Academic Calendar 2012 - Bangladesh Institute of Bank Management

Academic Calendar 2012 - Bangladesh Institute of Bank Management

Academic Calendar 2012 - Bangladesh Institute of Bank Management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

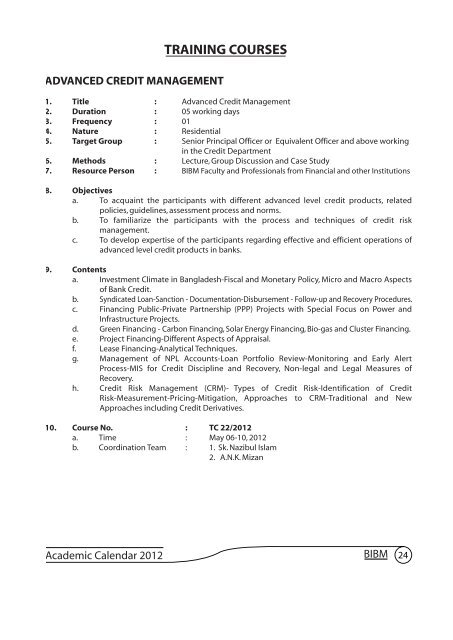

ADVANCED CREDIT MANAGEMENT<br />

TRAINING COURSES<br />

1. Title : Advanced Credit <strong>Management</strong><br />

2. Duration : 05 working days<br />

3. Frequency : 01<br />

4. Nature : Residential<br />

5. Target Group : Senior Principal Officer or Equivalent Officer and above working<br />

in the Credit Department<br />

6. Methods : Lecture, Group Discussion and Case Study<br />

7. Resource Person : BIBM Faculty and Pr<strong>of</strong>essionals from Financial and other Institutions<br />

8. Objectives<br />

a. To acquaint the participants with different advanced level credit products, related<br />

policies, guidelines, assessment process and norms.<br />

b. To familiarize the participants with the process and techniques <strong>of</strong> credit risk<br />

management.<br />

c. To develop expertise <strong>of</strong> the participants regarding effective and efficient operations <strong>of</strong><br />

advanced level credit products in banks.<br />

9. Contents<br />

a. Investment Climate in <strong>Bangladesh</strong>-Fiscal and Monetary Policy, Micro and Macro Aspects<br />

<strong>of</strong> <strong>Bank</strong> Credit.<br />

b. Syndicated Loan-Sanction - Documentation-Disbursement - Follow-up and Recovery Procedures.<br />

c. Financing Public-Private Partnership (PPP) Projects with Special Focus on Power and<br />

Infrastructure Projects.<br />

d. Green Financing - Carbon Financing, Solar Energy Financing, Bio-gas and Cluster Financing.<br />

e. Project Financing-Different Aspects <strong>of</strong> Appraisal.<br />

f. Lease Financing-Analytical Techniques.<br />

g. <strong>Management</strong> <strong>of</strong> NPL Accounts-Loan Portfolio Review-Monitoring and Early Alert<br />

Process-MIS for Credit Discipline and Recovery, Non-legal and Legal Measures <strong>of</strong><br />

Recovery.<br />

h. Credit Risk <strong>Management</strong> (CRM)- Types <strong>of</strong> Credit Risk-Identification <strong>of</strong> Credit<br />

Risk-Measurement-Pricing-Mitigation, Approaches to CRM-Traditional and New<br />

Approaches including Credit Derivatives.<br />

10. Course No. : TC 22/<strong>2012</strong><br />

a. Time : May 06-10, <strong>2012</strong><br />

b. Coordination Team : 1. Sk. Nazibul Islam<br />

2. A.N.K. Mizan<br />

<strong>Academic</strong> <strong>Calendar</strong> <strong>2012</strong> BIBM 24