 million for the extended 2006-<strong>2007</strong> fi nancial<br />

year (15 months). This profi t is strongly infl uenced by favourable<br />

divestments, with shareholdings sold above their most recent<br />

carrying values. On top of this comes also the favourable development<br />

in the value of the <strong>Gimv</strong> portfolio. Since the application<br />

of IFRS, <strong>Gimv</strong>’s profi t has been largely based on the evolution in<br />

the value of the portfolio, including both realised and unrealised<br />

value fl uctuations.<br />

Net realised capital gains in the <strong>2007</strong>-<strong>2008</strong> fi nancial year totalled<br />

EUR 128.1 million. Of this amount, 81 percent (EUR 103.8 million)<br />

came from the Corporate Investment activities (Belgium,<br />

Netherlands and Germany), 17 percent (EUR 21.9 million) from<br />

ICT and 2 percent (EUR 2.3 million) from Life Sciences.<br />

Net unrealised capital gains amounted to EUR 37.3 million. This<br />

breaks down into net unrealised capital gains of EUR 60.1 million<br />

on Corporate Investment activities, of EUR 0.2 million on the<br />

new activities, and negative contributions of EUR 21.6 million<br />

and EUR 1.4 million from Life Sciences and ICT respectively.<br />

Here it was primarily the listed shareholdings and the negative<br />

exchange rate effects which produced the negative value<br />

movements.<br />

14 | <strong>Gimv</strong> Annual Report <strong>2007</strong>-<strong>2008</strong> | Operating and fi nancial report<br />

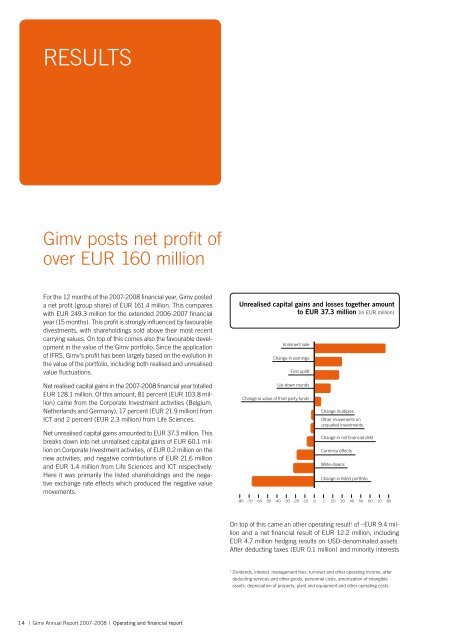

Unrealised capital gains and losses together amount<br />

to EUR 37.3 million (in EUR million)<br />

Imminent sale<br />

Change in earnings<br />

First uplift<br />

Up-down rounds<br />

Change in value of third party funds<br />

Change multiples<br />

Other movements on<br />

unquoted investments<br />

Change in net fi nancial debt<br />

Currency effects<br />

Write-downs<br />

Change in listed portfolio<br />

-80 -70 -60 -50 -40 -30 -20 -10 0 1 20 30 40 50 60 70 80<br />

On top of this came an other operating result 1 of –EUR 9.4 million<br />

and a net fi nancial result of EUR 12.2 million, including<br />

EUR 4.7 million hedging results on USD-denominated assets.<br />

After deducting taxes (EUR 0.1 million) and minority interests<br />

1 Dividends, interest, management fees, turnover and other operating income, after<br />

deducting services and other goods, personnel costs, amortization of intangible<br />

assets, depreciation of property, plant and equipment and other operating costs.