UTOPIA did notachieve its goal tocomplete construction<strong>of</strong> <strong>the</strong> network by <strong>the</strong>3 rd Quarter <strong>of</strong> 2007.UTOPIA Did Not Achieve Its Construction Goals. By <strong>the</strong> end<strong>of</strong> June 2007, UTOPIA had made service available to only 37,160addresses–less than a third <strong>of</strong> <strong>the</strong> original goal. Instead <strong>of</strong> having49,350 subscribers, <strong>the</strong> network had only 6,161 subscribers. Figure2.2 compares UTOPIA’s original goals to <strong>the</strong> number actuallyachieved by <strong>the</strong> years 2007, 2009, 2011, and 2012.Figure 2.2 UTOPIA Was Not Successful in Its Goal to Complete <strong>the</strong>Network by 2007. Initially, UTOPIA planned to <strong>of</strong>fer services to 141,000addresses by <strong>the</strong> third quarter <strong>of</strong> 2007. It was able to <strong>of</strong>fer service to only37,160 addresses that year. Of those, only 6,161 actually chose tosubscribe.GoalActualSept.2007June2007June2009June2011April2012Addresses Passed 141,000 37,160 48,646 56,000 58,100Subscribers 49,350 6,161 8,009 8,572 9,340Subscription Rate 35% 16.6% 16.5% 15.3% 16.1%Sources: 2007 Goals – UTOPIA presentation dated December 2003.2007, 2009 & 2011 Actuals - UTOPIA Annual Financial Statements.2012 Actuals – Extracted from UTOPIA Operations Database, April 5, 2012.Figure 2.2 shows that UTOPIA did not achieve its goal to haveservice available to 141,000 addresses by <strong>the</strong> year 2007. The figurealso shows that <strong>the</strong> agency continues to struggle in its effort to expandits network and add subscribers.UTOPIA Did Not Reach Its Goal to Be Pr<strong>of</strong>itable by 2009.According to <strong>the</strong> initial feasibility studies, even under <strong>the</strong> mostconservative scenario, UTOPIA’s operating revenues were expected toexceed its operating costs and debt service obligation by 2009.However, due to unforeseen circumstances, operating revenuesremained low while operating and interest expenses rose.- 8 -A <strong>Performance</strong> <strong>Audit</strong> <strong>of</strong> <strong>the</strong> <strong>Utah</strong> <strong>Telecommunication</strong> <strong>Open</strong> Infrastructure Agency (August 2012)

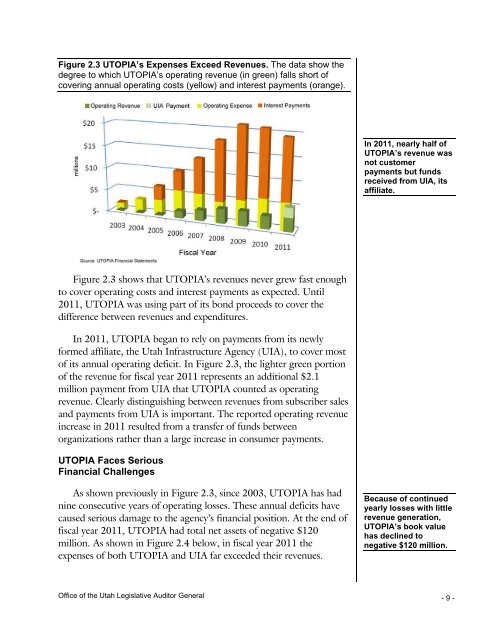

Figure 2.3 UTOPIA’s Expenses Exceed Revenues. The data show <strong>the</strong>degree to which UTOPIA’s operating revenue (in green) falls short <strong>of</strong>covering annual operating costs (yellow) and interest payments (orange).In 2011, nearly half <strong>of</strong>UTOPIA’s revenue wasnot customerpayments but fundsreceived from UIA, itsaffiliate.Figure 2.3 shows that UTOPIA’s revenues never grew fast enoughto cover operating costs and interest payments as expected. Until2011, UTOPIA was using part <strong>of</strong> its bond proceeds to cover <strong>the</strong>difference between revenues and expenditures.In 2011, UTOPIA began to rely on payments from its newlyformed affiliate, <strong>the</strong> <strong>Utah</strong> Infrastructure Agency (UIA), to cover most<strong>of</strong> its annual operating deficit. In Figure 2.3, <strong>the</strong> lighter green portion<strong>of</strong> <strong>the</strong> revenue for fiscal year 2011 represents an additional $2.1million payment from UIA that UTOPIA counted as operatingrevenue. Clearly distinguishing between revenues from subscriber salesand payments from UIA is important. The reported operating revenueincrease in 2011 resulted from a transfer <strong>of</strong> funds betweenorganizations ra<strong>the</strong>r than a large increase in consumer payments.UTOPIA Faces SeriousFinancial ChallengesAs shown previously in Figure 2.3, since 2003, UTOPIA has hadnine consecutive years <strong>of</strong> operating losses. These annual deficits havecaused serious damage to <strong>the</strong> agency’s financial position. At <strong>the</strong> end <strong>of</strong>fiscal year 2011, UTOPIA had total net assets <strong>of</strong> negative $120million. As shown in Figure 2.4 below, in fiscal year 2011 <strong>the</strong>expenses <strong>of</strong> both UTOPIA and UIA far exceeded <strong>the</strong>ir revenues.Because <strong>of</strong> continuedyearly losses with littlerevenue generation,UTOPIA’s book valuehas declined tonegative $120 million.Office <strong>of</strong> <strong>the</strong> <strong>Utah</strong> Legislative <strong>Audit</strong>or General - 9 -

- Page 1: REPORT TO THEUTAH LEGISLATURENumber

- Page 5: DigestA Performance Audit ofUtah Te

- Page 9: Table of ContentsDigest ...........

- Page 12 and 13: will be funded through UIA financin

- Page 14 and 15: the organization’s general manage

- Page 16 and 17: UTOPIA Did Not Reach Its Goal to Bu

- Page 20 and 21: Figure 2.4 Summary of the Agencies

- Page 22 and 23: efinancing, the maximum amount pled

- Page 24 and 25: One consequence of the slow growth

- Page 26 and 27: factors in deciding where to build.

- Page 28 and 29: completed in a timely fashion and h

- Page 30 and 31: Figure 2.10 Seven Years of Operatin

- Page 32 and 33: Figure 2.11 By 2010, UTOPIA Had Spe

- Page 34 and 35: plan did not anticipate the difficu

- Page 36 and 37: end of 2010, 3,698 former subscribe

- Page 38 and 39: Uncollected revenuesfrom retail pro

- Page 40 and 41: agreed to provide UTOPIA with a $66

- Page 42 and 43: As problems mounted, the board deci

- Page 44 and 45: The data in Figure 3.2 shows that,

- Page 46 and 47: As stated previously, two possible

- Page 48 and 49: This Page Left Blank Intentionally-

- Page 50 and 51: UTOPIA Has a New Development PlanAi

- Page 52 and 53: Centerville and in its legacy areas

- Page 54 and 55: UTOPIA shouldidentify specific area

- Page 56 and 57: e applied. Not surprisingly, we fou

- Page 58 and 59: act in its entirety. Also, the agen

- Page 60 and 61: Manual, which describes how local a

- Page 62 and 63: in public, the executive committee

- Page 64 and 65: separate public body that must comp

- Page 66 and 67: public entities that are subject to

- Page 68 and 69:

This Page Left Blank Intentionally-

- Page 70 and 71:

This Page Left Blank Intentionally-

- Page 72 and 73:

- 62 - A Performance Audit of the U

- Page 74 and 75:

This Page Left Blank Intentionally-

- Page 76 and 77:

This Page Left Blank Intentionally-

- Page 78 and 79:

Five‐Year Plan Summary 2Agency (U

- Page 80 and 81:

Five‐Year Plan Summary 4cities’

- Page 82 and 83:

This Page Left Blank Intentionally-

- Page 84 and 85:

This Page Left Blank Intentionally-

- Page 86 and 87:

- 76 - A Performance Audit of the U

- Page 88:

- 78 - A Performance Audit of the U