- Page 4 and 5:

BASE PROSPECTUS SUPPLEMENTIf at any

- Page 6 and 7:

RISK FACTORSThe Issuer believes tha

- Page 8 and 9:

which they are sold, resulting in c

- Page 10 and 11:

Risks Related to the Group’s Busi

- Page 12 and 13:

The Group’s operating results may

- Page 14 and 15:

Labour disputes may cause work stop

- Page 16 and 17:

Fixed/Floating Rate NotesFixed/Floa

- Page 18 and 19:

Credit ratings may not reflect all

- Page 20 and 21:

Form of Notes:Clearing Systems:Init

- Page 22 and 23:

Redemption:Redemption by Instalment

- Page 24 and 25:

TERMS AND CONDITIONS OF THE NOTESTh

- Page 26 and 27:

(c)(d)(e)(f)Exercise of Options or

- Page 29 and 30:

(y)(z)if the Relevant Screen Page i

- Page 31 and 32:

Period shall equal such Interest Am

- Page 33 and 34:

(v)if “30E/360” or “Eurobond

- Page 35 and 36:

“Interest Determination Date” m

- Page 37 and 38:

(ii)Other Notes: The Early Redempti

- Page 39 and 40:

the specified office of the Registr

- Page 41 and 42:

8 TaxationAll payments of principal

- Page 43 and 44:

approved by an Extraordinary Resolu

- Page 45 and 46:

Coupon, Talon or the Deed of Covena

- Page 47 and 48:

(c)Service of Process: The Issuer i

- Page 49 and 50:

3 Exchange3.1 Temporary Global Note

- Page 51 and 52:

principal in respect of any Notes w

- Page 53 and 54:

accountholders with a clearing syst

- Page 55 and 56:

CARLSBERG BREWERIES A/SIntroduction

- Page 57 and 58:

In 2008 Carlsberg and Heineken N.V.

- Page 59 and 60:

●In recent years most of the Grou

- Page 61 and 62:

complement its position in local ma

- Page 63 and 64:

ProductionDue to similar production

- Page 65 and 66:

entered into with Heineken regardin

- Page 67 and 68:

The following table shows the break

- Page 69 and 70:

GreeceMythos Brewery is the second

- Page 71 and 72:

AsiaOverviewThe Group’s activitie

- Page 73 and 74:

Regulatory EnvironmentThe Group’s

- Page 75 and 76:

Recent DevelopmentsIn January 2009,

- Page 77 and 78:

individual resident in another Memb

- Page 79 and 80:

United KingdomEach Dealer has repre

- Page 81 and 82:

Final Terms dated [●]Carlsberg Br

- Page 83 and 84:

13 [(i)] Status of the Notes: [Seni

- Page 85 and 86:

18 Index-Linked Interest[Applicable

- Page 87 and 88:

(ii)(iii) Notice period [●][●]

- Page 89 and 90:

29 Details relating to Instalment [

- Page 91 and 92:

5 [Index-Linked or other variable-l

- Page 93 and 94:

GENERAL INFORMATION(1) Application

- Page 95 and 96:

FINANCIAL INFORMATIONINFORMATION ON

- Page 97 and 98:

FINANCIAL INFORMATIONAudited consol

- Page 99 and 100:

Independent Auditors’ Report on t

- Page 101 and 102:

Carlsberg Breweries GroupIncome sta

- Page 103 and 104:

Carlsberg Breweries GroupBalance sh

- Page 105 and 106:

Carlsberg Breweries GroupStatement

- Page 107 and 108:

Carlsberg Breweries GroupNote 1 Sig

- Page 109 and 110:

Carlsberg Breweries GroupImpairment

- Page 111 and 112:

Carlsberg Breweries GroupProvisions

- Page 113 and 114:

Carlsberg Breweries GroupNotes2 Seg

- Page 115 and 116:

Carlsberg Breweries GroupNotes3 Cos

- Page 117 and 118:

Carlsberg Breweries GroupNotes7 Spe

- Page 119 and 120:

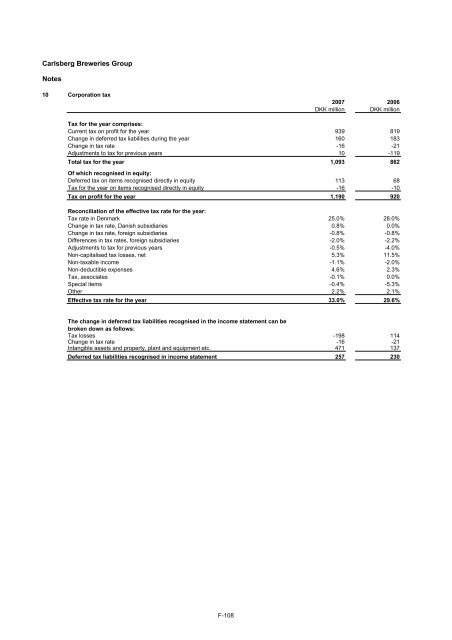

Carlsberg Breweries GroupNotes10 Co

- Page 121 and 122:

Carlsberg Breweries GroupNotes12 Ea

- Page 123 and 124:

Carlsberg Breweries GroupNotes14 Sh

- Page 125 and 126:

Carlsberg Breweries GroupNotes15 In

- Page 127 and 128:

Carlsberg Breweries GroupNotes16 Im

- Page 129 and 130:

Carlsberg Breweries GroupNotes16 Im

- Page 131 and 132:

Carlsberg Breweries GroupNotes17 Pr

- Page 133 and 134:

Carlsberg Breweries GroupNotes19 Se

- Page 135 and 136:

Carlsberg Breweries GroupNotes21 In

- Page 137 and 138:

Carlsberg Breweries GroupNotes23 As

- Page 139 and 140:

Carlsberg Breweries GroupNotes25 Bo

- Page 141 and 142:

Carlsberg Breweries GroupNotes25 Bo

- Page 143 and 144:

Carlsberg Breweries GroupNotes26 Re

- Page 145 and 146:

Carlsberg Breweries GroupNotes27 De

- Page 147 and 148:

Carlsberg Breweries GroupNotes29 Ot

- Page 149 and 150:

Carlsberg Breweries GroupNote31 Acq

- Page 151 and 152: Notes31 Acquisition and disposal of

- Page 153 and 154: Carlsberg Breweries GroupNotes31 Ac

- Page 155 and 156: Carlsberg Breweries GroupNotes33 Sp

- Page 157 and 158: Carlsberg Breweries GroupNotes35 Fi

- Page 159 and 160: Carlsberg Breweries GroupNotes35 Fi

- Page 161 and 162: Carlsberg Breweries GroupNotes36 Fi

- Page 163 and 164: Carlsberg Breweries GroupNotes37 Re

- Page 165 and 166: Carlsberg Breweries GroupNotes39 Op

- Page 167 and 168: Carlsberg Breweries Group IFRS 3 "B

- Page 169 and 170: Carlsberg Breweries GroupOn initial

- Page 171 and 172: Carlsberg Breweries GroupProfits/lo

- Page 173 and 174: Carlsberg Breweries GroupOn acquisi

- Page 175 and 176: Carlsberg Breweries GroupContributi

- Page 177 and 178: Carlsberg Breweries GroupCash flow

- Page 179 and 180: Carlsberg Breweries GroupGroup Comp

- Page 181 and 182: FINANCIAL INFORMATIONAudited consol

- Page 183 and 184: Independent Auditors’ Report on t

- Page 185 and 186: Carlsberg Breweries GroupIncome sta

- Page 187 and 188: Carlsberg Breweries GroupBalance sh

- Page 189 and 190: Carlsberg Breweries GroupStatement

- Page 191 and 192: Carlsberg Breweries GroupNote 1 Sig

- Page 193 and 194: Carlsberg Breweries GroupManagement

- Page 195 and 196: Carlsberg Breweries Groupbetween th

- Page 197 and 198: Carlsberg Breweries GroupNotes2 Seg

- Page 199 and 200: Carlsberg Breweries GroupNotes6 Oth

- Page 201: Carlsberg Breweries GroupNotes8 Fin

- Page 205 and 206: Carlsberg Breweries GroupNotes14 Sh

- Page 207 and 208: Carlsberg Breweries GroupNotes15 In

- Page 209 and 210: Carlsberg Breweries GroupNotes16 Im

- Page 211 and 212: Carlsberg Breweries GroupNotes16 Im

- Page 213 and 214: Carlsberg Breweries GroupNotes17 Pr

- Page 215 and 216: Carlsberg Breweries GroupNotes18 In

- Page 217 and 218: Carlsberg Breweries GroupNotes20 Re

- Page 219 and 220: Carlsberg Breweries GroupNotes23 As

- Page 221 and 222: Carlsberg Breweries GroupNotes25 Bo

- Page 223 and 224: Carlsberg Breweries GroupNotes26 Re

- Page 225 and 226: Carlsberg Breweries GroupNotes27 De

- Page 227 and 228: Carlsberg Breweries GroupNotes29 Ot

- Page 229 and 230: Carlsberg Breweries GroupNotes31 Ac

- Page 231 and 232: Carlsberg Breweries GroupNotes31 Ac

- Page 233 and 234: Carlsberg Breweries GroupNotes33 Sp

- Page 235 and 236: Carlsberg Breweries GroupNotes35 Fi

- Page 237 and 238: Carlsberg Breweries GroupNotes35 Fi

- Page 239 and 240: Carlsberg Breweries GroupNotes36 Fi

- Page 241 and 242: Carlsberg Breweries GroupNotes37 Re

- Page 243 and 244: Carlsberg Breweries GroupNotes38 Co

- Page 245 and 246: Carlsberg Breweries GroupNote 40 Ac

- Page 247 and 248: Carlsberg Breweries Groupchange rat

- Page 249 and 250: Carlsberg Breweries GroupFor deriva

- Page 251 and 252: Carlsberg Breweries GroupThe carryi

- Page 253 and 254:

Carlsberg Breweries GroupReceivable

- Page 255 and 256:

Carlsberg Breweries GroupFor define

- Page 257 and 258:

Carlsberg Breweries GroupAssets are

- Page 259 and 260:

Carlsberg Breweries GroupGroup comp

- Page 261 and 262:

Registered Office of the IssuerCarl

![[Name and Address] - Carlsberg Group](https://img.yumpu.com/49766377/1/184x260/name-and-address-carlsberg-group.jpg?quality=85)

![[Name and Address] - Carlsberg Group](https://img.yumpu.com/49015962/1/184x260/name-and-address-carlsberg-group.jpg?quality=85)