Past Reports

2014vcpa

2014vcpa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

India Venture Capital and Private Equity Report 2014<br />

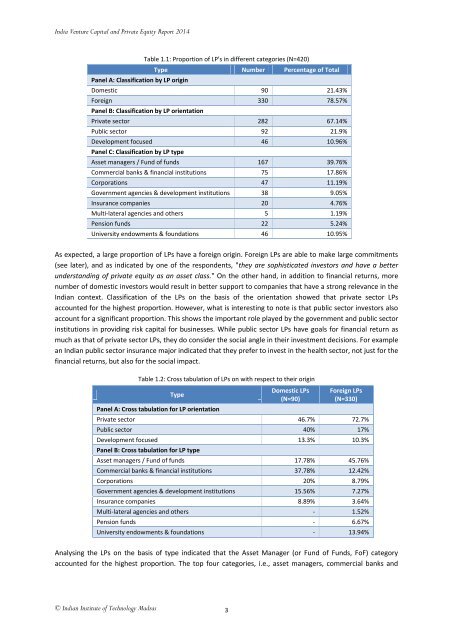

Table 1.1: Proportion of LP's in different categories (N=420)<br />

Type Number Percentage of Total<br />

Panel A: Classification by LP origin<br />

Domestic 90 21.43%<br />

Foreign 330 78.57%<br />

Panel B: Classification by LP orientation<br />

Private sector 282 67.14%<br />

Public sector 92 21.9%<br />

Development focused 46 10.96%<br />

Panel C: Classification by LP type<br />

Asset managers / Fund of funds 167 39.76%<br />

Commercial banks & financial institutions 75 17.86%<br />

Corporations 47 11.19%<br />

Government agencies & development institutions 38 9.05%<br />

Insurance companies 20 4.76%<br />

Multi-lateral agencies and others 5 1.19%<br />

Pension funds 22 5.24%<br />

University endowments & foundations 46 10.95%<br />

As expected, a large proportion of LPs have a foreign origin. Foreign LPs are able to make large commitments<br />

(see later), and as indicated by one of the respondents, "they are sophisticated investors and have a better<br />

understanding of private equity as an asset class." On the other hand, in addition to financial returns, more<br />

number of domestic investors would result in better support to companies that have a strong relevance in the<br />

Indian context. Classification of the LPs on the basis of the orientation showed that private sector LPs<br />

accounted for the highest proportion. However, what is interesting to note is that public sector investors also<br />

account for a significant proportion. This shows the important role played by the government and public sector<br />

institutions in providing risk capital for businesses. While public sector LPs have goals for financial return as<br />

much as that of private sector LPs, they do consider the social angle in their investment decisions. For example<br />

an Indian public sector insurance major indicated that they prefer to invest in the health sector, not just for the<br />

financial returns, but also for the social impact.<br />

Table 1.2: Cross tabulation of LPs on with respect to their origin<br />

Type<br />

Panel A: Cross tabulation for LP orientation<br />

Domestic LPs<br />

(N=90)<br />

Foreign LPs<br />

(N=330)<br />

Private sector 46.7% 72.7%<br />

Public sector 40% 17%<br />

Development focused 13.3% 10.3%<br />

Panel B: Cross tabulation for LP type<br />

Asset managers / Fund of funds 17.78% 45.76%<br />

Commercial banks & financial institutions 37.78% 12.42%<br />

Corporations 20% 8.79%<br />

Government agencies & development institutions 15.56% 7.27%<br />

Insurance companies 8.89% 3.64%<br />

Multi-lateral agencies and others - 1.52%<br />

Pension funds - 6.67%<br />

University endowments & foundations - 13.94%<br />

Analysing the LPs on the basis of type indicated that the Asset Manager (or Fund of Funds, FoF) category<br />

accounted for the highest proportion. The top four categories, i.e., asset managers, commercial banks and<br />

© Indian Institute of Technology Madras<br />

3