China XLX Fertiliser Ltd

China XLX Fertiliser Ltd

China XLX Fertiliser Ltd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

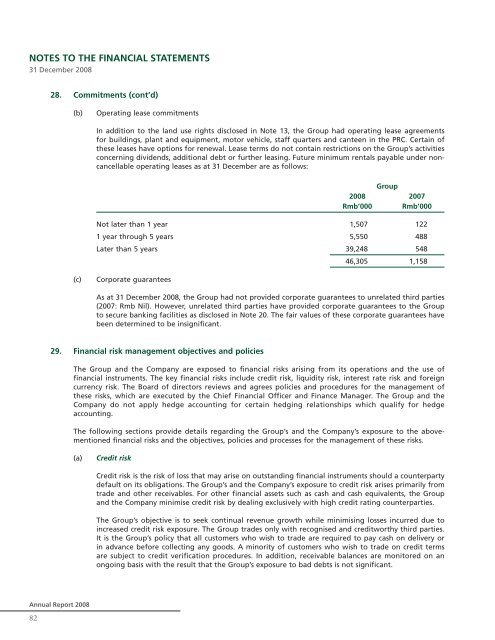

NOTES TO THE FINANCIAL STATEMENTS31 December 200828. Commitments (cont’d)(b)Operating lease commitmentsIn addition to the land use rights disclosed in Note 13, the Group had operating lease agreementsfor buildings, plant and equipment, motor vehicle, staff quarters and canteen in the PRC. Certain ofthese leases have options for renewal. Lease terms do not contain restrictions on the Group’s activitiesconcerning dividends, additional debt or further leasing. Future minimum rentals payable under noncancellableoperating leases as at 31 December are as follows:Group2008 2007Rmb’000 Rmb’000Not later than 1 year 1,507 1221 year through 5 years 5,550 488Later than 5 years 39,248 54846,305 1,158(c)Corporate guaranteesAs at 31 December 2008, the Group had not provided corporate guarantees to unrelated third parties(2007: Rmb Nil). However, unrelated third parties have provided corporate guarantees to the Groupto secure banking facilities as disclosed in Note 20. The fair values of these corporate guarantees havebeen determined to be insignificant.29. Financial risk management objectives and policiesThe Group and the Company are exposed to financial risks arising from its operations and the use offinancial instruments. The key financial risks include credit risk, liquidity risk, interest rate risk and foreigncurrency risk. The Board of directors reviews and agrees policies and procedures for the management ofthese risks, which are executed by the Chief Financial Officer and Finance Manager. The Group and theCompany do not apply hedge accounting for certain hedging relationships which qualify for hedgeaccounting.The following sections provide details regarding the Group’s and the Company’s exposure to the abovementionedfinancial risks and the objectives, policies and processes for the management of these risks.(a)Credit riskCredit risk is the risk of loss that may arise on outstanding financial instruments should a counterpartydefault on its obligations. The Group’s and the Company’s exposure to credit risk arises primarily fromtrade and other receivables. For other financial assets such as cash and cash equivalents, the Groupand the Company minimise credit risk by dealing exclusively with high credit rating counterparties.The Group’s objective is to seek continual revenue growth while minimising losses incurred due toincreased credit risk exposure. The Group trades only with recognised and creditworthy third parties.It is the Group’s policy that all customers who wish to trade are required to pay cash on delivery orin advance before collecting any goods. A minority of customers who wish to trade on credit termsare subject to credit verification procedures. In addition, receivable balances are monitored on anongoing basis with the result that the Group’s exposure to bad debts is not significant.Annual Report 200882