Academic Calendar 2012 - Bangladesh Institute of Bank Management

Academic Calendar 2012 - Bangladesh Institute of Bank Management

Academic Calendar 2012 - Bangladesh Institute of Bank Management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

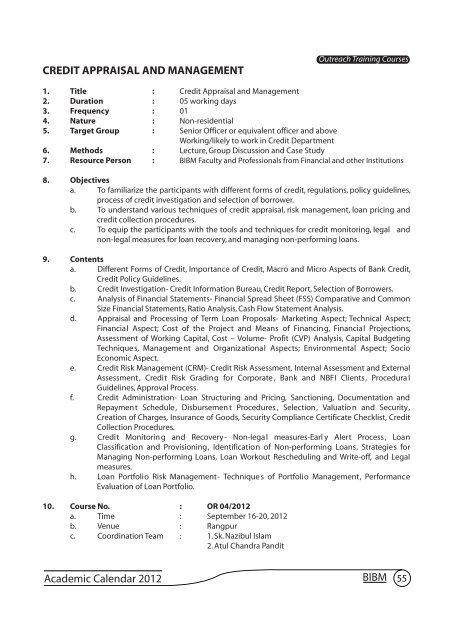

CREDIT APPRAISAL AND MANAGEMENT<br />

1. Title : Credit Appraisal and <strong>Management</strong><br />

2. Duration : 05 working days<br />

3. Frequency : 01<br />

4. Nature : Non-residential<br />

5. Target Group : Senior Officer or equivalent <strong>of</strong>ficer and above<br />

Working/likely to work in Credit Department<br />

6. Methods : Lecture, Group Discussion and Case Study<br />

7. Resource Person : BIBM Faculty and Pr<strong>of</strong>essionals from Financial and other Institutions<br />

8. Objectives<br />

a. To familiarize the participants with different forms <strong>of</strong> credit, regulations, policy guidelines,<br />

process <strong>of</strong> credit investigation and selection <strong>of</strong> borrower.<br />

b. To understand various techniques <strong>of</strong> credit appraisal, risk management, loan pricing and<br />

credit collection procedures.<br />

c. To equip the participants with the tools and techniques for credit monitoring, legal and<br />

non-legal measures for loan recovery, and managing non-performing loans.<br />

9. Contents<br />

a. Different Forms <strong>of</strong> Credit, Importance <strong>of</strong> Credit, Macro and Micro Aspects <strong>of</strong> <strong>Bank</strong> Credit,<br />

Credit Policy Guidelines.<br />

b. Credit Investigation- Credit Information Bureau, Credit Report, Selection <strong>of</strong> Borrowers.<br />

c. Analysis <strong>of</strong> Financial Statements- Financial Spread Sheet (FSS) Comparative and Common<br />

Size Financial Statements, Ratio Analysis, Cash Flow Statement Analysis.<br />

d. Appraisal and Processing <strong>of</strong> Term Loan Proposals- Marketing Aspect; Technical Aspect;<br />

Financial Aspect; Cost <strong>of</strong> the Project and Means <strong>of</strong> Financing, Financial Projections,<br />

Assessment <strong>of</strong> Working Capital, Cost – Volume- Pr<strong>of</strong>it (CVP) Analysis, Capital Budgeting<br />

Techniques, <strong>Management</strong> and Organizational Aspects; Environmental Aspect; Socio<br />

Economic Aspect.<br />

e. Credit Risk <strong>Management</strong> (CRM)- Credit Risk Assessment, Internal Assessment and External<br />

Assessment , Credit Risk Grading for Corporate , <strong>Bank</strong> and NBFI Clients, Procedura l<br />

Guidelines, Approval Process.<br />

f. Credit Administration- Loan Structuring and Pricing, Sanctioning, Documentation and<br />

Repayment Schedule, Disbursemen t Procedures , Selection, Valuatio n and Security,<br />

Creation <strong>of</strong> Charges, Insurance <strong>of</strong> Goods, Security Compliance Certificate Checklist, Credit<br />

Collection Procedures.<br />

g. Credit Monitorin g and Recovery- Non-legal measures-Earl y Alert Process , Loan<br />

Classification and Provisioning, Identification <strong>of</strong> Non-performing Loans, Strategies for<br />

Managing Non-performing Loans, Loan Workout Rescheduling and Write-<strong>of</strong>f, and Legal<br />

measures.<br />

h. Loan Portfolio Risk <strong>Management</strong>- Technique s <strong>of</strong> Portfolio <strong>Management</strong>, Performance<br />

Evaluation <strong>of</strong> Loan Portfolio.<br />

10. Course No. : OR 04/<strong>2012</strong><br />

a. Time : September 16-20, <strong>2012</strong><br />

b. Venue : Rangpur<br />

c. Coordination Team : 1. Sk. Nazibul Islam<br />

2. Atul Chandra Pandit<br />

Outreach Training Courses<br />

<strong>Academic</strong> <strong>Calendar</strong> <strong>2012</strong> BIBM 55