Academic Calendar 2012 - Bangladesh Institute of Bank Management

Academic Calendar 2012 - Bangladesh Institute of Bank Management

Academic Calendar 2012 - Bangladesh Institute of Bank Management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

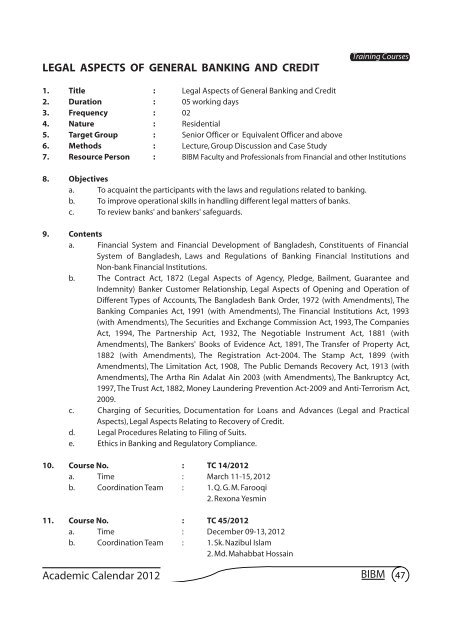

LEGAL ASPECTS OF GENERAL BANKING AND CREDIT<br />

Training Courses<br />

1. Title : Legal Aspects <strong>of</strong> General <strong>Bank</strong>ing and Credit<br />

2. Duration : 05 working days<br />

3. Frequency : 02<br />

4. Nature : Residential<br />

5. Target Group : Senior Officer or Equivalent Officer and above<br />

6. Methods : Lecture, Group Discussion and Case Study<br />

7. Resource Person : BIBM Faculty and Pr<strong>of</strong>essionals from Financial and other Institutions<br />

8. Objectives<br />

a. To acquaint the participants with the laws and regulations related to banking.<br />

b. To improve operational skills in handling different legal matters <strong>of</strong> banks.<br />

c. To review banks' and bankers' safeguards.<br />

9. Contents<br />

a. Financial System and Financial Development <strong>of</strong> <strong>Bangladesh</strong>, Constituents <strong>of</strong> Financial<br />

System <strong>of</strong> <strong>Bangladesh</strong>, Laws and Regulations <strong>of</strong> <strong>Bank</strong>ing Financial Institutions and<br />

Non-bank Financial Institutions.<br />

b. The Contract Act, 1872 (Legal Aspects <strong>of</strong> Agency, Pledge, Bailment, Guarantee and<br />

Indemnity) <strong>Bank</strong>er Customer Relationship, Legal Aspects <strong>of</strong> Opening and Operation <strong>of</strong><br />

Different Types <strong>of</strong> Accounts, The <strong>Bangladesh</strong> <strong>Bank</strong> Order, 1972 (with Amendments), The<br />

<strong>Bank</strong>ing Companies Act, 1991 (with Amendments), The Financial Institutions Act, 1993<br />

(with Amendments), The Securities and Exchange Commission Act, 1993, The Companies<br />

Act, 1994, The Partnership Act, 1932, The Negotiable Instrument Act, 1881 (with<br />

Amendments), The <strong>Bank</strong>ers' Books <strong>of</strong> Evidence Act, 1891, The Transfer <strong>of</strong> Property Act,<br />

1882 (with Amendments), The Registration Act-2004. The Stamp Act, 1899 (with<br />

Amendments), The Limitation Act, 1908, The Public Demands Recovery Act, 1913 (with<br />

Amendments), The Artha Rin Adalat Ain 2003 (with Amendments), The <strong>Bank</strong>ruptcy Act,<br />

1997, The Trust Act, 1882, Money Laundering Prevention Act-2009 and Anti-Terrorism Act,<br />

2009.<br />

c. Charging <strong>of</strong> Securities, Documentation for Loans and Advances (Legal and Practical<br />

Aspects), Legal Aspects Relating to Recovery <strong>of</strong> Credit.<br />

d. Legal Procedures Relating to Filing <strong>of</strong> Suits.<br />

e. Ethics in <strong>Bank</strong>ing and Regulatory Compliance.<br />

10. Course No. : TC 14/<strong>2012</strong><br />

a. Time : March 11-15, <strong>2012</strong><br />

b. Coordination Team : 1. Q. G. M. Farooqi<br />

2. Rexona Yesmin<br />

11. Course No. : TC 45/<strong>2012</strong><br />

a. Time : December 09-13, <strong>2012</strong><br />

b. Coordination Team : 1. Sk. Nazibul Islam<br />

2. Md. Mahabbat Hossain<br />

<strong>Academic</strong> <strong>Calendar</strong> <strong>2012</strong> BIBM 47