AUDIT ANALYTICS AUDIT

x8YaD9

x8YaD9

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ESSAY 6: MANAGING RISK AND THE <strong>AUDIT</strong> PROCESS<br />

objectively quantifiable and verifiable, it would be an unsatisfactory<br />

indicator.<br />

Second, a KRI must be relevant, meaning that changes in the measure<br />

must result in corresponding alterations in the probability of target risk<br />

event emergence. For instance, employee turnover rate might be<br />

considered as a proxy for risk of having material errors in the financial<br />

statements. While this seems a reasonable assumption, if the measure is<br />

not found to be highly predictive of the risk event, then it would not be a<br />

useful KRI in this context.<br />

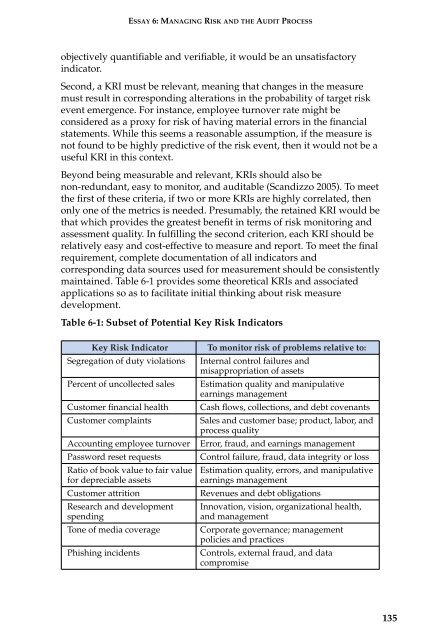

Beyond being measurable and relevant, KRIs should also be<br />

non-redundant, easy to monitor, and auditable (Scandizzo 2005). To meet<br />

the first of these criteria, if two or more KRIs are highly correlated, then<br />

only one of the metrics is needed. Presumably, the retained KRI would be<br />

that which provides the greatest benefit in terms of risk monitoring and<br />

assessment quality. In fulfilling the second criterion, each KRI should be<br />

relatively easy and cost-effective to measure and report. To meet the final<br />

requirement, complete documentation of all indicators and<br />

corresponding data sources used for measurement should be consistently<br />

maintained. Table 6-1 provides some theoretical KRIs and associated<br />

applications so as to facilitate initial thinking about risk measure<br />

development.<br />

Table 6-1: Subset of Potential Key Risk Indicators<br />

Key Risk Indicator<br />

Segregation of duty violations<br />

Percent of uncollected sales<br />

Customer financial health<br />

Customer complaints<br />

Accounting employee turnover<br />

Password reset requests<br />

Ratio of book value to fair value<br />

for depreciable assets<br />

Customer attrition<br />

Research and development<br />

spending<br />

Tone of media coverage<br />

Phishing incidents<br />

To monitor risk of problems relative to:<br />

Internal control failures and<br />

misappropriation of assets<br />

Estimation quality and manipulative<br />

earnings management<br />

Cash flows, collections, and debt covenants<br />

Sales and customer base; product, labor, and<br />

process quality<br />

Error, fraud, and earnings management<br />

Control failure, fraud, data integrity or loss<br />

Estimation quality, errors, and manipulative<br />

earnings management<br />

Revenues and debt obligations<br />

Innovation, vision, organizational health,<br />

and management<br />

Corporate governance; management<br />

policies and practices<br />

Controls, external fraud, and data<br />

compromise<br />

135