116770 Project Obelix Pt1.qxp - Carlsberg Group

116770 Project Obelix Pt1.qxp - Carlsberg Group

116770 Project Obelix Pt1.qxp - Carlsberg Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

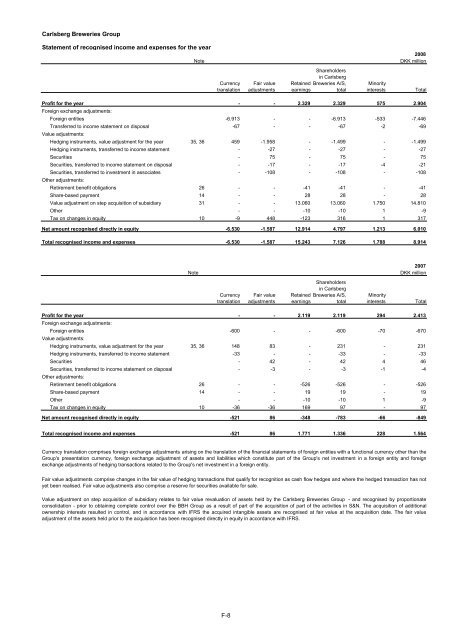

<strong>Carlsberg</strong> Breweries <strong>Group</strong>Statement of recognised income and expenses for the yearNote2008DKK millionCurrencytranslationFair valueadjustmentsShareholdersin <strong>Carlsberg</strong>Retained Breweries A/S,earningstotalMinorityinterestsTotalProfit for the year - - 2.329 2.329 575 2.904Foreign exchange adjustments:Foreign entities -6.913 - - -6.913 -533 -7.446Transferred to income statement on disposal -67 - - -67 -2 -69Value adjustments:Hedging instruments, value adjustment for the year 35, 36 459 -1.958 - -1.499 - -1.499Hedging instruments, transferred to income statement - -27 - -27 - -27Securities - 75 - 75 - 75Securities, transferred to income statement on disposal - -17 - -17 -4 -21Securities, transferred to investment in associates - -108 - -108 - -108Other adjustments:Retirement benefit obligations 26 - - -41 -41 - -41Share-based payment 14 - - 28 28 - 28Value adjustment on step acquisition of subsidiary 31 - - 13.060 13.060 1.750 14.810Other - - -10 -10 1 -9Tax on changes in equity 10 -9 448 -123 316 1 317Net amount recognised directly in equity -6.530 -1.587 12.914 4.797 1.213 6.010Total recognised income and expenses -6.530 -1.587 15.243 7.126 1.788 8.914Note2007DKK millionCurrencytranslationFair valueadjustmentsShareholdersin <strong>Carlsberg</strong>Retained Breweries A/S,earningstotalMinorityinterestsTotalProfit for the year - - 2.119 2.119 294 2.413Foreign exchange adjustments:Foreign entities -600 - - -600 -70 -670Value adjustments:Hedging instruments, value adjustment for the year 35, 36 148 83 - 231 - 231Hedging instruments, transferred to income statement -33 - - -33 - -33Securities - 42 - 42 4 46Securities, transferred to income statement on disposal - -3 - -3 -1 -4Other adjustments:Retirement benefit obligations 26 - - -526 -526 - -526Share-based payment 14 - - 19 19 - 19Other - - -10 -10 1 -9Tax on changes in equity 10 -36 -36 169 97 - 97Net amount recognised directly in equity -521 86 -348 -783 -66 -849Total recognised income and expenses -521 86 1.771 1.336 228 1.564Currency translation comprises foreign exchange adjustments arising on the translation of the financial statements of foreign entities with a functional currency other than the<strong>Group</strong>'s presentation currency, foreign exchange adjustment of assets and liabilities which constitute part of the <strong>Group</strong>'s net investment in a foreign entity and foreignexchange adjustments of hedging transactions related to the <strong>Group</strong>'s net investment in a foreign entity.Fair value adjustments comprise changes in the fair value of hedging transactions that qualify for recognition as cash flow hedges and where the hedged transaction has notyet been realised. Fair value adjustments also comprise a reserve for securities available for sale.Value adjustment on step acquisition of subsidiary relates to fair value revaluation of assets held by the <strong>Carlsberg</strong> Breweries <strong>Group</strong> - and recognised by proportionateconsolidation - prior to obtaining complete control over the BBH <strong>Group</strong> as a result of part of the acquisition of part of the activities in S&N. The acquisition of additionalownership interests resulted in control, and in accordance with IFRS the acquired intangible assets are recognised at fair value at the acquisition date. The fair valueadjustment of the assets held prior to the acquisition has been recognised directly in equity in accordance with IFRS.F-8

![[Name and Address] - Carlsberg Group](https://img.yumpu.com/49766377/1/184x260/name-and-address-carlsberg-group.jpg?quality=85)

![[Name and Address] - Carlsberg Group](https://img.yumpu.com/49015962/1/184x260/name-and-address-carlsberg-group.jpg?quality=85)