ANNUAL REPORT 2007 | 2008 - Gimv

ANNUAL REPORT 2007 | 2008 - Gimv

ANNUAL REPORT 2007 | 2008 - Gimv

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

VENTURE<br />

CAPITAL<br />

Information & Communication Technology<br />

In <strong>2007</strong> the ICT business unit continued its<br />

European expansion by acquiring an experienced<br />

ICT venture capitalist in France. This has already<br />

produced an investment in the French company<br />

Movea. The cooperation with Israeli venture<br />

capital fund Genesis Partners resulted during the<br />

fi nancial year in a joint investment in the Israeli<br />

company Oree.<br />

The continuing internationalization of its ICT activities refl ects<br />

<strong>Gimv</strong>’s ambition of attracting the best deals as a top tier<br />

European venture capital provider.<br />

With around thirty years of development behind it, the venture<br />

capital market has become more mature and international.<br />

Entrepreneurs looking for fi nancing no longer give preference<br />

to local players, but to venture capitalists who look beyond their<br />

own national boundaries. With international experience and local<br />

presence in various countries, <strong>Gimv</strong> ICT can look back on<br />

good performances and focus on attractive opportunities.<br />

In <strong>2007</strong> interest remained strong for internet companies with<br />

Web 2.0 applications, leading to extensive M&A activity at<br />

high valuations. Another striking feature was the sharp grown<br />

in consumer-directed technology like HDTV, advanced mobile<br />

phones, games and home server networks, all young markets<br />

which still offer lots of potential.<br />

The past fi nancial year saw acceptable valuations for early stage<br />

companies and rather high valuations for later stage ones. This<br />

phenomenon was more marked in France and in the United<br />

Kingdom, where the high numbers of venture capitalists spurred<br />

on the market, resulting in high prices. European market fi gures<br />

rose slightly in <strong>2007</strong>. In total EUR 4.60 billion of venture<br />

capital was invested, compared with EUR 4.46 billion in 2006.<br />

Up 2 percent on the previous year, this is the highest amount<br />

since 2002.<br />

40 | <strong>Gimv</strong> Annual Report <strong>2007</strong>-<strong>2008</strong> | Operating and fi nancial report<br />

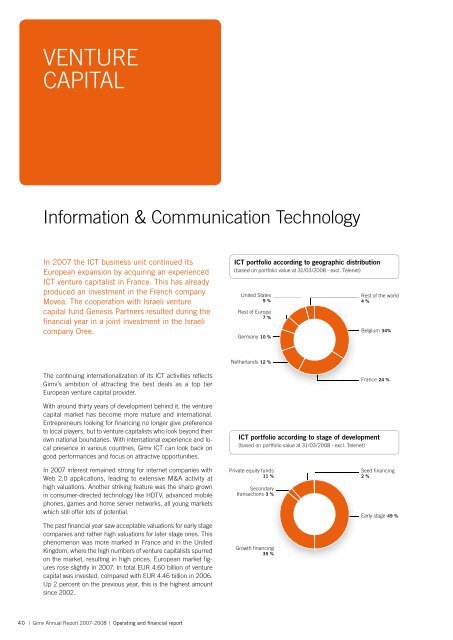

ICT portfolio according to geographic distribution<br />

(based on portfolio value at 31/03/<strong>2008</strong> - excl. Telenet)<br />

United States<br />

9 %<br />

Rest of Europe pe<br />

7 %<br />

Germany 10 %<br />

Netherlands 12 %<br />

Rest of the world<br />

4 %<br />

Belgium 34%<br />

France 24 %<br />

ICT portfolio according to stage of development<br />

(based on portfolio value at 31/03/<strong>2008</strong> - excl. Telenet)<br />

Private equity funds ds<br />

11 %<br />

Secondary ary<br />

transactions 3 %<br />

Growth fi nancing ng<br />

35 5 %<br />

Seed fi nancing<br />

2 %<br />

Early stage 49 %