DIPPED PRODUCTS PLC / ANNUAL REPORT 2008—2009

Annual Report- 2008/2009 - Colombo Stock Exchange

Annual Report- 2008/2009 - Colombo Stock Exchange

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Accounting Policies<br />

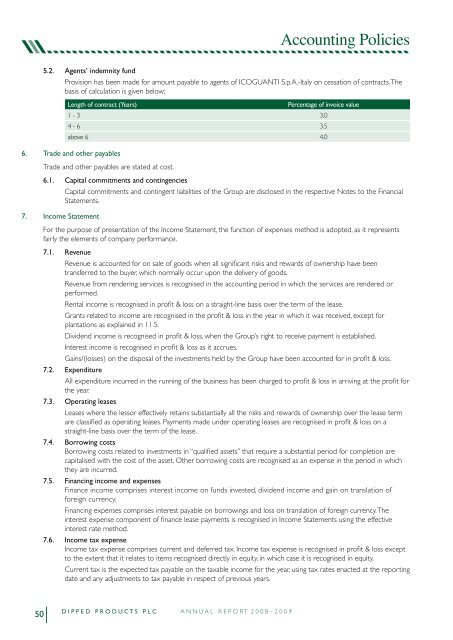

5.2. Agents’ indemnity fund<br />

Provision has been made for amount payable to agents of ICOGUANTI S.p.A.-Italy on cessation of contracts. The<br />

basis of calculation is given below;<br />

Length of contract (Years)<br />

Percentage of invoice value<br />

1 - 3 3.0<br />

4 - 6 3.5<br />

above 6 4.0<br />

6. Trade and other payables<br />

Trade and other payables are stated at cost.<br />

6.1. Capital commitments and contingencies<br />

Capital commitments and contingent liabilities of the Group are disclosed in the respective Notes to the Financial<br />

Statements.<br />

7. Income Statement<br />

For the purpose of presentation of the Income Statement, the function of expenses method is adopted, as it represents<br />

fairly the elements of company performance.<br />

7.1. Revenue<br />

Revenue is accounted for on sale of goods when all significant risks and rewards of ownership have been<br />

transferred to the buyer, which normally occur upon the delivery of goods.<br />

Revenue from rendering services is recognised in the accounting period in which the services are rendered or<br />

performed.<br />

Rental income is recognised in profit & loss on a straight-line basis over the term of the lease.<br />

Grants related to income are recognised in the profit & loss in the year in which it was received, except for<br />

plantations as explained in 11.5.<br />

Dividend income is recognised in profit & loss, when the Group’s right to receive payment is established.<br />

Interest income is recognised in profit & loss as it accrues.<br />

Gains/(losses) on the disposal of the investments held by the Group have been accounted for in profit & loss.<br />

7.2. Expenditure<br />

All expenditure incurred in the running of the business has been charged to profit & loss in arriving at the profit for<br />

the year.<br />

7.3. Operating leases<br />

Leases where the lessor effectively retains substantially all the risks and rewards of ownership over the lease term<br />

are classified as operating leases. Payments made under operating leases are recognised in profit & loss on a<br />

straight-line basis over the term of the lease.<br />

7.4. Borrowing costs<br />

Borrowing costs related to investments in “qualified assets” that require a substantial period for completion are<br />

capitalised with the cost of the asset. Other borrowing costs are recognised as an expense in the period in which<br />

they are incurred.<br />

7.5. Financing income and expenses<br />

Finance income comprises interest income on funds invested, dividend income and gain on translation of<br />

foreign currency.<br />

Financing expenses comprises interest payable on borrowings and loss on translation of foreign currency. The<br />

interest expense component of finance lease payments is recognised in Income Statements using the effective<br />

interest rate method.<br />

7.6. Income tax expense<br />

Income tax expense comprises current and deferred tax. Income tax expense is recognised in profit & loss except<br />

to the extent that it relates to items recognised directly in equity, in which case it is recognised in equity.<br />

Current tax is the expected tax payable on the taxable income for the year, using tax rates enacted at the reporting<br />

date and any adjustments to tax payable in respect of previous years.<br />

50<br />

D I P P E D P R O D U C T S P L C A N N U A L R E P O R T 2 0 0 8 – 2 0 0 9