China XLX Fertiliser Ltd

China XLX Fertiliser Ltd

China XLX Fertiliser Ltd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

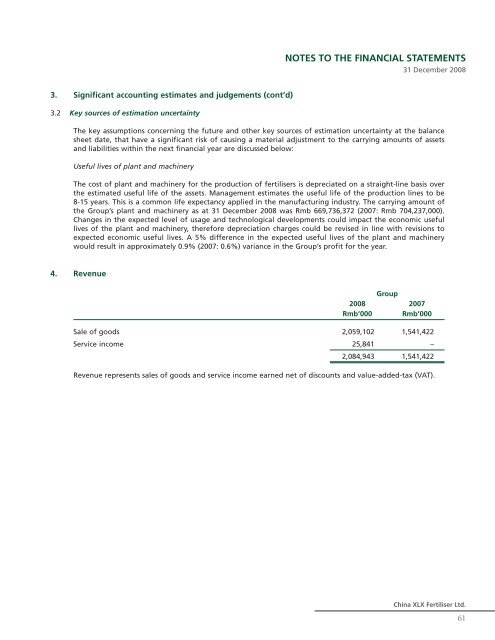

NOTES TO THE FINANCIAL STATEMENTS31 December 20083. Significant accounting estimates and judgements (cont’d)3.2 Key sources of estimation uncertaintyThe key assumptions concerning the future and other key sources of estimation uncertainty at the balancesheet date, that have a significant risk of causing a material adjustment to the carrying amounts of assetsand liabilities within the next financial year are discussed below:Useful lives of plant and machineryThe cost of plant and machinery for the production of fertilisers is depreciated on a straight-line basis overthe estimated useful life of the assets. Management estimates the useful life of the production lines to be8-15 years. This is a common life expectancy applied in the manufacturing industry. The carrying amount ofthe Group’s plant and machinery as at 31 December 2008 was Rmb 669,736,372 (2007: Rmb 704,237,000).Changes in the expected level of usage and technological developments could impact the economic usefullives of the plant and machinery, therefore depreciation charges could be revised in line with revisions toexpected economic useful lives. A 5% difference in the expected useful lives of the plant and machinerywould result in approximately 0.9% (2007: 0.6%) variance in the Group’s profit for the year.4. RevenueGroup2008 2007Rmb’000 Rmb’000Sale of goods 2,059,102 1,541,422Service income 25,841 –2,084,943 1,541,422Revenue represents sales of goods and service income earned net of discounts and value-added-tax (VAT).<strong>China</strong> <strong>XLX</strong> <strong>Fertiliser</strong> <strong>Ltd</strong>.61