116770 Project Obelix Pt1.qxp - Carlsberg Group

116770 Project Obelix Pt1.qxp - Carlsberg Group

116770 Project Obelix Pt1.qxp - Carlsberg Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

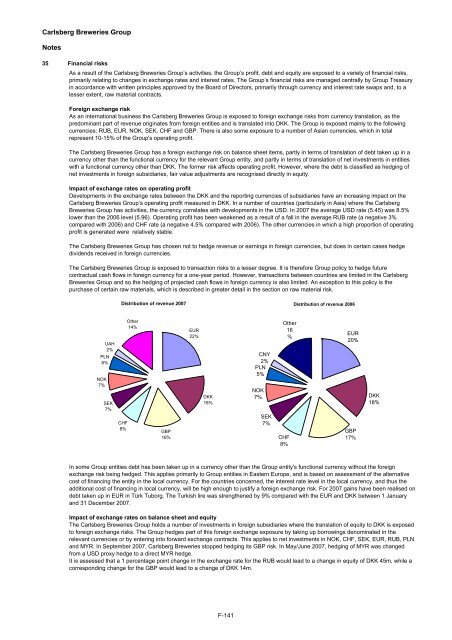

<strong>Carlsberg</strong> Breweries <strong>Group</strong>Notes35 Financial risksAs a result of the <strong>Carlsberg</strong> Breweries <strong>Group</strong>’s activities, the <strong>Group</strong>’s profit, debt and equity are exposed to a variety of financial risks,primarily relating to changes in exchange rates and interest rates. The <strong>Group</strong>’s financial risks are managed centrally by <strong>Group</strong> Treasuryin accordance with written principles approved by the Board of Directors, primarily through currency and interest rate swaps and, to alesser extent, raw material contracts.Foreign exchange riskAs an international business the <strong>Carlsberg</strong> Breweries <strong>Group</strong> is exposed to foreign exchange risks from currency translation, as thepredominant part of revenue originates from foreign entities and is translated into DKK. The <strong>Group</strong> is exposed mainly to the followingcurrencies: RUB, EUR, NOK, SEK, CHF and GBP. There is also some exposure to a number of Asian currencies, which in totalrepresent 10-15% of the <strong>Group</strong>'s operating profit.The <strong>Carlsberg</strong> Breweries <strong>Group</strong> has a foreign exchange risk on balance sheet items, partly in terms of translation of debt taken up in acurrency other than the functional currency for the relevant <strong>Group</strong> entity, and partly in terms of translation of net investments in entitieswith a functional currency other than DKK. The former risk affects operating profit. However, where the debt is classified as hedging ofnet investments in foreign subsidiaries, fair value adjustments are recognised directly in equity.Impact of exchange rates on operating profitDevelopments in the exchange rates between the DKK and the reporting currencies of subsidiaries have an increasing impact on the<strong>Carlsberg</strong> Breweries <strong>Group</strong>’s operating profit measured in DKK. In a number of countries (particularly in Asia) where the <strong>Carlsberg</strong>Breweries <strong>Group</strong> has activities, the currency correlates with developments in the USD. In 2007 the average USD rate (5.45) was 8.5%lower than the 2006 level (5.96). Operating profit has been weakened as a result of a fall in the average RUB rate (a negative 3%compared with 2006) and CHF rate (a negative 4.5% compared with 2006). The other currencies in which a high proportion of operatingprofit is generated were relatively stable.The <strong>Carlsberg</strong> Breweries <strong>Group</strong> has chosen not to hedge revenue or earnings in foreign currencies, but does in certain cases hedgedividends received in foreign currencies.The <strong>Carlsberg</strong> Breweries <strong>Group</strong> is exposed to transaction risks to a lesser degree. It is therefore <strong>Group</strong> policy to hedge futurecontractual cash flows in foreign currency for a one-year period. However, transactions between countries are limited in the <strong>Carlsberg</strong>Breweries <strong>Group</strong> and so the hedging of projected cash flows in foreign currency is also limited. An exception to this policy is thepurchase of certain raw materials, which is described in greater detail in the section on raw material risk.Distribution of revenue 2007Distribution of revenue 2006PLN6%NOK7%UAH2%SEK7%CHF8%Other14%GBP16%EUR22%DKK18%CNY2%PLN5%NOK7%SEK7%Other16%CHF8%EUR20%GBP17%DKK18%In some <strong>Group</strong> entities debt has been taken up in a currency other than the <strong>Group</strong> entity's functional currency without the foreignexchange risk being hedged. This applies primarily to <strong>Group</strong> entities in Eastern Europe, and is based on assessment of the alternativecost of financing the entity in the local currency. For the countries concerned, the interest rate level in the local currency, and thus theadditional cost of financing in local currency, will be high enough to justify a foreign exchange risk. For 2007 gains have been realised ondebt taken up in EUR in Türk Tuborg. The Turkish lire was strengthened by 9% compared with the EUR and DKK between 1 Januaryand 31 December 2007.Impact of exchange rates on balance sheet and equityThe <strong>Carlsberg</strong> Breweries <strong>Group</strong> holds a number of investments in foreign subsidiaries where the translation of equity to DKK is exposedto foreign exchange risks. The <strong>Group</strong> hedges part of this foreign exchange exposure by taking up borrowings denominated in therelevant currencies or by entering into forward exchange contracts. This applies to net investments in NOK, CHF, SEK, EUR, RUB, PLNand MYR. In September 2007, <strong>Carlsberg</strong> Breweries stopped hedging its GBP risk. In May/June 2007, hedging of MYR was changedfrom a USD proxy hedge to a direct MYR hedge.It is assessed that a 1 percentage point change in the exchange rate for the RUB would lead to a change in equity of DKK 45m, while acorresponding change for the GBP would lead to a change of DKK 14m.F-141

![[Name and Address] - Carlsberg Group](https://img.yumpu.com/49766377/1/184x260/name-and-address-carlsberg-group.jpg?quality=85)

![[Name and Address] - Carlsberg Group](https://img.yumpu.com/49015962/1/184x260/name-and-address-carlsberg-group.jpg?quality=85)