China XLX Fertiliser Ltd

China XLX Fertiliser Ltd

China XLX Fertiliser Ltd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

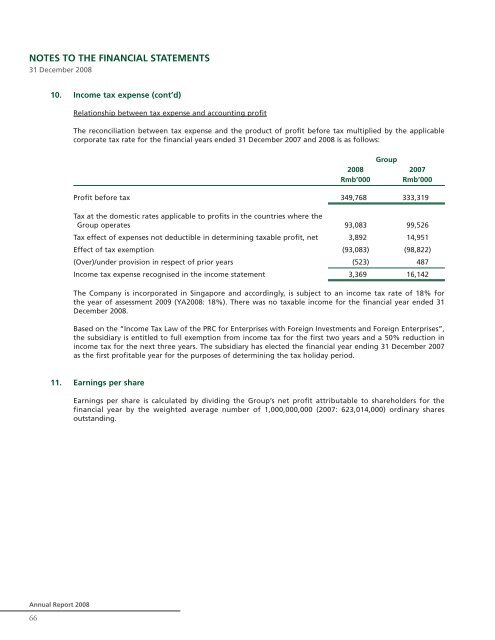

NOTES TO THE FINANCIAL STATEMENTS31 December 200810. Income tax expense (cont’d)Relationship between tax expense and accounting profitThe reconciliation between tax expense and the product of profit before tax multiplied by the applicablecorporate tax rate for the financial years ended 31 December 2007 and 2008 is as follows:Group2008 2007Rmb’000 Rmb’000Profit before tax 349,768 333,319Tax at the domestic rates applicable to profits in the countries where theGroup operates 93,083 99,526Tax effect of expenses not deductible in determining taxable profit, net 3,892 14,951Effect of tax exemption (93,083) (98,822)(Over)/under provision in respect of prior years (523) 487Income tax expense recognised in the income statement 3,369 16,142The Company is incorporated in Singapore and accordingly, is subject to an income tax rate of 18% forthe year of assessment 2009 (YA2008: 18%). There was no taxable income for the financial year ended 31December 2008.Based on the “Income Tax Law of the PRC for Enterprises with Foreign Investments and Foreign Enterprises”,the subsidiary is entitled to full exemption from income tax for the first two years and a 50% reduction inincome tax for the next three years. The subsidiary has elected the financial year ending 31 December 2007as the first profitable year for the purposes of determining the tax holiday period.11. Earnings per shareEarnings per share is calculated by dividing the Group’s net profit attributable to shareholders for thefinancial year by the weighted average number of 1,000,000,000 (2007: 623,014,000) ordinary sharesoutstanding.Annual Report 200866