DIPPED PRODUCTS PLC / ANNUAL REPORT 2008—2009

Annual Report- 2008/2009 - Colombo Stock Exchange

Annual Report- 2008/2009 - Colombo Stock Exchange

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Financial Statements<br />

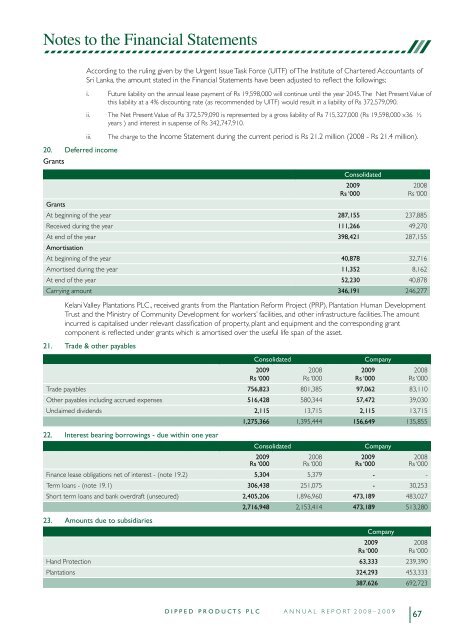

According to the ruling given by the Urgent Issue Task Force (UITF) of The Institute of Chartered Accountants of<br />

Sri Lanka, the amount stated in the Financial Statements have been adjusted to reflect the followings;<br />

i. Future liability on the annual lease payment of Rs 19,598,000 will continue until the year 2045. The Net Present Value of<br />

this liability at a 4% discounting rate (as recommended by UITF) would result in a liability of Rs 372,579,090.<br />

ii.<br />

iii.<br />

The Net Present Value of Rs 372,579,090 is represented by a gross liability of Rs 715,327,000 (Rs 19,598,000 x36 ½<br />

years ) and interest in suspense of Rs 342,747,910.<br />

The charge to the Income Statement during the current period is Rs 21.2 million (2008 - Rs 21.4 million).<br />

20. Deferred income<br />

Grants<br />

Consolidated<br />

2009<br />

Rs ‘000<br />

2008<br />

Rs ‘000<br />

Grants<br />

At beginning of the year 287,155 237,885<br />

Received during the year 111,266 49,270<br />

At end of the year 398,421 287,155<br />

Amortisation<br />

At beginning of the year 40,878 32,716<br />

Amortised during the year 11,352 8,162<br />

At end of the year 52,230 40,878<br />

Carrying amount 346,191 246,277<br />

Kelani Valley Plantations <strong>PLC</strong>., received grants from the Plantation Reform Project (PRP), Plantation Human Development<br />

Trust and the Ministry of Community Development for workers’ facilities, and other infrastructure facilities. The amount<br />

incurred is capitalised under relevant classification of property, plant and equipment and the corresponding grant<br />

component is reflected under grants which is amortised over the useful life span of the asset.<br />

21. Trade & other payables<br />

Consolidated<br />

2009<br />

Rs ‘000<br />

2008<br />

Rs ‘000<br />

Company<br />

2009<br />

Rs ‘000<br />

2008<br />

Rs ‘000<br />

Trade payables 756,823 801,385 97,062 83,110<br />

Other payables including accrued expenses 516,428 580,344 57,472 39,030<br />

Unclaimed dividends 2,115 13,715 2,115 13,715<br />

22. Interest bearing borrowings - due within one year<br />

1,275,366 1,395,444 156,649 135,855<br />

Consolidated<br />

2009<br />

Rs ‘000<br />

2008<br />

Rs ‘000<br />

Company<br />

2009<br />

Rs ‘000<br />

2008<br />

Rs ‘000<br />

Finance lease obligations net of interest - (note 19.2) 5,304 5,379 - -<br />

Term loans - (note 19.1) 306,438 251,075 - 30,253<br />

Short term loans and bank overdraft (unsecured) 2,405,206 1,896,960 473,189 483,027<br />

23. Amounts due to subsidiaries<br />

2,716,948 2,153,414 473,189 513,280<br />

Company<br />

2009<br />

Rs ‘000<br />

2008<br />

Rs ‘000<br />

Hand Protection 63,333 239,390<br />

Plantations 324,293 453,333<br />

387,626 692,723<br />

D I P P E D P R O D U C T S P L C A N N U A L R E P O R T 2 0 0 8 – 2 0 0 9<br />

67