Academic Calendar 2012 - Bangladesh Institute of Bank Management

Academic Calendar 2012 - Bangladesh Institute of Bank Management

Academic Calendar 2012 - Bangladesh Institute of Bank Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

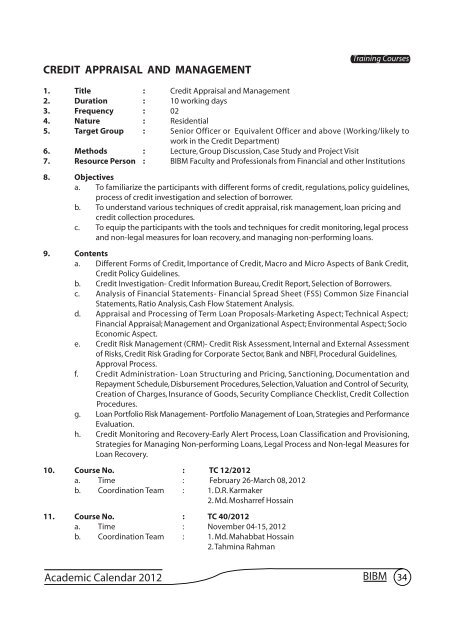

CREDIT APPRAISAL AND MANAGEMENT<br />

Training Courses<br />

1. Title : Credit Appraisal and <strong>Management</strong><br />

2. Duration : 10 working days<br />

3. Frequency : 02<br />

4. Nature : Residential<br />

5. Target Group : Senior Officer or Equivalent Officer and above (Working/likely to<br />

work in the Credit Department)<br />

6. Methods : Lecture, Group Discussion, Case Study and Project Visit<br />

7. Resource Person : BIBM Faculty and Pr<strong>of</strong>essionals from Financial and other Institutions<br />

8. Objectives<br />

a. To familiarize the participants with different forms <strong>of</strong> credit, regulations, policy guidelines,<br />

process <strong>of</strong> credit investigation and selection <strong>of</strong> borrower.<br />

b. To understand various techniques <strong>of</strong> credit appraisal, risk management, loan pricing and<br />

credit collection procedures.<br />

c. To equip the participants with the tools and techniques for credit monitoring, legal process<br />

and non-legal measures for loan recovery, and managing non-performing loans.<br />

9. Contents<br />

a. Different Forms <strong>of</strong> Credit, Importance <strong>of</strong> Credit, Macro and Micro Aspects <strong>of</strong> <strong>Bank</strong> Credit,<br />

Credit Policy Guidelines.<br />

b. Credit Investigation- Credit Information Bureau, Credit Report, Selection <strong>of</strong> Borrowers.<br />

c. Analysis <strong>of</strong> Financial Statements- Financial Spread Sheet (FSS) Common Size Financial<br />

Statements, Ratio Analysis, Cash Flow Statement Analysis.<br />

d. Appraisal and Processing <strong>of</strong> Term Loan Proposals-Marketing Aspect; Technical Aspect;<br />

Financial Appraisal; <strong>Management</strong> and Organizational Aspect; Environmental Aspect; Socio<br />

Economic Aspect.<br />

e. Credit Risk <strong>Management</strong> (CRM)- Credit Risk Assessment, Internal and External Assessment<br />

<strong>of</strong> Risks, Credit Risk Grading for Corporate Sector, <strong>Bank</strong> and NBFI, Procedural Guidelines,<br />

Approval Process.<br />

f. Credit Administration- Loan Structuring and Pricing, Sanctioning, Documentation and<br />

Repayment Schedule, Disbursement Procedures, Selection, Valuation and Control <strong>of</strong> Security,<br />

Creation <strong>of</strong> Charges, Insurance <strong>of</strong> Goods, Security Compliance Checklist, Credit Collection<br />

Procedures.<br />

g. Loan Portfolio Risk <strong>Management</strong>- Portfolio <strong>Management</strong> <strong>of</strong> Loan, Strategies and Performance<br />

Evaluation.<br />

h. Credit Monitoring and Recovery-Early Alert Process, Loan Classification and Provisioning,<br />

Strategies for Managing Non-performing Loans, Legal Process and Non-legal Measures for<br />

Loan Recovery.<br />

10. Course No. : TC 12/<strong>2012</strong><br />

a. Time : February 26-March 08, <strong>2012</strong><br />

b. Coordination Team : 1. D.R. Karmaker<br />

2. Md. Mosharref Hossain<br />

11. Course No. : TC 40/<strong>2012</strong><br />

a. Time : November 04-15, <strong>2012</strong><br />

b. Coordination Team : 1. Md. Mahabbat Hossain<br />

2. Tahmina Rahman<br />

<strong>Academic</strong> <strong>Calendar</strong> <strong>2012</strong> BIBM 34