ANNUAL REPORT 2007 | 2008 - Gimv

ANNUAL REPORT 2007 | 2008 - Gimv

ANNUAL REPORT 2007 | 2008 - Gimv

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

RESULTS<br />

Securitized paper<br />

7%<br />

Funds 10%<br />

Bonds 4%<br />

Insurance products<br />

31%<br />

2-5 years<br />

17%<br />

3 months-2 years<br />

47%<br />

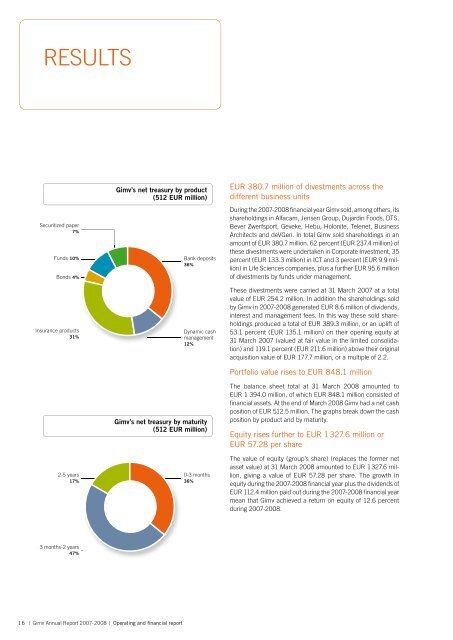

<strong>Gimv</strong>’s net treasury by product<br />

(512 EUR million)<br />

<strong>Gimv</strong>’s net treasury by maturity<br />

(512 EUR million)<br />

16 | <strong>Gimv</strong> Annual Report <strong>2007</strong>-<strong>2008</strong> | Operating and fi nancial report<br />

Bank deposits<br />

36%<br />

Dynamic cash<br />

management<br />

12%<br />

0-3 months<br />

36%<br />

EUR 380.7 million of divestments across the<br />

different business units<br />

During the <strong>2007</strong>-<strong>2008</strong> fi nancial year <strong>Gimv</strong> sold, among others, its<br />

shareholdings in Alfacam, Jensen Group, Dujardin Foods, DTS,<br />

Bever Zwerfsport, Geveke, Hebu, Holonite, Telenet, Business<br />

Architects and deVGen. In total <strong>Gimv</strong> sold shareholdings in an<br />

amount of EUR 380.7 million. 62 percent (EUR 237.4 million) of<br />

these divestments were undertaken in Corporate Investment, 35<br />

percent (EUR 133.3 million) in ICT and 3 percent (EUR 9.9 million)<br />

in Life Sciences companies, plus a further EUR 95.6 million<br />

of divestments by funds under management.<br />

These divestments were carried at 31 March <strong>2007</strong> at a total<br />

value of EUR 254.2 million. In addition the shareholdings sold<br />

by <strong>Gimv</strong> in <strong>2007</strong>-<strong>2008</strong> generated EUR 8.6 million of dividends,<br />

interest and management fees. In this way these sold shareholdings<br />

produced a total of EUR 389.3 million, or an uplift of<br />

53.1 percent (EUR 135.1 million) on their opening equity at<br />

31 March <strong>2007</strong> (valued at fair value in the limited consolidation)<br />

and 119.1 percent (EUR 211.6 million) above their original<br />

acquisition value of EUR 177.7 million, or a multiple of 2.2.<br />

Portfolio value rises to EUR 848.1 million<br />

The balance sheet total at 31 March <strong>2008</strong> amounted to<br />

EUR 1 394.0 million, of which EUR 848.1 million consisted of<br />

fi nancial assets. At the end of March <strong>2008</strong> <strong>Gimv</strong> had a net cash<br />

position of EUR 512.5 million. The graphs break down the cash<br />

position by product and by maturity.<br />

Equity rises further to EUR 1 327.6 million or<br />

EUR 57.28 per share<br />

The value of equity (group’s share) (replaces the former net<br />

asset value) at 31 March <strong>2008</strong> amounted to EUR 1 327.6 million,<br />

giving a value of EUR 57.28 per share. The growth in<br />

equity during the <strong>2007</strong>-<strong>2008</strong> fi nancial year plus the dividends of<br />

EUR 112.4 million paid out during the <strong>2007</strong>-<strong>2008</strong> fi nancial year<br />

mean that <strong>Gimv</strong> achieved a return on equity of 12.6 percent<br />

during <strong>2007</strong>-<strong>2008</strong>.