116770 Project Obelix Pt1.qxp - Carlsberg Group

116770 Project Obelix Pt1.qxp - Carlsberg Group

116770 Project Obelix Pt1.qxp - Carlsberg Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

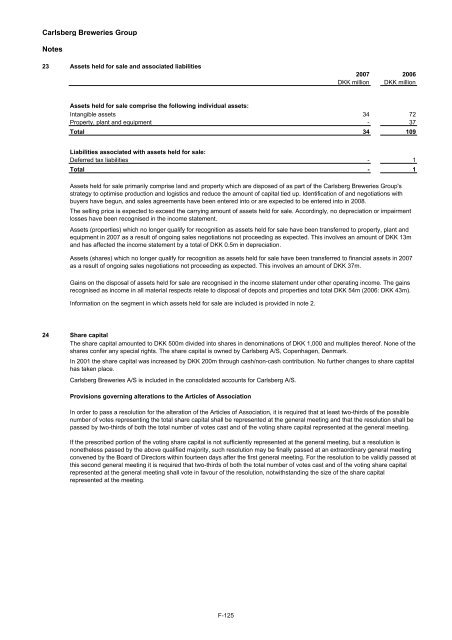

<strong>Carlsberg</strong> Breweries <strong>Group</strong>Notes23 Assets held for sale and associated liabilities2007 2006DKK million DKK millionAssets held for sale comprise the following individual assets:Intangible assets 34 72Property, plant and equipment - 37Total 34 109Liabilities associated with assets held for sale:Deferred tax liabilities - 1Total - 1Assets held for sale primarily comprise land and property which are disposed of as part of the <strong>Carlsberg</strong> Breweries <strong>Group</strong>'sstrategy to optimise production and logistics and reduce the amount of capital tied up. Identification of and negotiations withbuyers have begun, and sales agreements have been entered into or are expected to be entered into in 2008.The selling price is expected to exceed the carrying amount of assets held for sale. Accordingly, no depreciation or impairmentlosses have been recognised in the income statement.Assets (properties) which no longer qualify for recognition as assets held for sale have been transferred to property, plant andequipment in 2007 as a result of ongoing sales negotiations not proceeding as expected. This involves an amount of DKK 13mand has affected the income statement by a total of DKK 0.5m in depreciation.Assets (shares) which no longer qualify for recognition as assets held for sale have been transferred to financial assets in 2007as a result of ongoing sales negotiations not proceeding as expected. This involves an amount of DKK 37m.Gains on the disposal of assets held for sale are recognised in the income statement under other operating income. The gainsrecognised as income in all material respects relate to disposal of depots and properties and total DKK 54m (2006: DKK 43m).Information on the segment in which assets held for sale are included is provided in note 2.24 Share capitalThe share capital amounted to DKK 500m divided into shares in denominations of DKK 1,000 and multiples thereof. None of theshares confer any special rights. The share capital is owned by <strong>Carlsberg</strong> A/S, Copenhagen, Denmark.In 2001 the share capital was increased by DKK 200m through cash/non-cash contribution. No further changes to share captitalhas taken place.<strong>Carlsberg</strong> Breweries A/S is included in the consolidated accounts for <strong>Carlsberg</strong> A/S.Provisions governing alterations to the Articles of AssociationIn order to pass a resolution for the alteration of the Articles of Association, it is required that at least two-thirds of the possiblenumber of votes representing the total share capital shall be represented at the general meeting and that the resolution shall bepassed by two-thirds of both the total number of votes cast and of the voting share capital represented at the general meeting.If the prescribed portion of the voting share capital is not sufficiently represented at the general meeting, but a resolution isnonetheless passed by the above qualified majority, such resolution may be finally passed at an extraordinary general meetingconvened by the Board of Directors within fourteen days after the first general meeting. For the resolution to be validly passed atthis second general meeting it is required that two-thirds of both the total number of votes cast and of the voting share capitalrepresented at the general meeting shall vote in favour of the resolution, notwithstanding the size of the share capitalrepresented at the meeting.F-125

![[Name and Address] - Carlsberg Group](https://img.yumpu.com/49766377/1/184x260/name-and-address-carlsberg-group.jpg?quality=85)

![[Name and Address] - Carlsberg Group](https://img.yumpu.com/49015962/1/184x260/name-and-address-carlsberg-group.jpg?quality=85)