Past Reports

2014vcpa

2014vcpa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Accordingly, insurers were allowed to invest in Category I AIFs which invest in start up or early stage ventures or social<br />

ventures or SMEs or infrastructure or other sectors which the Government or regulators consider as socially or<br />

economically desirable. This included venture capital funds, SME funds, social venture funds and infrastructure funds.<br />

Such funds were not permitted to invest in companies incorporated outside India. The other regulations stayed the<br />

same as in the previous circular 6 .<br />

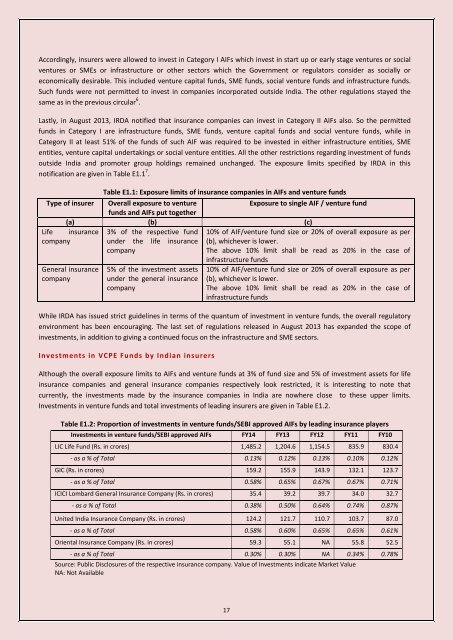

Lastly, in August 2013, IRDA notified that insurance companies can invest in Category II AIFs also. So the permitted<br />

funds in Category I are infrastructure funds, SME funds, venture capital funds and social venture funds, while in<br />

Category II at least 51% of the funds of such AIF was required to be invested in either infrastructure entities, SME<br />

entities, venture capital undertakings or social venture entities. All the other restrictions regarding investment of funds<br />

outside India and promoter group holdings remained unchanged. The exposure limits specified by IRDA in this<br />

notification are given in Table E1.1 7 .<br />

Table E1.1: Exposure limits of insurance companies in AIFs and venture funds<br />

Type of insurer Overall exposure to venture<br />

Exposure to single AIF / venture fund<br />

funds and AIFs put together<br />

(a) (b) (c)<br />

Life insurance 3% of the respective fund 10% of AIF/venture fund size or 20% of overall exposure as per<br />

company<br />

under the life insurance (b), whichever is lower.<br />

company<br />

The above 10% limit shall be read as 20% in the case of<br />

infrastructure funds<br />

General insurance<br />

company<br />

5% of the investment assets<br />

under the general insurance<br />

company<br />

10% of AIF/venture fund size or 20% of overall exposure as per<br />

(b), whichever is lower.<br />

The above 10% limit shall be read as 20% in the case of<br />

infrastructure funds<br />

While IRDA has issued strict guidelines in terms of the quantum of investment in venture funds, the overall regulatory<br />

environment has been encouraging. The last set of regulations released in August 2013 has expanded the scope of<br />

investments, in addition to giving a continued focus on the infrastructure and SME sectors.<br />

Investments in VCPE Funds by Indian insurers<br />

Although the overall exposure limits to AIFs and venture funds at 3% of fund size and 5% of investment assets for life<br />

insurance companies and general insurance companies respectively look restricted, it is interesting to note that<br />

currently, the investments made by the insurance companies in India are nowhere close to these upper limits.<br />

Investments in venture funds and total investments of leading insurers are given in Table E1.2.<br />

Table E1.2: Proportion of investments in venture funds/SEBI approved AIFs by leading insurance players<br />

Investments in venture funds/SEBI approved AIFs FY14 FY13 FY12 FY11 FY10<br />

LIC Life Fund (Rs. in crores) 1,485.2 1,204.6 1,154.5 835.9 830.4<br />

- as a % of Total 0.13% 0.12% 0.13% 0.10% 0.12%<br />

GIC (Rs. in crores) 159.2 155.9 143.9 132.1 123.7<br />

- as a % of Total 0.58% 0.65% 0.67% 0.67% 0.71%<br />

ICICI Lombard General Insurance Company (Rs. in crores) 35.4 39.2 39.7 34.0 32.7<br />

- as a % of Total 0.38% 0.50% 0.64% 0.74% 0.87%<br />

United India Insurance Company (Rs. in crores) 124.2 121.7 110.7 103.7 87.0<br />

- as a % of Total 0.58% 0.60% 0.65% 0.65% 0.61%<br />

Oriental Insurance Company (Rs. in crores) 59.3 55.1 NA 55.8 52.5<br />

- as a % of Total 0.30% 0.30% NA 0.34% 0.78%<br />

Source: Public Disclosures of the respective insurance company. Value of Investments indicate Market Value<br />

NA: Not Available<br />

17