116770 Project Obelix Pt1.qxp - Carlsberg Group

116770 Project Obelix Pt1.qxp - Carlsberg Group

116770 Project Obelix Pt1.qxp - Carlsberg Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

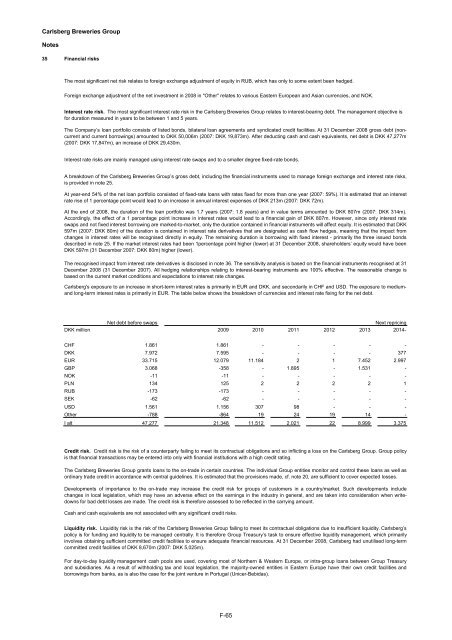

<strong>Carlsberg</strong> Breweries <strong>Group</strong>Notes35 Financial risksThe most significant net risk relates to foreign exchange adjustment of equity in RUB, which has only to some extent been hedged.Foreign exchange adjustment of the net investment in 2008 in "Other" relates to various Eastern European and Asian currencies, and NOK.Interest rate risk. The most significant interest rate risk in the <strong>Carlsberg</strong> Breweries <strong>Group</strong> relates to interest-bearing debt. The management objective isfor duration measured in years to be between 1 and 5 years.The Company’s loan portfolio consists of listed bonds, bilateral loan agreements and syndicated credit facilities. At 31 December 2008 gross debt (noncurrentand current borrowings) amounted to DKK 50,006m (2007: DKK 19,873m). After deducting cash and cash equivalents, net debt is DKK 47,277m(2007: DKK 17,847m), an increase of DKK 29,430m.Interest rate risks are mainly managed using interest rate swaps and to a smaller degree fixed-rate bonds.A breakdown of the <strong>Carlsberg</strong> Breweries <strong>Group</strong>’s gross debt, including the financial instruments used to manage foreign exchange and interest rate risks,is provided in note 25.At year-end 54% of the net loan portfolio consisted of fixed-rate loans with rates fixed for more than one year (2007: 59%). It is estimated that an interestrate rise of 1 percentage point would lead to an increase in annual interest expenses of DKK 213m (2007: DKK 72m).At the end of 2008, the duration of the loan portfolio was 1.7 years (2007: 1.8 years) and in value terms amounted to DKK 807m (2007: DKK 314m).Accordingly, the effect of a 1 percentage point increase in interest rates would lead to a financial gain of DKK 807m. However, since only interest rateswaps and not fixed interest borrowing are marked-to-market, only the duration contained in financial instruments will affect equity. It is estimated that DKK597m (2007: DKK 80m) of the duration is contained in interest rate derivatives that are designated as cash flow hedges, meaning that the impact fromchanges in interest rates will be recognised directly in equity. The remaining duration is borrowing with fixed interest - primarily the three issued bondsdescribed in note 25. If the market interest rates had been 1percentage point higher (lower) at 31 December 2008, shareholders’ equity would have beenDKK 597m (31 December 2007: DKK 80m) higher (lower).The recognised impact from interest rate derivatives is disclosed in note 36. The sensitivity analysis is based on the financial instruments recognised at 31December 2008 (31 December 2007). All hedging relationships relating to interest-bearing instruments are 100% effective. The reasonable change isbased on the current market conditions and expectations to interest rate changes.<strong>Carlsberg</strong>'s exposure to an increase in short-term interest rates is primarily in EUR and DKK, and secondarily in CHF and USD. The exposure to mediumandlong-term interest rates is primarily in EUR. The table below shows the breakdown of currencies and interest rate fixing for the net debt.Net debt before swapsNext repricingDKK million 2009 2010 2011 2012 2013 2014-CHF 1.861 1.861 - - - - -DKK 7.972 7.595 - - - - 377EUR 33.715 12.079 11.184 2 1 7.452 2.997GBP 3.068 -358 - 1.895 - 1.531 -NOK -11 -11 - - - - -PLN 134 125 2 2 2 2 1RUB -173 -173 - - - - -SEK -62 -62 - - - - -USD 1.561 1.156 307 98 - - -Other -788 -864 19 24 19 14 -I alt 47.277 21.348 11.512 2.021 22 8.999 3.375Credit risk. Credit risk is the risk of a counterparty failing to meet its contractual obligations and so inflicting a loss on the <strong>Carlsberg</strong> <strong>Group</strong>. <strong>Group</strong> policyis that financial transactions may be entered into only with financial institutions with a high credit rating.The <strong>Carlsberg</strong> Breweries <strong>Group</strong> grants loans to the on-trade in certain countries. The individual <strong>Group</strong> entities monitor and control these loans as well asordinary trade credit in accordance with central guidelines. It is estimated that the provisions made, cf. note 20, are sufficient to cover expected losses.Developments of importance to the on-trade may increase the credit risk for groups of customers in a country/market. Such developments includechanges in local legislation, which may have an adverse effect on the earnings in the industry in general, and are taken into consideration when writedownsfor bad debt losses are made. The credit risk is therefore assessed to be reflected in the carrying amount.Cash and cash equivalents are not associated with any significant credit risks.Liquidity risk. Liquidity risk is the risk of the <strong>Carlsberg</strong> Breweries <strong>Group</strong> failing to meet its contractual obligations due to insufficient liquidity. <strong>Carlsberg</strong>’spolicy is for funding and liquidity to be managed centrally. It is therefore <strong>Group</strong> Treasury’s task to ensure effective liquidity management, which primarilyinvolves obtaining sufficient committed credit facilities to ensure adequate financial resources. At 31 December 2008, <strong>Carlsberg</strong> had unutilised long-termcommitted credit facilities of DKK 8,670m (2007: DKK 5,025m).For day-to-day liquidity management cash pools are used, covering most of Northern & Western Europe, or intra-group loans between <strong>Group</strong> Treasuryand subsidiaries. As a result of withholding tax and local legislation, the majority-owned entities in Eastern Europe have their own credit facilities andborrowings from banks, as is also the case for the joint venture in Portugal (Unicer-Bebidas).F-65

![[Name and Address] - Carlsberg Group](https://img.yumpu.com/49766377/1/184x260/name-and-address-carlsberg-group.jpg?quality=85)

![[Name and Address] - Carlsberg Group](https://img.yumpu.com/49015962/1/184x260/name-and-address-carlsberg-group.jpg?quality=85)