China XLX Fertiliser Ltd

China XLX Fertiliser Ltd

China XLX Fertiliser Ltd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

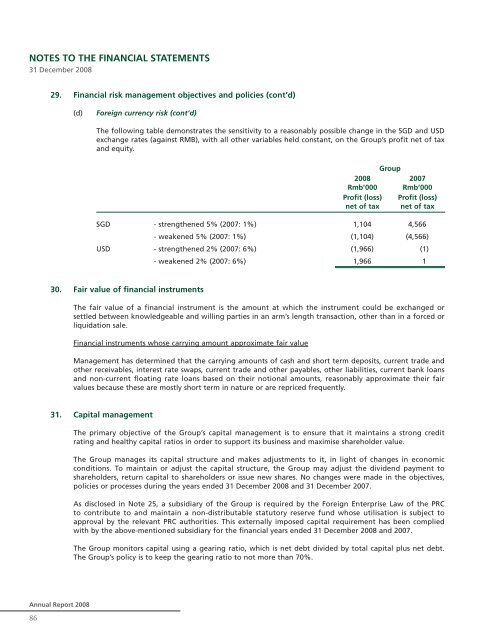

NOTES TO THE FINANCIAL STATEMENTS31 December 200829. Financial risk management objectives and policies (cont’d)(d)Foreign currency risk (cont’d)The following table demonstrates the sensitivity to a reasonably possible change in the SGD and USDexchange rates (against RMB), with all other variables held constant, on the Group’s profit net of taxand equity.Group20082007Rmb’000 Rmb’000Profit (loss) Profit (loss)net of tax net of taxSGD - strengthened 5% (2007: 1%) 1,104 4,566- weakened 5% (2007: 1%) (1,104) (4,566)USD - strengthened 2% (2007: 6%) (1,966) (1)- weakened 2% (2007: 6%) 1,966 130. Fair value of financial instrumentsThe fair value of a financial instrument is the amount at which the instrument could be exchanged orsettled between knowledgeable and willing parties in an arm’s length transaction, other than in a forced orliquidation sale.Financial instruments whose carrying amount approximate fair valueManagement has determined that the carrying amounts of cash and short term deposits, current trade andother receivables, interest rate swaps, current trade and other payables, other liabilities, current bank loansand non-current floating rate loans based on their notional amounts, reasonably approximate their fairvalues because these are mostly short term in nature or are repriced frequently.31. Capital managementThe primary objective of the Group’s capital management is to ensure that it maintains a strong creditrating and healthy capital ratios in order to support its business and maximise shareholder value.The Group manages its capital structure and makes adjustments to it, in light of changes in economicconditions. To maintain or adjust the capital structure, the Group may adjust the dividend payment toshareholders, return capital to shareholders or issue new shares. No changes were made in the objectives,policies or processes during the years ended 31 December 2008 and 31 December 2007.As disclosed in Note 25, a subsidiary of the Group is required by the Foreign Enterprise Law of the PRCto contribute to and maintain a non-distributable statutory reserve fund whose utilisation is subject toapproval by the relevant PRC authorities. This externally imposed capital requirement has been compliedwith by the above-mentioned subsidiary for the financial years ended 31 December 2008 and 2007.The Group monitors capital using a gearing ratio, which is net debt divided by total capital plus net debt.The Group’s policy is to keep the gearing ratio to not more than 70%.Annual Report 200886