Finance Annual Report 2007-2008 - Gauteng Online

Finance Annual Report 2007-2008 - Gauteng Online

Finance Annual Report 2007-2008 - Gauteng Online

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

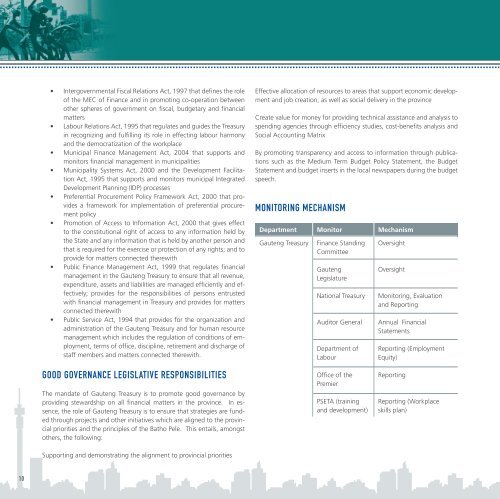

• Intergovernmental Fiscal Relations Act, 1997 that defines the roleof the MEC of <strong>Finance</strong> and in promoting co-operation betweenother spheres of government on fiscal, budgetary and financialmatters• Labour Relations Act, 1995 that regulates and guides the Treasuryin recognizing and fulfilling its role in effecting labour harmonyand the democratization of the workplace• Municipal <strong>Finance</strong> Management Act, 2004 that supports andmonitors financial management in municipalities• Municipality Systems Act, 2000 and the Development FacilitationAct, 1995 that supports and monitors municipal IntegratedDevelopment Planning (IDP) processes• Preferential Procurement Policy Framework Act, 2000 that providesa framework for implementation of preferential procurementpolicy• Promotion of Access to Information Act, 2000 that gives effectto the constitutional right of access to any information held bythe State and any information that is held by another person andthat is required for the exercise or protection of any rights; and toprovide for matters connected therewith• Public <strong>Finance</strong> Management Act, 1999 that regulates financialmanagement in the <strong>Gauteng</strong> Treasury to ensure that all revenue,expenditure, assets and liabilities are managed efficiently and effectively;provides for the responsibilities of persons entrustedwith financial management in Treasury and provides for mattersconnected therewith• Public Service Act, 1994 that provides for the organization andadministration of the <strong>Gauteng</strong> Treasury and for human resourcemanagement which includes the regulation of conditions of employment,terms of office, discipline, retirement and discharge ofstaff members and matters connected therewith.Effective allocation of resources to areas that support economic developmentand job creation, as well as social delivery in the provinceCreate value for money for providing technical assistance and analysis tospending agencies through efficiency studies, cost-benefits analysis andSocial Accounting MatrixBy promoting transparency and access to information through publicationssuch as the Medium Term Budget Policy Statement, the BudgetStatement and budget inserts in the local newspapers during the budgetspeech.Monitoring MechanismDepartment Monitor Mechanism<strong>Gauteng</strong> Treasury<strong>Finance</strong> StandingCommittee<strong>Gauteng</strong>LegislatureNational TreasuryAuditor GeneralDepartment ofLabourOversightOversightMonitoring, Evaluationand <strong>Report</strong>ing<strong>Annual</strong> FinancialStatements<strong>Report</strong>ing (EmploymentEquity)Good governance legislative responsibilitiesThe mandate of <strong>Gauteng</strong> Treasury is to promote good governance byproviding stewardship on all financial matters in the province. In essence,the role of <strong>Gauteng</strong> Treasury is to ensure that strategies are fundedthrough projects and other initiatives which are aligned to the provincialpriorities and the principles of the Batho Pele. This entails, amongstothers, the following:Supporting and demonstrating the alignment to provincial prioritiesOffice of thePremierPSETA (trainingand development)<strong>Report</strong>ing<strong>Report</strong>ing (Workplaceskills plan)10