116770 Project Obelix Pt1.qxp - Carlsberg Group

116770 Project Obelix Pt1.qxp - Carlsberg Group

116770 Project Obelix Pt1.qxp - Carlsberg Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

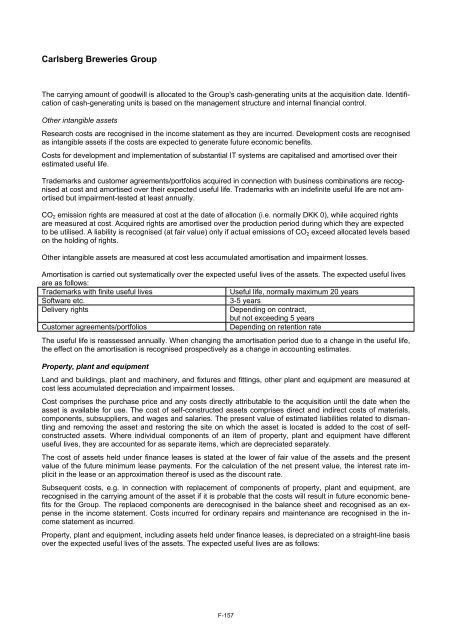

<strong>Carlsberg</strong> Breweries <strong>Group</strong>The carrying amount of goodwill is allocated to the <strong>Group</strong>'s cash-generating units at the acquisition date. Identificationof cash-generating units is based on the management structure and internal financial control.Other intangible assetsResearch costs are recognised in the income statement as they are incurred. Development costs are recognisedas intangible assets if the costs are expected to generate future economic benefits.Costs for development and implementation of substantial IT systems are capitalised and amortised over theirestimated useful life.Trademarks and customer agreements/portfolios acquired in connection with business combinations are recognisedat cost and amortised over their expected useful life. Trademarks with an indefinite useful life are not amortisedbut impairment-tested at least annually.CO 2 emission rights are measured at cost at the date of allocation (i.e. normally DKK 0), while acquired rightsare measured at cost. Acquired rights are amortised over the production period during which they are expectedto be utilised. A liability is recognised (at fair value) only if actual emissions of CO 2 exceed allocated levels basedon the holding of rights.Other intangible assets are measured at cost less accumulated amortisation and impairment losses.Amortisation is carried out systematically over the expected useful lives of the assets. The expected useful livesare as follows:Trademarks with finite useful livesUseful life, normally maximum 20 yearsSoftware etc.3-5 yearsDelivery rightsDepending on contract,but not exceeding 5 yearsCustomer agreements/portfoliosDepending on retention rateThe useful life is reassessed annually. When changing the amortisation period due to a change in the useful life,the effect on the amortisation is recognised prospectively as a change in accounting estimates.Property, plant and equipmentLand and buildings, plant and machinery, and fixtures and fittings, other plant and equipment are measured atcost less accumulated depreciation and impairment losses.Cost comprises the purchase price and any costs directly attributable to the acquisition until the date when theasset is available for use. The cost of self-constructed assets comprises direct and indirect costs of materials,components, subsuppliers, and wages and salaries. The present value of estimated liabilities related to dismantlingand removing the asset and restoring the site on which the asset is located is added to the cost of selfconstructedassets. Where individual components of an item of property, plant and equipment have differentuseful lives, they are accounted for as separate items, which are depreciated separately.The cost of assets held under finance leases is stated at the lower of fair value of the assets and the presentvalue of the future minimum lease payments. For the calculation of the net present value, the interest rate implicitin the lease or an approximation thereof is used as the discount rate.Subsequent costs, e.g. in connection with replacement of components of property, plant and equipment, arerecognised in the carrying amount of the asset if it is probable that the costs will result in future economic benefitsfor the <strong>Group</strong>. The replaced components are derecognised in the balance sheet and recognised as an expensein the income statement. Costs incurred for ordinary repairs and maintenance are recognised in the incomestatement as incurred.Property, plant and equipment, including assets held under finance leases, is depreciated on a straight-line basisover the expected useful lives of the assets. The expected useful lives are as follows:F-157

![[Name and Address] - Carlsberg Group](https://img.yumpu.com/49766377/1/184x260/name-and-address-carlsberg-group.jpg?quality=85)

![[Name and Address] - Carlsberg Group](https://img.yumpu.com/49015962/1/184x260/name-and-address-carlsberg-group.jpg?quality=85)