116770 Project Obelix Pt1.qxp - Carlsberg Group

116770 Project Obelix Pt1.qxp - Carlsberg Group

116770 Project Obelix Pt1.qxp - Carlsberg Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

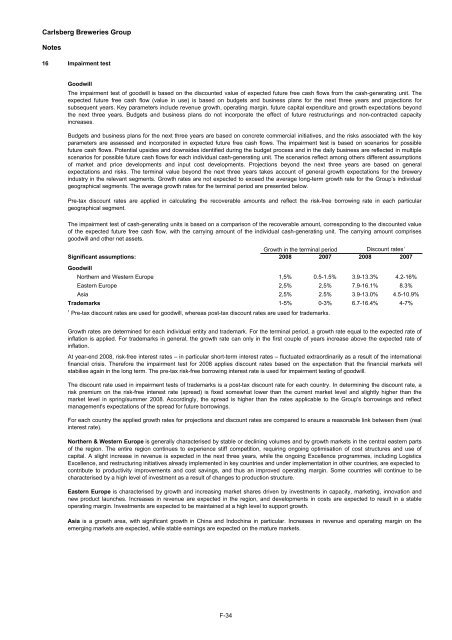

<strong>Carlsberg</strong> Breweries <strong>Group</strong>Notes16 Impairment testGoodwillThe impairment test of goodwill is based on the discounted value of expected future free cash flows from the cash-generating unit. Theexpected future free cash flow (value in use) is based on budgets and business plans for the next three years and projections forsubsequent years. Key parameters include revenue growth, operating margin, future capital expenditure and growth expectations beyondthe next three years. Budgets and business plans do not incorporate the effect of future restructurings and non-contracted capacityincreases.Budgets and business plans for the next three years are based on concrete commercial initiatives, and the risks associated with the keyparameters are assessed and incorporated in expected future free cash flows. The impairment test is based on scenarios for possiblefuture cash flows. Potential upsides and downsides identified during the budget process and in the daily business are reflected in multiplescenarios for possible future cash flows for each individual cash-generating unit. The scenarios reflect among others different assumptionsof market and price developments and input cost developments. <strong>Project</strong>ions beyond the next three years are based on generalexpectations and risks. The terminal value beyond the next three years takes account of general growth expectations for the breweryindustry in the relevant segments. Growth rates are not expected to exceed the average long-term growth rate for the <strong>Group</strong>’s individualgeographical segments. The average growth rates for the terminal period are presented below.Pre-tax discount rates are applied in calculating the recoverable amounts and reflect the risk-free borrowing rate in each particulargeographical segment.The impairment test of cash-generating units is based on a comparison of the recoverable amount, corresponding to the discounted valueof the expected future free cash flow, with the carrying amount of the individual cash-generating unit. The carrying amount comprisesgoodwill and other net assets.Growth in the terminal periodDiscount rates 1Significant assumptions: 2008 2007 2008 2007GoodwillNorthern and Western Europe 1,5% 0.5-1.5% 3.9-13.3% 4.2-16%Eastern Europe 2,5% 2,5% 7.9-16.1% 8.3%Asia 2,5% 2.5% 3.9-13.0% 4.5-10.9%Trademarks 1-5% 0-3% 6.7-16.4% 4-7%1 Pre-tax discount rates are used for goodwill, whereas post-tax discount rates are used for trademarks.Growth rates are determined for each individual entity and trademark. For the terminal period, a growth rate equal to the expected rate ofinflation is applied. For trademarks in general, the growth rate can only in the first couple of years increase above the expected rate ofinflation.At year-end 2008, risk-free interest rates – in particular short-term interest rates – fluctuated extraordinarily as a result of the internationalfinancial crisis. Therefore the impairment test for 2008 applies discount rates based on the expectation that the financial markets willstabilise again in the long term. The pre-tax risk-free borrowing interest rate is used for impairment testing of goodwill.The discount rate used in impairment tests of trademarks is a post-tax discount rate for each country. In determining the discount rate, arisk premium on the risk-free interest rate (spread) is fixed somewhat lower than the current market level and slightly higher than themarket level in spring/summer 2008. Accordingly, the spread is higher than the rates applicable to the <strong>Group</strong>'s borrowings and reflectmanagement's expectations of the spread for future borrowings.For each country the applied growth rates for projections and discount rates are compared to ensure a reasonable link between them (realinterest rate).Northern & Western Europe is generally characterised by stable or declining volumes and by growth markets in the central eastern partsof the region. The entire region continues to experience stiff competition, requiring ongoing optimisation of cost structures and use ofcapital. A slight increase in revenue is expected in the next three years, while the ongoing Excellence programmes, including LogisticsExcellence, and restructuring initiatives already implemented in key countries and under implementation in other countries, are expected tocontribute to productivity improvements and cost savings, and thus an improved operating margin. Some countries will continue to becharacterised by a high level of investment as a result of changes to production structure.Eastern Europe is characterised by growth and increasing market shares driven by investments in capacity, marketing, innovation andnew product launches. Increases in revenue are expected in the region, and developments in costs are expected to result in a stableoperating margin. Investments are expected to be maintained at a high level to support growth.Asia is a growth area, with significant growth in China and Indochina in particular. Increases in revenue and operating margin on theemerging markets are expected, while stable earnings are expected on the mature markets.F-34

![[Name and Address] - Carlsberg Group](https://img.yumpu.com/49766377/1/184x260/name-and-address-carlsberg-group.jpg?quality=85)

![[Name and Address] - Carlsberg Group](https://img.yumpu.com/49015962/1/184x260/name-and-address-carlsberg-group.jpg?quality=85)