China XLX Fertiliser Ltd

China XLX Fertiliser Ltd

China XLX Fertiliser Ltd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

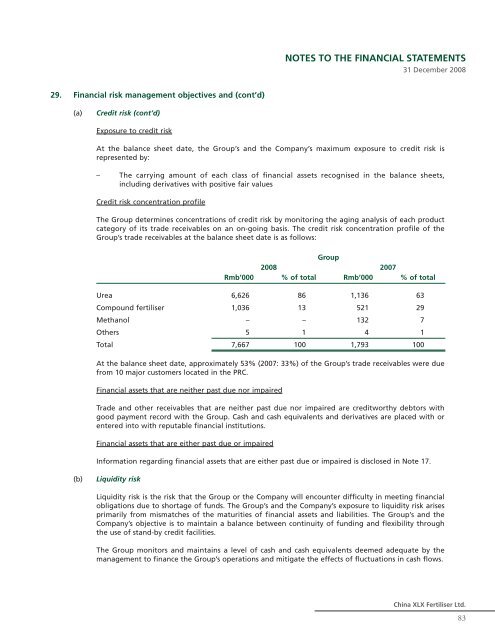

NOTES TO THE FINANCIAL STATEMENTS31 December 200829. Financial risk management objectives and (cont’d)(a)Credit risk (cont’d)Exposure to credit riskAt the balance sheet date, the Group’s and the Company’s maximum exposure to credit risk isrepresented by:– The carrying amount of each class of financial assets recognised in the balance sheets,including derivatives with positive fair valuesCredit risk concentration profileThe Group determines concentrations of credit risk by monitoring the aging analysis of each productcategory of its trade receivables on an on-going basis. The credit risk concentration profile of theGroup’s trade receivables at the balance sheet date is as follows:Group2008 2007Rmb’000 % of total Rmb’000 % of totalUrea 6,626 86 1,136 63Compound fertiliser 1,036 13 521 29Methanol – – 132 7Others 5 1 4 1Total 7,667 100 1,793 100At the balance sheet date, approximately 53% (2007: 33%) of the Group’s trade receivables were duefrom 10 major customers located in the PRC.Financial assets that are neither past due nor impairedTrade and other receivables that are neither past due nor impaired are creditworthy debtors withgood payment record with the Group. Cash and cash equivalents and derivatives are placed with orentered into with reputable financial institutions.Financial assets that are either past due or impairedInformation regarding financial assets that are either past due or impaired is disclosed in Note 17.(b)Liquidity riskLiquidity risk is the risk that the Group or the Company will encounter difficulty in meeting financialobligations due to shortage of funds. The Group’s and the Company’s exposure to liquidity risk arisesprimarily from mismatches of the maturities of financial assets and liabilities. The Group’s and theCompany’s objective is to maintain a balance between continuity of funding and flexibility throughthe use of stand-by credit facilities.The Group monitors and maintains a level of cash and cash equivalents deemed adequate by themanagement to finance the Group’s operations and mitigate the effects of fluctuations in cash flows.<strong>China</strong> <strong>XLX</strong> <strong>Fertiliser</strong> <strong>Ltd</strong>.83