116770 Project Obelix Pt1.qxp - Carlsberg Group

116770 Project Obelix Pt1.qxp - Carlsberg Group

116770 Project Obelix Pt1.qxp - Carlsberg Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

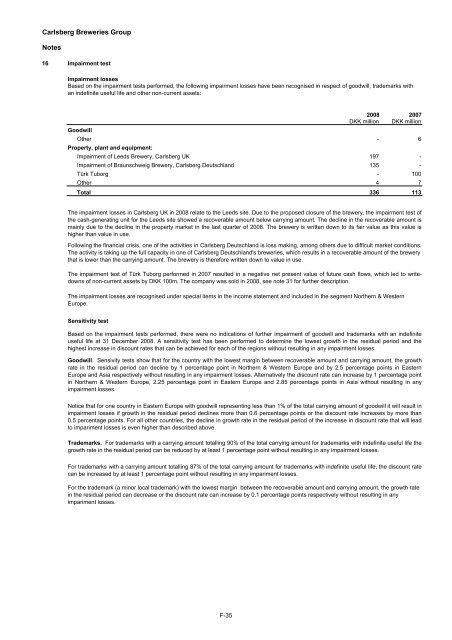

<strong>Carlsberg</strong> Breweries <strong>Group</strong>Notes16 Impairment testImpairment lossesBased on the impairment tests performed, the following impairment losses have been recognised in respect of goodwill, trademarks withan indefinite useful life and other non-current assets:2008 2007DKK million DKK millionGoodwillOther - 6Property, plant and equipment:Impairment of Leeds Brewery, <strong>Carlsberg</strong> UK 197 -Impairment of Braunschweig Brewery, <strong>Carlsberg</strong> Deutschland 135 -Türk Tuborg - 100Other 4 7Total 336 113The impairment losses in <strong>Carlsberg</strong> UK in 2008 relate to the Leeds site. Due to the proposed closure of the brewery, the impairment test ofthe cash-generating unit for the Leeds site showed a recoverable amount below carrying amount. The decline in the recoverable amount ismainly due to the decline in the property market in the last quarter of 2008. The brewery is written down to its fair value as this value ishigher than value in use.Following the financial crisis, one of the activities in <strong>Carlsberg</strong> Deutschland is loss making, among others due to difficult market conditions.The activity is taking up the full capacity in one of <strong>Carlsberg</strong> Deutschland's breweries, which results in a recoverable amount of the brewerythat is lower than the carrying amount. The brewery is therefore written down to value in use.The impairment test of Türk Tuborg performed in 2007 resulted in a negative net present value of future cash flows, which led to writedownsof non-current assets by DKK 100m. The company was sold in 2008, see note 31 for further description.The impairment losses are recognised under special items in the income statement and included in the segment Northern & WesternEurope.Sensitivity testBased on the impairment tests performed, there were no indications of further impairment of goodwill and trademarks with an indefiniteuseful life at 31 December 2008. A sensitivity test has been performed to determine the lowest growth in the residual period and thehighest increase in discount rates that can be achieved for each of the regions without resulting in any impairment losses.Goodwill. Sensivity tests show that for the country with the lowest margin between recoverable amount and carrying amount, the growthrate in the residual period can decline by 1 percentage point in Northern & Western Europe and by 2.5 percentage points in EasternEurope and Asia respectively without resulting in any impairment losses. Alternatively the discount rate can increase by 1 percentage pointin Northern & Western Europe, 2.25 percentage point in Eastern Europe and 2.85 percentage points in Asia without resulting in anyimpairment losses.Notice that for one country in Eastern Europe with goodwill representing less than 1% of the total carrying amount of goodwill it will result inimpairment losses if growth in the residual period declines more than 0.6 percentage points or the discount rate increases by more than0.5 percentage points. For all other countries, the decline in growth rate in the residual period of the increase in discount rate that will leadto impariment losses is even higher than described above.Trademarks. For trademarks with a carrying amount totalling 90% of the total carrying amount for trademarks with indefinite useful life thegrowth rate in the residual period can be reduced by at least 1 percentage point without resulting in any impairment losses.For trademarks with a carrying amount totalling 87% of the total carrying amount for trademarks with indefinite useful life, the discount ratecan be increased by at least 1 percentage point without resulting in any impariment losses.For the trademark (a minor local trademark) with the lowest margin between the recoverable amount and carrying amount, the growth ratein the residual period can decrease or the discount rate can increase by 0.1 percentage points respectively without resulting in anyimpariment losses.F-35

![[Name and Address] - Carlsberg Group](https://img.yumpu.com/49766377/1/184x260/name-and-address-carlsberg-group.jpg?quality=85)

![[Name and Address] - Carlsberg Group](https://img.yumpu.com/49015962/1/184x260/name-and-address-carlsberg-group.jpg?quality=85)